Most tracking tools in the digital asset space are either overly simplistic or locked behind premium subscriptions. CoinCodex takes a different approach by packaging real-time market data, AI-enhanced forecasts, and multi-asset portfolio monitoring into a platform that remains free to use.

Active since 2017, the platform has grown into a cross-market resource for traders who want crypto price feeds alongside stock and forex data without juggling multiple apps. This review looks at its strongest features, the areas where it still needs refinement, and how it compares to more established names.

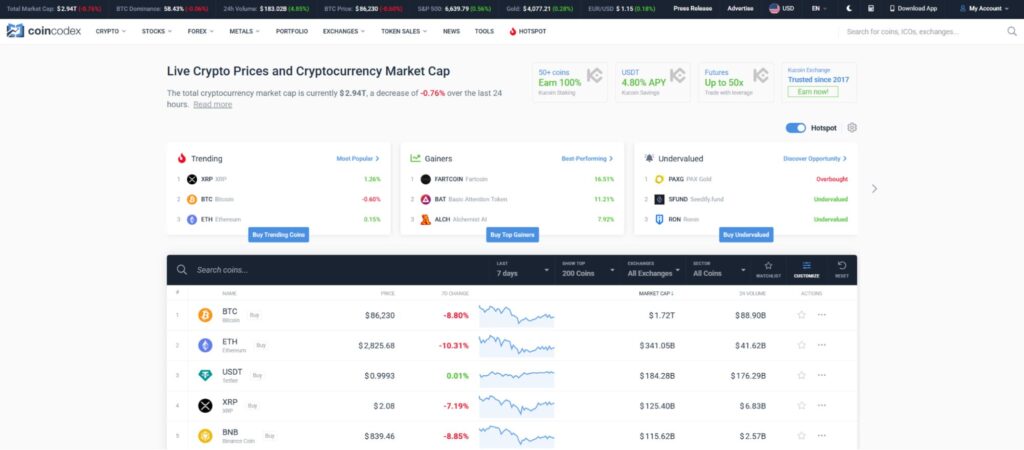

A Dashboard That Prioritizes Simplicity

The CoinCodex frontpage offers a simple look into various assets.

Instead of overwhelming new users with endless tables and widgets, CoinCodex presents a minimalistic layout where the emphasis is on readability. The interface centers around a clean data feed, with optional modules you can toggle on or off depending on how much complexity you want.

You can switch between crypto, stocks, and forex at the top level, allowing users to seamlessly switch between the different dashboards. Prices can be shown in dozens of currencies — including BTC and ETH — and the entire interface is also available in multiple languages.

Wide Asset Coverage

Before diving into features, it’s worth highlighting the sheer scale of CoinCodex’s market coverage. The platform tracks over 44,000 cryptocurrencies across 400+ exchanges, making it capable of indexing virtually any active token — from blue chips to obscure experimental coins.

This broad coverage gives traders two benefits:

- You’re unlikely to encounter an asset the database doesn’t include.

- Historical data is deep enough to support long-term analysis and forecasting.

CoinCodex gradually expanded beyond crypto and now also includes:

- U.S.-listed stocks

- Major forex pairs

- Precious metals (gold, silver)

Market Discovery Tools

CoinCodex organizes its markets in a very flexible way. Instead of only listing assets by market cap, the platform encourages discovery through:

- Trending lists (based on user interest

- Undervalued coin lists

- Gainers/losers

- Newly added assets

- Watchlists you can build and reorder manually

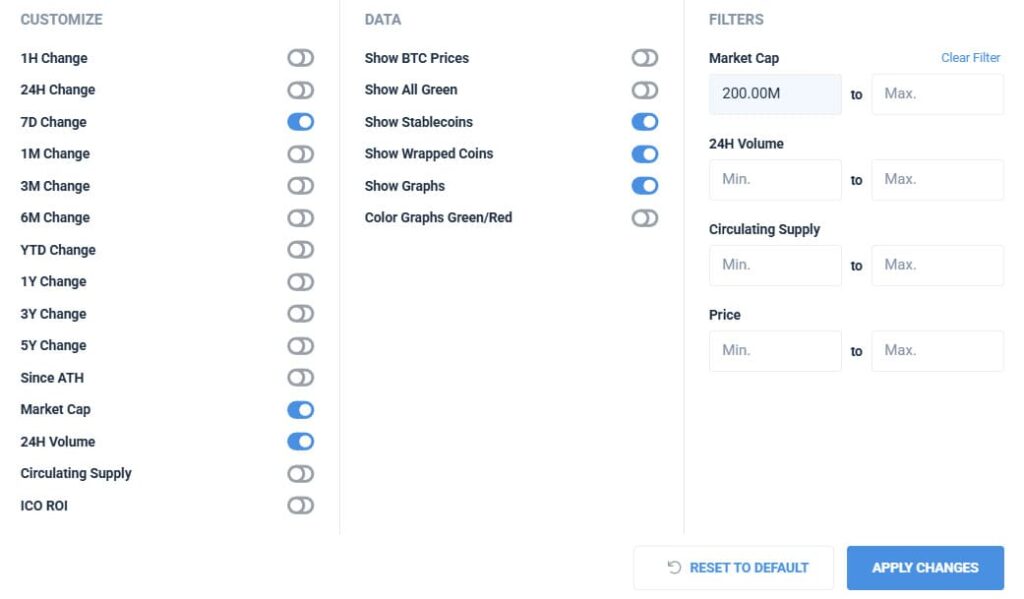

Advanced filters let you exclude certain classes of tokens (e.g., wrapped assets, stablecoins) or hide anything that doesn’t meet your preferred market cap, volume, or supply thresholds.

This system is particularly helpful for investors who want to eliminate noise and focus only on assets that fit their strategy.

You can customize what assets are shown on the frontpage via CoinCodex’s filters.

Charts, Metrics & Exchange-Level Insights

Once you click into any asset, CoinCodex opens a detailed analytics panel. Here you’ll find:

- Standard line charts

- TradingView-powered charts for technical analysis

- Historical highs/lows

- Volatility and supply inflation

- Circulating vs. max supply

- Real-time liquidity and volumes per individual trading pair

That last point is a standout — you can instantly identify where a coin is being traded most actively, which is essential for judging market quality.

A standard line chart shows Bitcoin’s price movement, while users can switch to TradingView for more advanced technical tools.

Essential Utility Tools Built Into the Platform

Instead of spreading functionality across separate pages, CoinCodex integrates a set of investor tools that complement the main data feed:

- Converter: Check exchange rates across any asset type, with support for crypto-to-crypto, fiat-to-crypto, and traditional currency conversions.

- Price alerts: Create custom alerts and receive an email the moment a coin hits your target price.

- Profit calculator: Estimate potential gains or losses across different trading scenarios.

- Fear & Greed Index: Monitor overall market sentiment through a single, easy-to-read indicator.

- Historical data: Access market snapshots dating back to 2010 and download the data in .csv format for deeper analysis.

- Portfolio: Track the performance of your holdings—covering both cryptocurrencies and stocks—in one consolidated dashboard.

- Bitcoin dominance & total market cap: Follow major macro trends that influence the broader crypto landscape.

- Special charts: Explore long-term price behavior using unique visual models like the Bitcoin Rainbow Chart and the Pi Cycle Top Indicator.

These tools help both beginners and experienced traders check key metrics quickly without leaving the site.

AI & Algorithmic Forecasting

One feature that differentiates CoinCodex from other free trackers is its AI-assisted price predictions. Using long-term market cycles and historical pricing behavior, the system generates forecasts across dozens of timeframes — from 5-day predictions to decade-long projections.

The chart displays historical prices in blue, while the projected values appear in gray.

The charts visually divide past and projected movements, highlighting possible scenarios rather than offering guarantees. The predictions also appear alongside the following indicators:

- Moving averages

- RSI readings

- MACD

- Oscillators

This makes the prediction module feel more analytical rather than purely speculative.

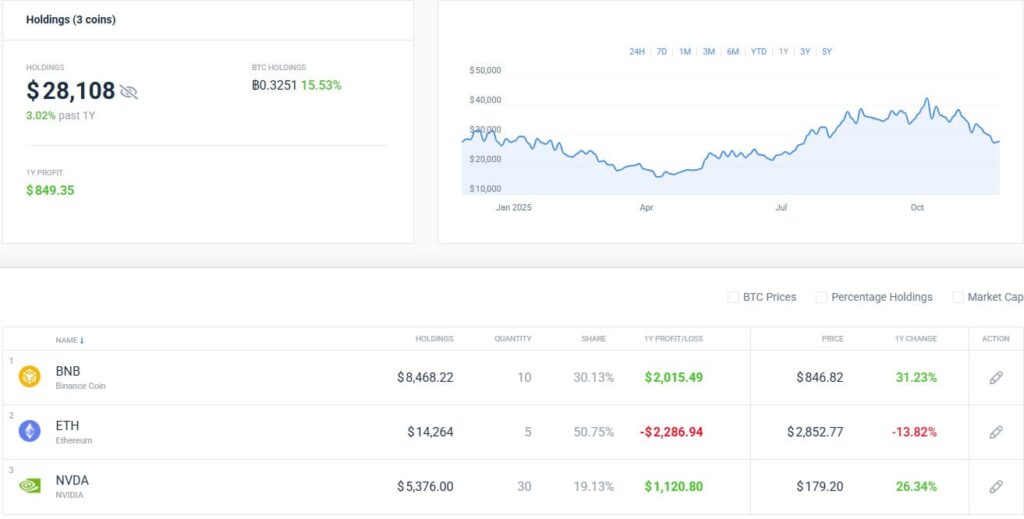

Unified Portfolio Tracking for Both Crypto & Traditional Markets

Many users look at CoinCodex primarily for its portfolio tracker, which blends crypto and stocks into a single performance dashboard. You can view your gains and losses over different timeframes, track daily changes, and categorize positions however you like.

Using the Android app, all portfolio entries sync automatically with the desktop version. Registration is required but free and quick.

Mobile Experience

The CoinCodex Android app mirrors most of the platform’s desktop functionality in a compact, mobile-friendly format. It’s especially useful for live price alerts and portfolio monitoring on the go.

The only downside: There’s currently no iOS version, which limits adoption among iPhone users.

Who Should Use CoinCodex?

CoinCodex works best for:

- Crypto traders who also track stocks or forex

- Users who want predictions without paying for proprietary AI tools

- Investors who prefer configurable dashboards

- People looking for a free alternative to premium analytics platforms

- Anyone who prioritizes deep asset coverage

If you trade only traditional stocks or need advanced order-book analytics, the platform may feel limited — but for mixed-market investors, it’s surprisingly capable.

Final Verdict

CoinCodex stands out for its broad coverage, customizable interface, and algorithmic forecasting — all while remaining completely free. Its database rivals industry leaders, and its ability to mix crypto, stocks, and forex in one place makes it useful for diversified investors.

The absence of an iOS app and the U.S.-only stock coverage are areas that still need work, but the platform already offers more than enough functionality to compete with larger, more commercialized trackers.

If you’re looking for a consolidated view of your investments — without paying premium subscription fees — CoinCodex is one of the strongest options available.