TLDR

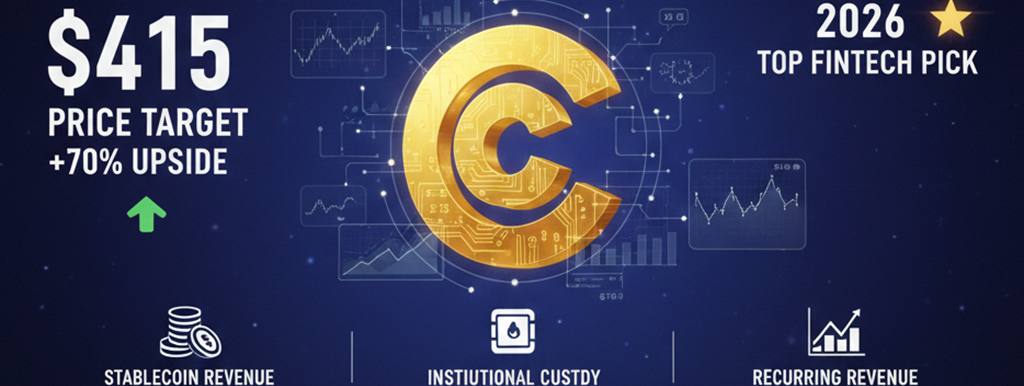

- Clear Street sets a price target of $415, suggesting a 70% upside potential.

- The company is evolving from a retail exchange into a comprehensive infrastructure platform.

- Recurring revenue from custody and stablecoins reduces dependence on trading fees.

According to analysts, the financial technology landscape already has a clear protagonist for 2026. Coinbase shares were selected by Clear Street analyst Owen Lau as one of his top three investment recommendations for the coming year.

Alongside giants such as S&P Global and Nasdaq, the U.S. exchange positions itself as a key piece for investors seeking exposure to digital market infrastructure and blockchain technology.

Currently, the firm maintains a “Buy” rating on Coinbase shares, estimating a price target of $415. This valuation implies potential growth of nearly 70% relative to current levels.

The report highlights that the market is structurally undervaluing the company by treating it solely as a cryptocurrency trading intermediary, ignoring its expansive role in the on-chain economy.

From Exchange to Financial Infrastructure Platform

Clear Street’s optimism focuses on the resilience of Coinbase’s business model. A strategic diversification of its income is highlighted, moving away from the volatility of retail trading fees to focus on more stable streams. Key pillars among these include institutional custody services, revenue derived from stablecoins, and its subscription products.

By 2026, Coinbase shares are expected to be driven by key catalysts such as the “Coinbase Tokenize” platform, aimed at the tokenization of traditional assets, and its foray into prediction markets. These advancements suggest an evolution toward an “everything exchange” that integrates artificial intelligence and regulatory compliance.

In summary, experts predict that 2026 will be a transition year where companies with recurring revenue models and regulatory alignment will outperform their peers.

In this context, betting on Coinbase shares represents an investment in the foundational base of the new digital financial system, allowing the exchange to benefit not only from market cycles but also from the long-term mass adoption of blockchain technology.