TL;DR

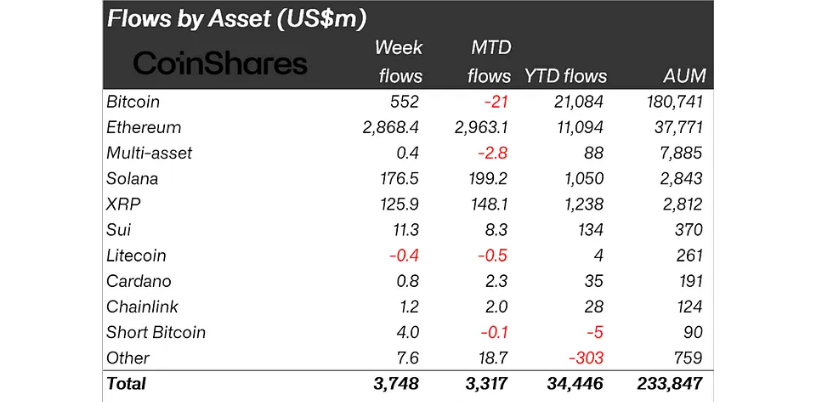

- Digital asset investment products experienced a remarkable US$3.75bn inflow last week, the fourth-largest weekly total on record.

- Ethereum led the surge with US$2.87B, making up 77% of total inflows and pushing year-to-date inflows to US$11B.

- Bitcoin saw more modest gains with US$552M inflows, while Solana and XRP attracted US$176.5m and US$125.9m respectively.

Digital asset investment products recorded US$3.75B in inflows last week, marking a strong rebound following several weeks of subdued market sentiment. The inflows were heavily concentrated in a single provider, iShares, and one of their key investment products. Total assets under management reached a record US$244B on 13th August, boosted by recent price increases. Regionally, the United States dominated flows with US$3.73B, while Canada, Hong Kong, and Australia saw smaller inflows. Brazil and Sweden recorded minor outflows, reflecting how global appetite for crypto remains uneven yet resilient across different markets.

Ethereum Dominates Weekly Flows

Ethereum continues to outperform all other digital assets. Last week’s inflows totaled US$2.87B, representing 77% of total weekly inflows, and lifting year-to-date inflows to a record US$11B. These figures highlight Ethereum’s growing popularity among institutional investors. The inflows far exceed Bitcoin’s US$552M, which constitutes only 11.6% of AuM year-to-date, demonstrating ETH’s current dominance in the market. Ethereum’s adoption is being fueled not only by ETFs but also by increasing decentralized finance activity, layer-two solutions, and upcoming network upgrades, reinforcing investor confidence and its long-term growth potential.

Bitcoin Lags While Other Altcoins Make Gains

Bitcoin posted modest inflows in comparison, while Solana and XRP attracted significant interest with US$176.5M and US$125.9M respectively. Meanwhile, Litecoin and Ton experienced minor outflows of US$0.4M and US$1M. Despite Ethereum’s strong inflows, the asset recently faced a sharp 10% pullback from monthly highs following over US$870M in liquidations. The sell-off wiped out some short-term gains, but analysts suggest this may be a temporary correction in an otherwise bullish trend for crypto markets overall.

Investors continue to show confidence in Ethereum, drawn by new ETFs, institutional adoption, and the broader growth of the crypto ecosystem, even as the market experiences occasional volatility. With AuM at historic levels, digital asset funds remain a key channel for channeling capital into cryptocurrencies, and Ethereum is clearly leading the charge in shaping the next phase of institutional crypto adoption, while other altcoins slowly carve out space in diversified portfolios across global markets.