TL;DR

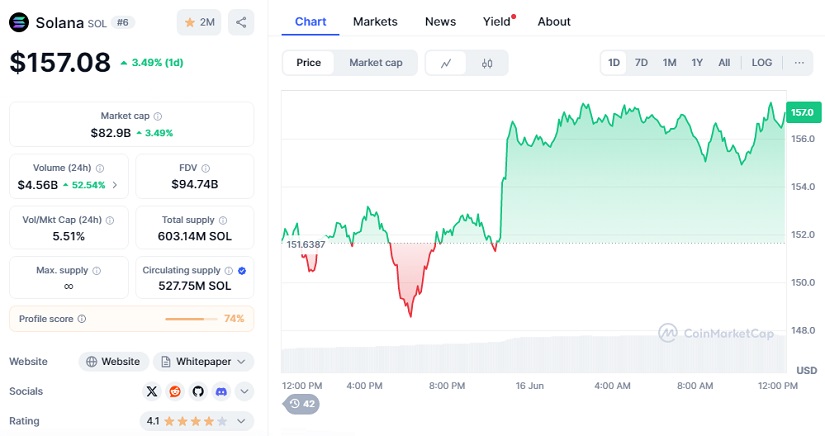

- CoinShares submitted an official application to the SEC to launch a Solana spot ETF, triggering a 3.49% price increase in SOL, which is currently trading at $157.08.

- The proposal includes a non-staking model to avoid regulatory objections.

- With over $1.9 billion in digital asset inflows last week, institutional demand for altcoins like Solana continues to grow.

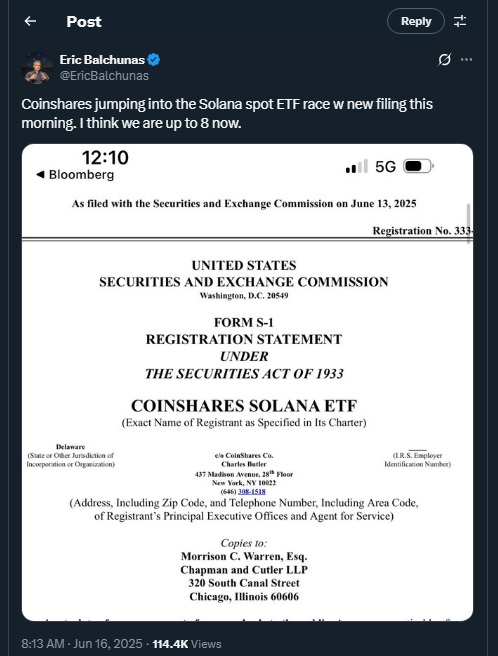

CoinShares, one of Europe’s leading digital asset managers, filed on June 13 with the SEC to list the “CoinShares Solana ETF” an exchange-traded fund designed to provide direct exposure to Solana’s (SOL) performance through traditional stock markets. The filing, submitted under Delaware’s business-friendly jurisdiction, marks a strategic move in the growing race to offer crypto ETFs beyond Bitcoin and Ethereum.

The proposal stands out for its structure: a non-staking ETF model aimed at sidestepping longstanding regulatory concerns from U.S. authorities, particularly regarding the proof-of-stake (PoS) model. According to sources familiar with the matter, this design could ease approval by avoiding any interpretation of unregistered securities.

CoinShares is aiming to outpace competitors like Grayscale and 21Shares, who also filed similar applications in recent weeks. Additionally, the company has highlighted its previous experience with regulated financial products in Europe as a favorable factor for approval. The institutional momentum accumulated in recent months reinforces this strategy focused on combining advanced technology, security and strong regulatory compliance in evolving markets.

Bullish Outlook For Solana If Approval Is Granted

According to CoinMarketCap, Solana is currently trading at $157.08, with a market capitalization of $82.9 billion and a 3.49% gain in the last 24 hours. Year to date, SOL has shown a steady uptrend, with a 25.97% increase over the past 90 days. The Solana network, praised for high speed and low transaction fees, now holds over $8.7 billion in total value locked (TVL), making it the second-largest smart contract platform after Ethereum.

Bloomberg estimates a 90% chance of approval within the next two to four months. CoinShares thus joins a growing list of players, including VanEck, 21Shares, Grayscale, and Invesco Galaxy. All are racing to launch similar products in a market driven by rising institutional appetite for diversified digital assets.

This competition not only strengthens Solana’s legitimacy in traditional markets but could also accelerate regulated blockchain adoption in mainstream investment funds. Many analysts agree that the mix of institutional demand, increasing volume, and solid technical backing may position Solana as the next major player in the tokenized financial ecosystem.