TL;DR

- Brian Armstrong argues that banks that refuse to adopt stablecoins and on-chain infrastructure will lose ground to crypto-native platforms.

- He reveals that Coinbase is already running pilots with major U.S. institutions, showing concrete movement toward digital finance.

- The political fight over stablecoin programs intensifies as banks lobby for restrictions, while institutions in Europe and Asia accelerate tokenized money initiatives that signal a global shift.

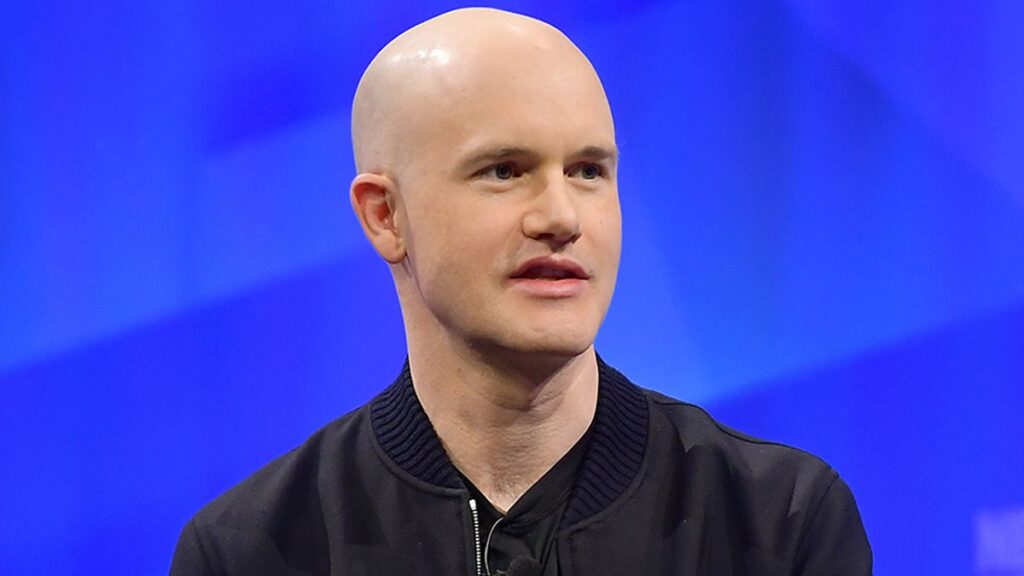

Brian Armstrong maintains that stablecoin adoption is no longer optional for banks. His remarks come after new institutional pilots and during a regulatory debate that seeks to define how digital money fits into the broader financial system.

Banks Face Pressure As Stablecoin Adoption Accelerates

Armstrong explains that several U.S. banks are now evaluating tokenized payment models that enable continuous settlement and lower operational costs. He notes that stablecoins improve cross-border efficiency and reduce reliance on outdated settlement rails. His position reflects rising institutional activity, with global firms incorporating digital assets into long-term planning.

He adds that Coinbase is running pilots covering stablecoin payments, custody and trading services. Participating banks aim to test whether on-chain tools can integrate with legacy infrastructure while maintaining compliance, auditability and standardized reporting. Armstrong views these pilots as early signals that traditional finance is shifting from experimentation to practical deployment. In recent weeks, additional institutions have requested technical briefings, seeking clearer guidance on operational readiness and long-term integration pathways.

Stablecoin Policy Debate Intensifies In Washington

Armstrong says traditional banks are pressuring lawmakers to curb stablecoin reward programs, arguing potential risks to deposits. This conflict grows as legislators discuss a new framework for U.S. issuers. Various crypto advocates believe clear rules would expand use cases and increase competition, while banks fear losing share in payments and consumer services. The debate reflects a deeper struggle over who will control core functions of digital money. Several policy analysts note that the discussion now involves broader questions about competition, technological leadership and financial autonomy for consumers.

Global Institutions Prepare For On-Chain Finance

Meanwhile, European banks move forward with a joint project to issue a euro-denominated stablecoin compatible with MiCAR. Across Asia and the Middle East, major institutions test tokenized deposits and multi-currency models for commercial payments. Armstrong states that this global movement shows how adoption advances quickly beyond the U.S. banking structure, especially where regulatory clarity accelerates digital finance.

Armstrong argues that stablecoins already operate as foundational infrastructure for a more efficient financial system. Banks that embrace this shift can offer more competitive services, while those that resist will face declining relevance in a landscape where digital transactions continue to expand.