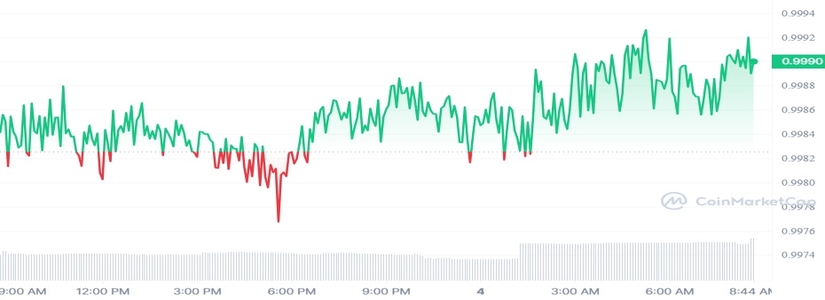

The stablecoin of Curve, crvUSD, reacted to the uncertainty surrounding the platform following the recent exploit and depegged. Just recently, the stablecoin fell by almost 0.35% within a single day. The crvUSD stablecoin relies on a mechanism, called the PegKeeper to maintain its peg with the US Dollar. The mechanism is responsible for managing the interest rate and liquidation ratio based on the overall stablecoin supply and demand to maintain its value. In short, the mechanism ensures that crvUSD value is properly backed by collateral while balancing supply and demand.

Based on the stablecoin issued by Curve on X, the platform compared the depegging of the stablecoin similar to the depegging of USDC following the collapse of the Silicon Valley Bank. The current situation is enough to make anyone believe that the decentralized stablecoin is facing its first stress test since its introduction in May this year.

What about crvUSD? How does its price react to shock events, does it depeg?

Events of recent days felt similar to SVB/USDC situation in some sense. However, crvUSD had just a 0.35% dip, and currently 0.1% from the peg pic.twitter.com/HaMfbkiFSR

— Curve Finance (@CurveFinance) August 3, 2023

DeFi Leaders Stand by Curve Following crvUSD Mishap

Curve suffered a hack as a result of an exploit in the Vyper programming language, and since then, the concerns surrounding its effects on the DeFi ecosystems have skyrocketed, resulting in panic among various protocols.

These developments inevitably led to the decline of the trading value of the CRV token by 46.72%. At the time of writing, the situation surrounding the crvUSD token has improved as the stablecoin has surged by 0.06% within the last 24 hours. The increase has pushed the trading price of the stablecoin to just a little below its intended $1 peg at $0.9991.

Following the hack and the increased mishaps surrounding the platform, many within the crypto world wondered whether other protocols would be subject to a domino effect. The founder of Curve, Michael Egorov, had a $100 million stablecoin loan using his own CRV holdings as collateral. It is evident that his holding would have faced a significant devaluation amid recent events.

Nonetheless, several DeFi protocols have lent their support to Curve amid the ongoing crisis. The co-founder of Huobi recently purchased CRV tokens worth $4 million from Egorov. At the same time, the founder of Aave proposed the treasury to buy $2 million worth of CRV tokens from the protocol. It is believed that these actions would send strong signals that DeFi players support the health of the ecosystem.