Coinbase has recently reported net revenue of $663 million for Q2 2023, which is boosted by its deal with Blackrock regardless of regulatory action. However, the net revenue was down by almost 10% in comparison to Q2 2022, but it greatly surpassed the initial estimates.

Our Q2'23 financial results are in and our letter to shareholders can be found on the Investor Relations website at https://t.co/8ovHEtQp5N pic.twitter.com/03JF6gUS0R

— Coinbase 🛡️📞 (@coinbase) August 3, 2023

The net loss was reported to be $97 million, which is undoubtedly the sixth consecutive quarterly loss for the exchange, but increasingly narrower than the loss suffered in Q2 2022. The adjusted EBITDA, which is responsible for providing meaningful metrics when comparing company performance, was approximately $194 million.

As long as transaction value is concerned, it suffered a decline of almost 13% in comparison to Q1 of this year. Coinbase saw transaction revenue of $327 million coupled with a quarterly decline in trading volume by 37%. The CEO of the exchange, Brian Armstrong, stated that the exchange was focused on the non-trading parts of the business over the next three to five years. However, he did mention that the exchange prioritized scalability, regulatory clarity, and driving crypto utility.

Armstrong added,

“Q2 was a strong quarter for Coinbase as we executed well and showed resilience in a challenging environment. We’ve cut costs, are operating efficiently, and remain well-positioned to build the future of the crypto economy and help drive regulatory clarity.”

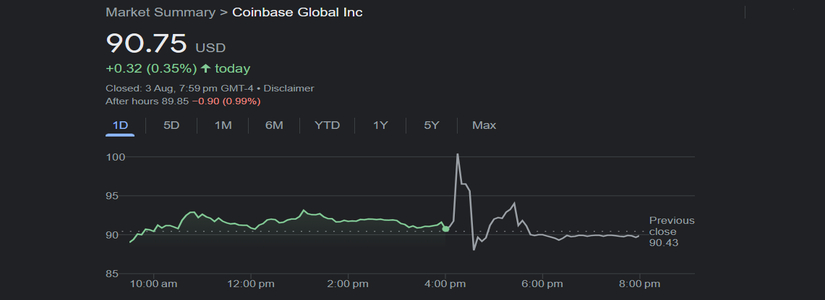

With the developments surrounding Coinbase, the stock price of the exchange has surged by 0.35% as of today and is currently switching hands for $90.75. However, the share price of the crypto exchange is still down by a staggering 73% from an all-time high of $343 in November 2021.

Coinbase to File an Order Seeking Dismissal of SEC Lawsuit

The Chief Legal Officer at Coinbase, Paul Grewal, expressed a sense of positivity surrounding the posibility of a win from Coinbase against the SEC and highlighted the plans of the exchange to file an order in court to have the case dismissed as Grewal asserts that the allegations made by the regulatory body, which claim that Coinbase engaged in the sale of securities, are “devoid of merit and factual basis”.

As per its Aug. 3 second-quarter 2023 earnings call, the Coinbase legal chief expressed confidence that the exchange would win the court case brought by the SEC. In his words, “With respect to the litigation with the SEC, I want to be very clear. We do think we can win and expect to win.”

Grewal continued to argue that Coinbase never listed securities on its platform as it consider the regulator “claims” that cryptocurrencies offered by the exchange are securities as nonsense. At the same time, he argued that the SEC has no regulatory authority over crypto exchanges and never asked Coinbase to register with the regulator .

Amid the intense lawsuit, Coinbase expects the SEC to at least provide proper regulatory clarity. The main reason for taking such an initiative can be linked to the conflicting messages the current law provides.Notably, the outcome of this legal maneuver could potentially influence the way other crypto-related entities address similar regulatory challenges in the evolving digital financial realm. Grewal added, “Regardless of the outcome of the court case, clarity itself is the goal as it defines winning.”