The latest exchange benchmark report by CCData positioned Coinbase in the first place. CCData established standards in evaluating risks associated with these platforms, and their report is a benchmark in the industry.

The latest edition of the report provides a detailed view of the industry and reveals key data on the performance of exchanges in various categories.

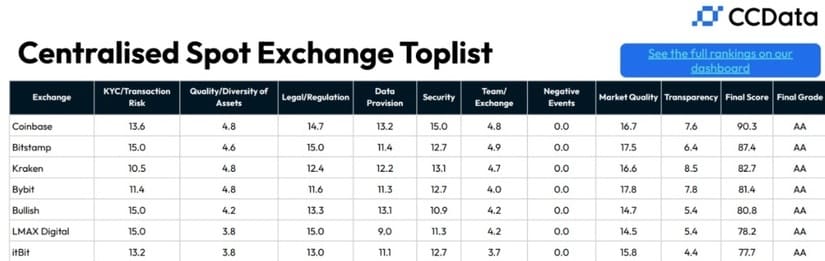

In this report, a select group of seven exchanges that achieved the coveted AA rating is highlighted. These ratings reflect the evolution of platform standards.

Coinbase, Bitstamp, and Kraken are among those leading this group, demonstrating their commitment to excellence in terms of security and quality.

Coinbase Takes the Podium

According to the report, Coinbase emerges as the leader in the centralized exchange category. The company obtained the highest rating in terms of security and has surpassed Bitstamp, which previously held the top position in this category.

In the derivatives exchange category, eight out of the 27 evaluated platforms have received a “Top-Tier” (BB+) rating.

OKX leads the category, with Bybit also obtaining an AA rating. These ratings indicate that these exchanges have demonstrated their commitment to the highest standards in the derivatives market.

On the other hand, in the realm of decentralized exchanges, Uniswap stands out as the only one with an AA rating.

An award was granted for their outstanding security and liquidity. Other decentralized exchanges, such as Curve, dYdX, and GMX, also receive recognition in the report for their work in terms of security and quality.

The report also indicates an increase in regulatory compliance within the industry. According to VASPnet data, 75 out of the 107 centralized exchanges now hold regulatory licenses.

This demonstrates a greater focus on adhering to regulations and legal standards in the cryptocurrency industry.

Furthermore, exchanges are improving their “Know Your Customer” (KYC) practices, with an average KYC score of 3.2 out of 4. This represents a significant increase compared to the average score of 2.8 recorded six months ago.

The report underscores the growing importance of regulatory compliance and security. Exchanges are committed to enhancing operational quality, security, and compliance to provide a safer and more reliable experience for users.