Market participants are weighing a range of factors when comparing cryptoassets. The Hedera (HBAR) technical outlook shows hesitation, with reported outflows and pressure near key support zones. Meanwhile, the SUI price pattern is being watched for a possible breakout based on commonly cited chart formations, though both assets remain sensitive to broader market conditions.

Separately, Cold Wallet (CWT) has been promoted by the project as running an ongoing token sale. According to project materials, it has raised more than $6.4 million and is positioning its product around fee refunds and transaction-based rewards. These claims are project-reported and should be treated as unverified.

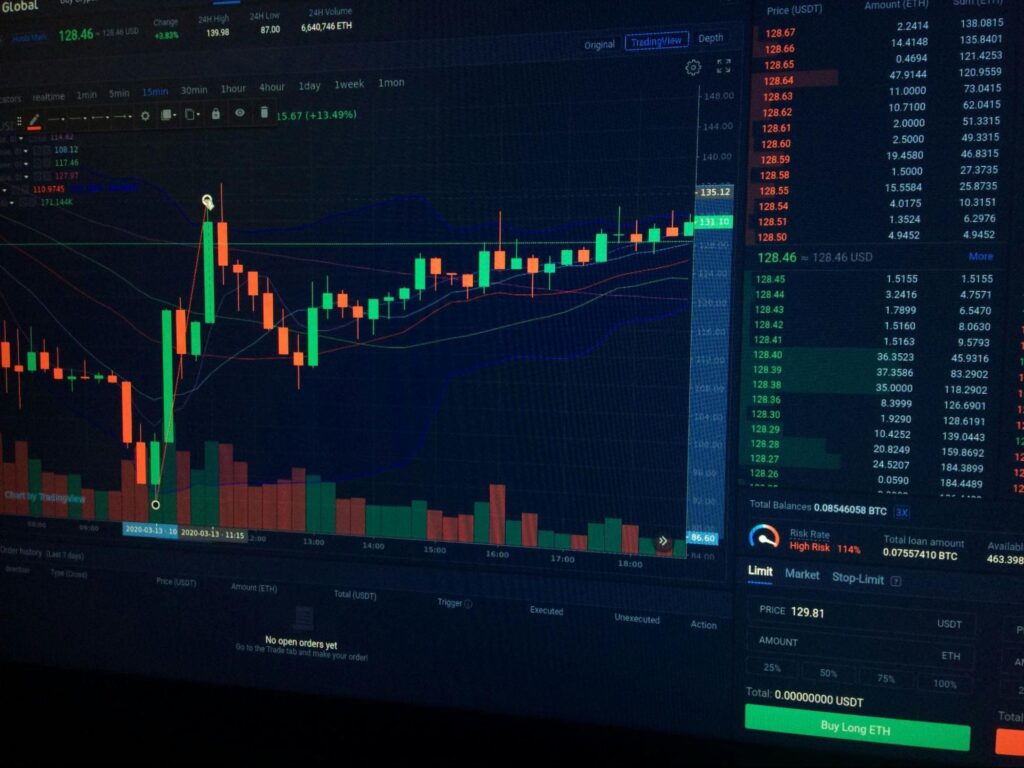

HBAR Consolidates as Outflows Pressure Price Action

HBAR has been trading between $0.244 and $0.271, with outflows weighing on sentiment. The Chaikin Money Flow (CMF) dropped to its lowest point in two months, which can indicate net selling pressure. At the same time, the Relative Strength Index (RSI) is holding above neutral, leaving room for a rebound if conditions improve.

The $0.244 level remains a key area to watch. A move below it could open the door to a retest of the $0.230 zone. Until a clearer move occurs, the Hedera (HBAR) technical outlook appears range-bound.

SUI Price Pattern Suggests a Possible Move Higher

Sui (SUI) is being tracked for a potential upside move based on a cup-and-handle pattern and a converging triangle. If the setup plays out, some technical projections place potential targets above the current range, although chart patterns do not guarantee outcomes. A reported rise in daily trading volume of 18% to $8.52 billion is also being cited by traders monitoring momentum.

For now, resistance sits near $4.00. A sustained close above that level could support a continuation attempt, while a move under $3.50 would increase the risk of a pullback.

Cold Wallet Token Sale: Project-Reported Figures and Product Claims

Cold Wallet’s ongoing token sale is described by the team as having reached Stage 17, with a stage price of $0.00998. The project also states an intended listing price of $0.3517, but any future market price is uncertain and depends on factors outside the project’s control.

The project further says its wallet is already live and that it has more than 2 million users. These figures and adoption claims have not been independently verified in this article.

According to project descriptions, the product includes a fee-refund and rewards model tied to activity such as swaps, gas fees, and fiat ramps. As with similar mechanisms, users should consider token and platform risks, including changes to terms, smart-contract risk, and market volatility.

As the sale continues through additional stages, the token price may change. Readers should treat stage-based pricing narratives as marketing information rather than a forecast of future returns.

Any return-on-investment (ROI) figures referenced in project promotions are inherently speculative and should not be interpreted as a guarantee of results.

Wrapping Up

The SUI price pattern is being monitored for potential upside, while the Hedera (HBAR) technical outlook points to consolidation with notable support and resistance levels. Cold Wallet, meanwhile, is being marketed around an ongoing token sale and a rewards-based wallet model, based on project-provided information.

Because cryptoassets can be highly volatile and project claims may be incomplete or unverified, readers may want to review primary sources and risk disclosures before making decisions.

Project links (for reference):

Website: https://coldwallet.com/

X: https://x.com/coldwalletapp

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.