The Creditcoin project is an innovative credit platform that has the goal of turning digital wallets into an investment market with the use of credit. Gluwa and Aella have jointly developed a protocol that allows investors to participate in the inter-blockchain loan market through the use of Creditcoin.

A successful cryptocurrency loan market will have lenders able to connect directly with each other in order to arrange loans in cryptocurrencies in a safe and honest environment.

In order for the project’s creators to achieve their goal, the database is expected to be able to capture the transactions of people without credit histories – so-called “unbanked” people with no access to financial institutions – in a secure manner. Those who use Creditcoin have the opportunity to use its native currency.

What is Creditcoin?

The Creditcoin platform offers a powerful solution for borrowing and lending with the use of CTC cryptocurrency. This project was developed with the goal of connecting resources that were located on different blockchains or, to put it another way, from different cryptocurrency networks.

As a result of a simple-to-use protocol, it was possible to accomplish this. A marketplace for inter-blockchain lending was created in this way, offering all cryptocurrency holders the ability to lend to each other.

A currency, according to the creators, has the ability to be accepted as a currency if people have the option of borrowing from each other, just like they do in a traditional financial exchange.

As a result, CTC is able to close the gap between the crypto ecosystem and the mainstream monetary circulation we have come to expect. Due to the fact that many different blockchains are being connected, both potential lenders, as well as prospective borrowers will be able to connect regardless of what cryptocurrency they are using.

There is nothing worse than being unable to get a loan through the traditional banking system. Creditcoin offers a lifeline for people like that. Alternative sources of funding may come in handy when a situation such as this arises.

A para-bank institution that offers lending services can be considered one of these types of institutions. It is also important to remember that even these types of loans may not be accessible to those with a poor credit history, for example.

There is a possibility that the CTC platform could be a solution for a number of people. The process of granting loans within its framework is carried out on somewhat different principles than the traditional system, which is governed by the laws of the country.

This can be attributed to the nature of blockchain-based networks due to their decentralized nature. In addition to your credit history, your transactions made within the Creditcoin network will be taken into account here as well.

How does Creditcoin Work?

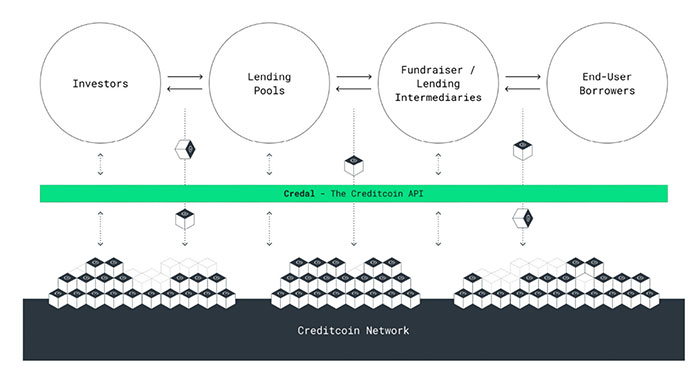

To start with, fundraisers will create loan orders on the Creditcoin network and pay a transaction fee to the Creditcoin network as a transaction fee for each loan order created with their preferred loan amount, collateral asset, interest rate, and loan duration.

As part of the matching process, lenders can evaluate the risks associated with the fundraisers’ fundraising campaigns by checking out their credit history on the Creditcoin network during the order matching process.

As soon as they both agree on making a deal, the lender will transfer the money to the fundraiser as soon as they agree on a deal. Upon receiving the repayment from the fundraiser, the investor will close the loan cycle, bringing the loan cycle to an end. It is anticipated that the distributed ledger will be able to store all the records of the transactions involved permanently, thus building credit for borrowers in the long run.

In the present day, Creditcoin supports the lending of Bitcoin, Ethereum, and ERC-20 tokens through its network.

Creditcoin Features

In the real world, this blockchain can be used for a variety of use cases, and decentralized services can be provided. Below you will find a brief description of some of them.

Self-Sustainable Lending System

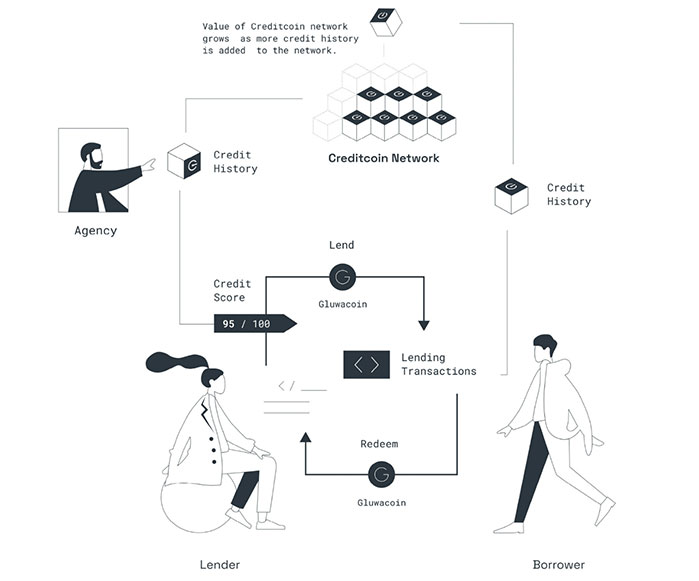

It is expected that Creditcoin will serve at least 1M users with around 150K loans per month as a result of the booming demand for small loans and credit building in emerging markets. In this way, Creditcoin will become more valuable and more valuable as more credit history is added to the network, and there will be an increase in the need to buy and hold Creditcoin. Therefore, Creditcoin has been able to provide a self-sustaining lending system from the very beginning.

Baked by fintech investors

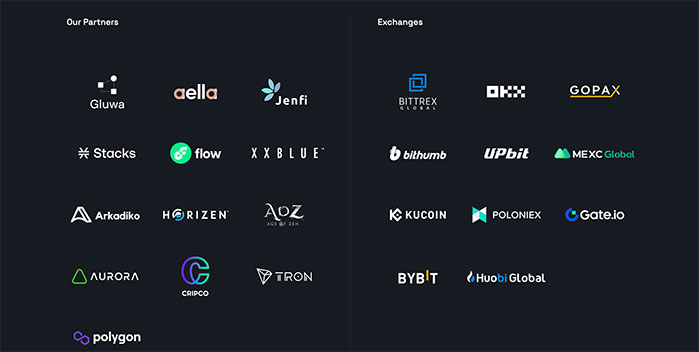

Gluwa and Aella Credit, two leading fintech innovators based in San Francisco, have cofounded and developed Creditcoin, a ten-million-dollar blockchain-based protocol based on the Bitcoin blockchain.

The company Gluwa International is a borderless financial platform, and Aella Credit is a company dedicated to mobile lending. In addition to the Y Combinator and 500 Startups, Brad Armstrong (co-founder and CEO of Coinbase), Michael Siebel (CEO of Y Combinator), and Tom James (co-founder of Intec), all of which are backed by notable investors from the valley, they include Steve Chen (co-founder of YouTube), Brian Armstrong (co-founder and CEO of Coinbase), and Michael Siebel (CEO of Y Combinator).

What is DeFi Lending?

There are a lot of similarities between the DeFi lending service and the traditional lending service offered by the banks, except for the fact that it is offered by decentralized applications that are decentralized rather than banks. Using DeFi lending platforms, people can borrow and lend funds. This allows crypto holders to earn substantial incomes since they will be able to borrow and lend funds.

There is a simple process involved in the DeFi lending process. A trustless approach with a focus on crypto loans is what the company aims to achieve. Using the DeFi lending platform, users will be able to lock their crypto assets without worrying about intermediaries as they will be able to lock their assets directly on the platform. With P2P lending, borrowers will be able to borrow directly from the decentralized platform, provided they select a lender straight from the platform.

Furthermore, the DeFi lending protocol leads to the possibility of lenders earning interest on crypto assets as a result of it.

How to take a creditcoin loan

Fundraisers on the Creditcoin network are accounts that borrow funds from another account in order to finance their campaigns. In order to begin a loan cycle, the fundraiser will create a bid order describing the loan condition he wishes to have. In order to attract potential investors, a bid order will be posted to the Creditcoin network, and the network will be notified of the bid.

During the announcement of the details of the bid order, a fundraiser can provide more details. There are three components to this report: the amount, the interest, and the maturity date. There may be a fundraiser, for example, that offers to lend 100 bitcoins for a 10% interest rate per 30 days.

A transaction fee will be paid by the fundraiser to the Creditcoin network, which will be used to create the order on the network. This offer is not in Creditcoin but in Bitcoin, so be sure to keep that in mind.

The Creditcoin network isn’t a credit or debit network in which you lend or borrow credit in Creditcoin. It is a blockchain in which another cryptocurrency is used. As of right now, Creditcoin is supporting Bitcoin, Ethereum, and ERC-20 token loans as part of the network.

The investor can make an offer if he likes the fundraiser’s bid order and wants to contribute to the fundraiser. There are two orders included within the offer information. An add order and a matching bid order. There is a free list of offers that can be retrieved by the fundraiser.

It is up to the fundraiser to accept an offer he receives by sending the investor a corresponding deal if the offer is acceptable to him. In the offer, it will be described exactly how the loan conditions will be applied to the deal. To be able to send the deal, an amount of Creditcoin will be paid to the Creditcoin network by the fundraiser as a transaction fee.

How to make money with Creditcoin loans

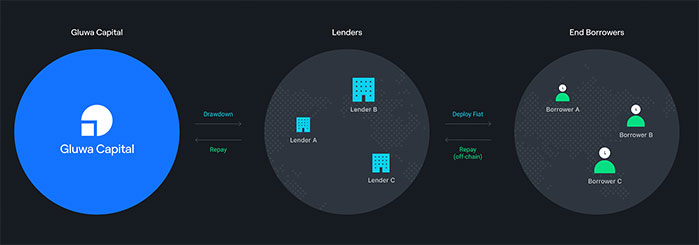

Creditcoin has a network in which investors are accounts that lend money to other accounts on the network.

The first step in starting a loan cycle is to create an ask order that describes the loan offer that the investor would like to make. As the ask order is announced, it attracts potential investors, resulting in investment deals being made.

By registering a transaction on the Creditcoin network, investors will be able to accept an offer they like by registering their investments.

An investor does not need to be involved in the repayment process when a fundraiser is able to repay the full amount. If an investor wants to exempt part of his repayment from paying back his loan, he can choose to do so.

A loan, or a bond, may be transferred into another account by an investor who wishes to transfer the ownership to a different account. A new account is called a “collector.” Once the bond in question has been transferred to a collector, the lender will be repaid the bond by sending the repayment to the collector. The advantage of this is that it allows an investor to liquidate their bonds before the maturity date of their loan.

What are the Creditcoin Mining Pools

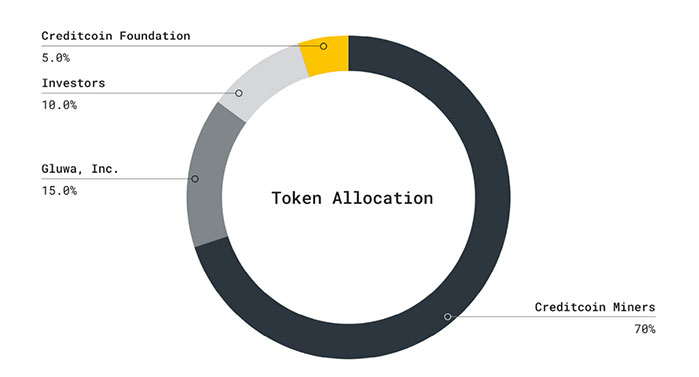

Creditcoin mining pools are not very well known, and there is no credible information available on them at the time of this writing. The whitepaper indicates that at the time of the publication of the paper, there were still plans being made toward the creation and implementation of a Creditcoin Mining Pool as of the publication of the paper.

It is possible to form a Mining Pool, which gives groups of miners the opportunity to combine their computational resources in order to increase their chances of finding blocks and also share in the rewards as a result.

Where can I Buy the Creditcoin Token ($CTC)

Currently, there are some reliable crypto exchanges that offer CTC pairs at the time of writing. There are a few examples of these types of exchanges, such as KuCoin, Bithumb, Huobi, and OKEx. If you wish to exchange CTC with Bitcoin or other supported coins, simply sign up on these exchanges, deposit some coins such as BTC, USDT, or any other supported pair, and exchange them with CTC.

Is it a good idea to invest in Creditcoin for the long term?

It is estimated that Creditcoin will serve at least 1M users with around 150K loans per month in emerging markets as a result of booming demand for small loans and credit building. In other words, as more and more credit history is added to the Credit network, the value of the Creditcoin network will increase, leading to the need to buy and hold Creditcoin in the future. In order to achieve self-sustainability, the entire Creditcoin lending system has to be self-sustaining.

Since the Creditcoin system is completely decentralized and public, Creditcoin assures its users a high level of security. In addition, users have the option to share their credit history while keeping their personal information private, so hackers will not be able to access their information.

With the credit history provided by the network, investors can assess risk and make decisions based on the information they have access to.

In light of these facts and the claims that are being made, it seems that there may be a bright future for CTC in the long run. As with any other form of crypto investment, you should be careful about the amount of investment you make and never invest what you cannot afford to lose.

Conclusion

A team of professionals from the US, Canada, South Korea, Nigeria, and Estonia launched a project called Creditcoin in order to address the lack of credit systems among the unbanked in emerging markets.

In case a person does not have access to the banking system, they have to borrow from a non-banking institution. Banks, on the other hand, do not accept credit records from non-banks since they cannot trust the data the companies provide. By storing the credit transaction history objectively on a public blockchain, the project aims to solve the problem of the credit transaction history.