Introduction — Cloud Mining in 2025 Still Requires Careful Verification

For more than a decade, cloud mining has faced the same criticism: too many promises, too little evidence.

In 2025, some operators publish more information about their operations (such as energy sources, facility photos, payout records, and contract terms). However, public disclosures can vary in quality, and users still need to assess counterparty risk and the possibility of misleading marketing.

This guide reviews seven cloud-mining-related platforms and highlights what differentiates their products or interfaces. Inclusion is for context and comparison and should not be read as an endorsement.

1️⃣ AutoHash — A Data-Forward Interface Compared With Many Competitors

Angle: AutoHash as a “data-first” mining platform (as presented by the service)

Many cloud-mining sites emphasize a simple purchase flow. AutoHash, by contrast, places more emphasis on dashboards and operational-style metrics.

The platform interface highlights items such as:

- difficulty charts and related network indicators

- block reward and payout-related information

- energy-cost modeling or similar cost assumptions

- routing or allocation logs described as SmartHash Routing™

- a map-style view indicating where a contract is described as running

This approach may appeal to users who prefer more visibility into how a provider presents its activity.

Notable Points Cited by the Platform

- The site describes a trial or promotional offer; terms and availability can change and should be reviewed directly on the provider’s website.

- The company states it is Swiss-registered (Blockchain Finance AG); readers should independently verify any registration or corporate filings.

- The platform lists short contract durations (for example, 1–5 days); shorter durations may reduce exposure to long-term assumptions but do not remove market or operational risk.

- The project claims the use of renewable-energy-linked facilities in locations such as Iceland, Norway, Paraguay, and Texas; these claims should be treated as provider-reported unless independently verified.

- The service describes automated allocation intended to optimize for factors like energy cost; results are not guaranteed and depend on network conditions and fees.

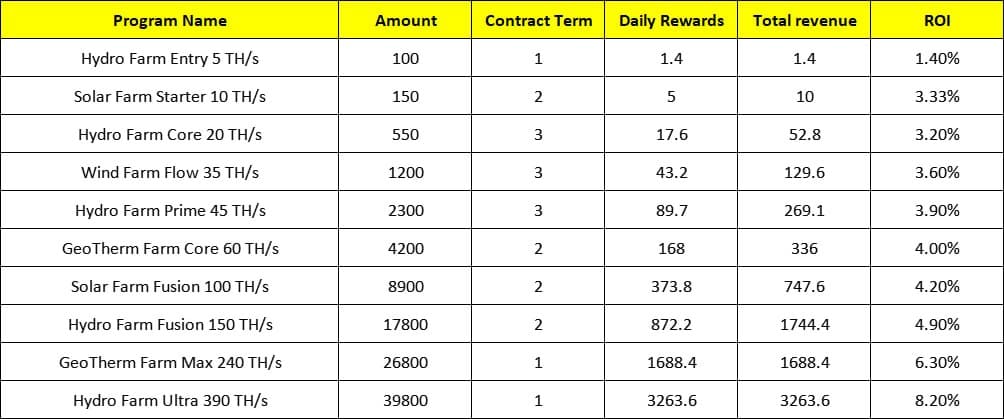

Quick Contract Snapshot

As with any cloud mining provider, reported payout schedules, fees, and execution depend on the contract terms and on network conditions, and they can change over time.

2️⃣ ECOS — A Cloud-Mining Product Packaged Like a Traditional Financial App

Angle: Institutional-style presentation

ECOS uses a relatively conservative interface that resembles a portfolio dashboard more than a typical crypto app.

Instead of a simplified purchase flow, users may see features framed as:

- a contract or product portfolio view

- difficulty or network estimates (which are inherently uncertain)

- longer-horizon projections or calculators (which should not be treated as predictions)

This may appeal to users who prefer a more structured presentation, though projected figures remain assumptions rather than guarantees.

May appeal to: users who prefer longer-duration products and a portfolio-style layout.

Possible limitation: shorter-term flexibility may be more limited depending on the product selected.

3️⃣ BitDeer — Emphasis on Facilities and Hardware Imagery

Angle: Facility visibility as a trust signal

BitDeer’s marketing materials place more emphasis on physical infrastructure (such as racks, cooling aisles, and maintenance content) than some competitors that use generic visuals.

For users who are skeptical of purely virtual dashboards, this type of content can be helpful context, though it is still important to verify contract terms, fees, and withdrawal rules.

Potential strength: a focus on industrial-scale operations (as presented by the company).

Potential limitation: pricing and contract availability can vary, and some products may be expensive relative to alternatives.

4️⃣ NiceHash — Hashpower Marketplace Rather Than Fixed Contracts

Angle: Marketplace model

NiceHash is often described differently from fixed-term cloud mining: it operates more like a marketplace for hash power rather than a standard contract-based offering.

Instead of selecting a preset duration, users can typically configure parameters and change or stop activity based on their own preferences.

This can mean:

- more user control over settings

- no fixed yields and no guaranteed outcomes

- the need to understand pool settings, fees, and market pricing

- the option to pause or stop, subject to the platform’s rules

It is generally more hands-on than contract-style products.

May appeal to: users who prioritize control and are comfortable managing parameters.

5️⃣ StormGain — Mobile-First “Tap to Mine” Presentation

Angle: App-first experience

StormGain presents a simplified mobile experience that resembles a consumer finance app more than a traditional mining dashboard.

The app experience is often described as starting a mining-style process from within the interface, with balances changing over time.

Because app-based “mining” features can be implemented in different ways across the industry, users should read the product description and terms carefully to understand what is being offered and what conditions apply to withdrawals.

Key consideration: withdrawals and eligibility requirements may depend on additional platform activity, and users may find those conditions restrictive.

6️⃣ ViaBTC Cloud — Cloud Products Alongside Mining Pools

Angle: hybrid pool + cloud offering

ViaBTC is widely known for its mining pool services, with cloud-style products positioned as an extension of that broader ecosystem.

Some users may start with a small cloud product and later explore pool mining if they want more direct involvement, though both approaches carry market, fee, and operational risk.

Why it can stand out:

the same provider offering both pool participation and cloud-style products can make it easier to compare options in one place.

7️⃣ Hashing24 — Simple, Minimal-Choice Contract-Style Mining

Angle: simplicity-first

Some users prefer to avoid complex dashboards, allocation features, and projections.

- automated routing claims

- multi-option contract matrices

- difficulty charts and forecast tools

- energy mapping displays

- long-horizon projections

Hashing24’s presentation is more minimalist, focusing on a smaller set of choices and a straightforward contract-style product.

Potential benefit: a simpler user experience for those who want fewer configuration options.

Potential trade-off: fewer advanced features compared with platforms that offer more tooling.

2025 Cloud Mining Reality Check — What Usually Matters Most

Regardless of platform, outcomes in cloud mining are typically influenced by several variables:

1. Energy Source and Cost Structure

Lower-cost or more stable energy inputs can improve mining economics, all else equal. Energy claims should be treated as provider-reported unless independently verified.

2. Contract Length and Fees

Shorter contract periods may reduce exposure to long-term assumptions, while longer periods can increase exposure to changes in difficulty, fees, and market conditions.

3. Transparency and Verifiability

If a platform does not provide clear information about fees, payout calculation methods, withdrawal rules, and the operating entity, it becomes harder to evaluate the risks involved.

- operational logs (where available)

- payout history (where available)

- clear corporate and jurisdictional information

to help assess accountability.

4. Platform Operations and Policy Changes

Platforms can change fee schedules, payout timing, minimum withdrawals, and product structures. More disclosure can make evaluation easier, but it does not guarantee reliability or future performance.

Several services—including newer products that emphasize dashboards and operational reporting—position transparency as a differentiator. Readers should verify key claims independently.

Risk & Compliance Notes

Cloud mining is associated with multiple risks, including:

- BTC price volatility

- changes in network difficulty and block rewards

- energy and operational cost changes

- counterparty risk and operational failures

Be cautious with platforms that advertise fixed or guaranteed daily returns, and review fee schedules, withdrawal rules, and corporate disclosures before using any service.

U.S. users should review IRS guidance related to mining income or consult a qualified tax professional.

Conclusion — Cloud Mining Remains High-Risk and Highly Variable

In 2025, some cloud mining services present more operational detail than earlier generations of products. That may help readers compare offerings, but it does not remove the underlying uncertainty around costs, difficulty, and counterparty risk.

Among the examples discussed, AutoHash emphasizes a data-heavy interface and short-duration products (as described by the project), while other platforms focus on institutional-style presentation, facility visuals, marketplace mechanics, mobile-first experiences, pool ecosystems, or minimalism.

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. This article provides information about cloud mining services or staking platforms. We recommend that our readers conduct thorough research before using any service, as these types of products may involve certain risks associated with the crypto sector.