Choosing between crypto assets involves weighing different risk profiles, liquidity, and use cases. While XRP and Cardano remain widely followed due to their longevity and established communities, some market participants are also tracking newer payment-focused projects. Remittix (RTX) is one such project that positions itself around utility in cross-border transfers and crypto-to-bank payments, according to its public materials.

In recent days, traders have discussed ETF-related developments around XRP, ongoing debate about Cardano’s ability to sustain upward momentum, and increased attention on remittance and payment infrastructure in crypto. These themes can influence sentiment, but outcomes remain uncertain and can change quickly with market conditions.

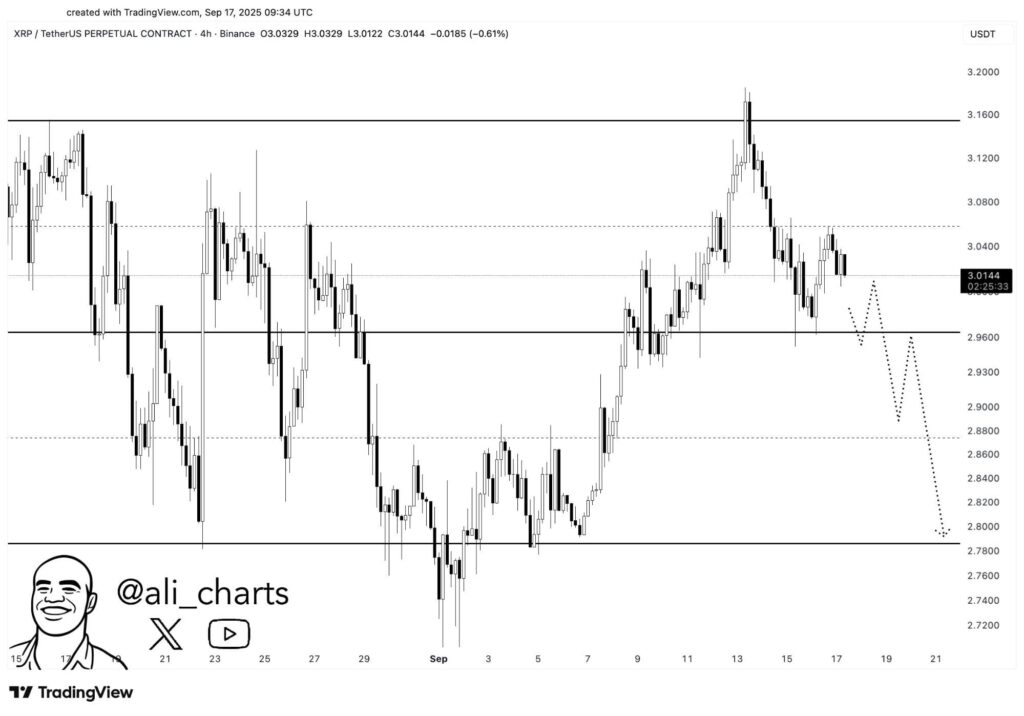

XRP: Cross-Border Payments Focus, With Technical Levels in View

XRP is often discussed in the context of cross-border payments and has long-standing visibility among market participants. Recent ETF-related commentary has also contributed to attention around the asset, though it is not a guarantee of price direction.

From a technical-analysis perspective, XRP has recently traded near the $3 area, with support around $2.78. Some analysts on X (formerly Twitter) have discussed potential resistance near $3.50 and speculative upside scenarios above that level, while also noting that a breakdown of support could lead to lower prices. These are opinions, not forecasts, and should be treated as uncertain.

Longer-term price targets circulating online (including multi-dollar targets) are speculative and depend on many variables, including regulatory developments, broader market cycles, and adoption.

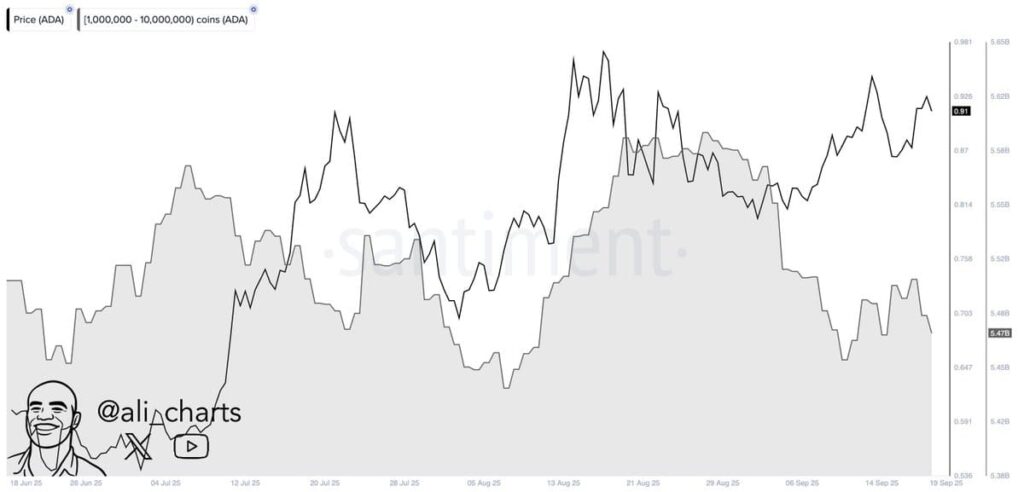

Cardano (ADA): Ongoing Development, Mixed Market Sentiment

Cardano continues to evolve through its development roadmap, while market sentiment around adoption, scaling, and ecosystem activity remains mixed. Commentary around ADA varies widely and often depends on assumptions about broader market conditions.

Some market discussions tie ADA price scenarios to potential changes in market capitalization, but such estimates are inherently uncertain and should not be read as expectations. More aggressive targets are typically framed around major catalysts or a strong bull-market environment.

Other near-term commentary is more cautious, particularly when momentum weakens. This comes as reports circulated on social media that 530 million Cardano tokens were sold by large holders over a 48-hour period; such claims can be difficult to verify independently and may not capture the full market context.

Remittix (RTX): Payment-Focused Project in Early Stages

Remittix is a PayFi-themed project that says it aims to support cross-border payments and crypto-to-bank transfers across multiple jurisdictions. The project also says its wallet (currently described as beta) supports multiple cryptocurrencies and fiat currencies.

According to the project, it has undergone a security audit by CertiK. The project also states that it has announced centralized exchange listings on BitMart and LBank. In addition, project materials describe marketing incentives such as a referral program and community promotions; details and eligibility can change and should be checked directly with the project.

Compared with more established networks, early-stage projects can carry different risks related to execution, liquidity, regulatory considerations, and product delivery. Any comparisons between XRP, Cardano, and newer tokens should account for differences in scale and maturity.

Project Features Mentioned by Remittix

- A stated focus on payments and cross-border transfers.

- A wallet product described as in beta.

- A reported third-party audit (CertiK).

- Planned ecosystem expansion through integrations and exchange availability (as stated by the project).

Recent Updates Cited by the Project

- Beta testing for the wallet.

- Audit and team-related information published via CertiK.

- Exchange-listing announcements involving BitMart and LBank.

- Community promotions described by the project.

Summary: Different Assets, Different Risk Profiles

XRP and Cardano are established assets with long trading histories and broad market coverage, while newer projects like Remittix present a different set of uncertainties alongside any potential product adoption. Readers evaluating any token should consider factors such as liquidity, regulatory risk, technical development, token distribution, and independently verifiable evidence of real-world usage.

Project links (for reference):

Website: https://remittix.io

Socials: https://linktr.ee/remittix

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. Any references to a token sale, promotions, audits, listings, or product features reflect publicly available project statements and may change; readers should verify details independently.