Shares of Coinbase, one of the world’s leading cryptocurrency exchanges, has jumped double digits owing to multiple factors that seem to have boosted investor confidence in the exchange.

Coinbase Share Prices Shoot Double Digits

Coinbase shares soared over 13% on Monday after exchange operator Chicago Board Options Exchange (Cboe) revealed it was working with the cypto exchange in its effort to launch a spot bitcoin exchange-traded fund.

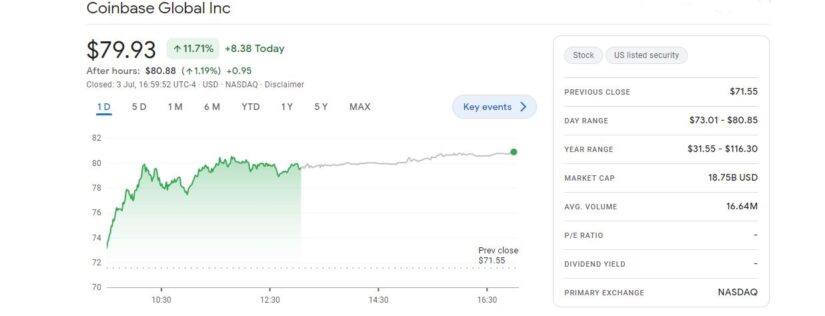

Coinbase shares jumped almost 12% Monday to around $79.93, according to Dow Jones market data. As a result, COIN was trading at $80.98 in after-hours trading on July 4.

This comes shortly after Cboe refilled an application with the United States Securities and Exchange Commission (SEC) to launch a bitcoin exchange-traded fund (ETF) by asset manager Fidelity, on Friday.

As per the filing, the exchange operator named Coinbase as the crypto platform that was chosen to be the market for surveillance-sharing agreements in the ETF applications. In a nutshell, Coinbase would help Cboe police manipulation in the exchange traded fund.

Meanwhile, on July 3, Nasdaq revealed that the world’s largest asset manager BlackRock had re-filed its application for a spot Bitcoin ETF, noting the details included a “surveillance-sharing agreement” with Coinbase. This proved to be another catalyst for the sudden spike in Coinbase shares.

Nasdaq refiles BlackRock's bitcoin ETF application with SEC https://t.co/UXYS3vR2B5 pic.twitter.com/bj09eeAPRB

— Reuters (@Reuters) July 4, 2023

MicroStrategy Shares Bounce

These developments have not only boosted Coinbase share but also pushed shares of MicroStrategy to a new 52-week high of $378.27. MSTR stock gained 10.3% on July 3 and rose another 2% in extended trading yesterday.

This comes after the SEC forced several firms to resubmit their ETF applications as it claimed the filings submitted by Nasdaq and Cboe on their behalf were “inadequate.”

Will go on record…

Think spot bitcoin ETF launch shatters previous record ETF launch.

It won’t even be close.

<not investment advice>

— Nate Geraci (@NateGeraci) July 4, 2023

There has been a sudden spurt in fresh applications for a Bitcoin ETF in the past few weeks. On June 4, ETF Store President Nate Geraci said that a spot Bitcoin ETF launch will shatter previous ETF launch records.

Other market experts also anticipate the increasing chances of a spot bitcoin ETF finally getting approved by the SEC as bullish for Bitcoin (BTC), since it could simplify adoption by traditional investors with stock accounts.

The overall crypto market is also up over the past 24 hours with the global crypto market cap soaring 0.27% to $1.21 trillion. The total crypto market volume over the last 24 hours increased 21.63% to $37.98 billion. On the other hand, Bitcoin (BTC), Ethereum (ETH) and major altcoins continued to gain on Tuesday.