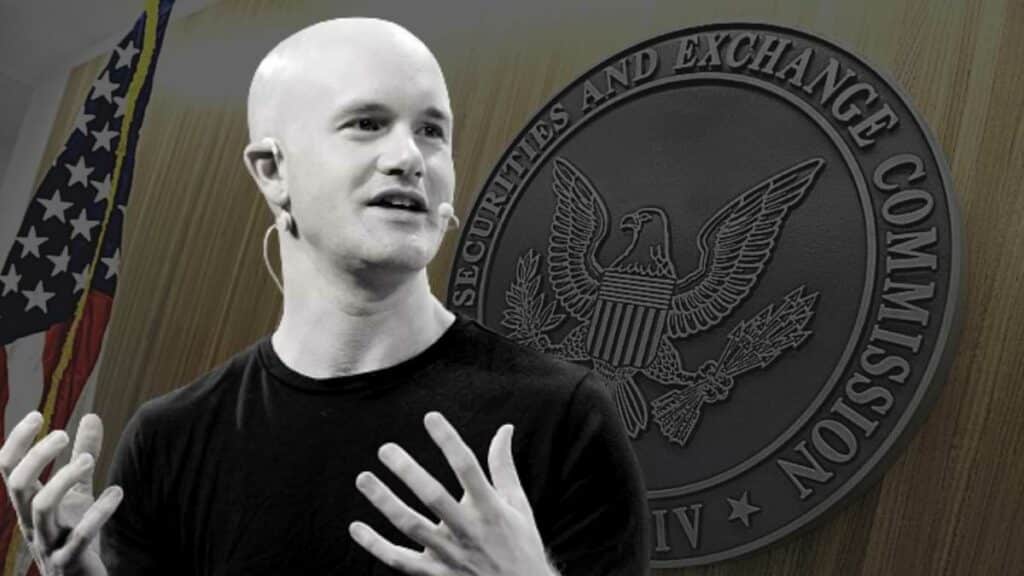

The United States Securities and Exchange Commission (SEC) is proposing a ban on crypto staking for retail users in the nation, according to Brian Armstrong, CEO of Coinbase Global Inc., the largest cryptocurrency exchange in the United States.

Armstrong did not specify the source of the news, citing “rumors,” but said that allowing it to happen would be a terrible path for the United States.

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

— Brian Armstrong (@brian_armstrong) February 8, 2023

The crypto executive also outlined some of the advantages of staking, calling it an “important innovation” in the industry as it enables users to actively take part in running open crypto networks.

He continued,

“Staking brings many positive improvements to the space, including scalability, increased security, and reduced carbon footprints.”

Armstrong also cited a blog post from the cryptocurrency investing company Paradigm dated October 5, stating that Ethereum’s switch to proof-of-stake and subsequent “staking” mechanism does not qualify it as a security.

The Paradigm post came only a few weeks after SEC chair Gary Gensler hinted to reporters during a Senate Banking Committee meeting that proof-of-stake (PoS) cryptocurrencies might trigger securities regulations on September 15, 2022.

Sec’s Crypto Staking Ban Might be a Bad Idea

Moreover, the CEO of Coinbase voiced his opinion that aggressive enforcement is ineffective since it merely encourages businesses to go offshore to evade regulators, much like the now-collapsed FTX did when it selected the Bahamas as its headquarters.

Instead, Armstrong says he hopes the crypto community can help create sensible and clear rules for the industry and that new technologies should be encouraged rather than stifled in the US.

Rather than uniting for the sake of the industry as a whole in response to Armstrong’s worries, Charles Hoskinson, the founder of Cardano, used the opportunity to take a shot at his rival.

“Ethereum staking is problematic,” he said. “Temporarily giving up your assets to someone else to have them get a return looks a lot like regulated products.”

The industry will suffer more as a result of the SEC’s crackdown on crypto staking than it will benefit from it. Staking provides a way for retail investors to earn passive income and participate in the growth of blockchain networks.

By limiting this option, regulators are making it even more difficult for retail investors to generate wealth and diversify their investment portfolio.

Whatever the motives, using cryptocurrency is a personal decision, and restricting staking might be viewed as an attack on personal freedoms. Retail investors ought to be free to choose their own investments and methods of operating in the cryptocurrency market.