TL;DR

- Large investors have transferred over $300 million in LINK from exchanges in recent weeks, signaling massive accumulation and growing conviction in Chainlink’s long-term potential.

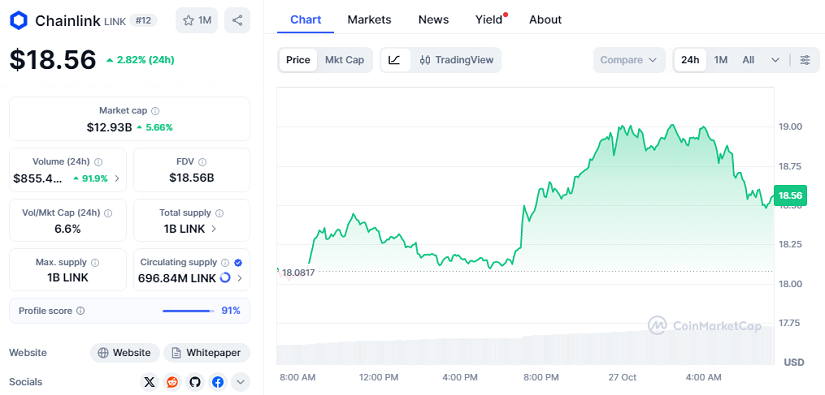

- The asset is trading at $18.56 (+2.82%), with a $12.93 billion market cap and a 92% surge in trading volume.

- Analysts believe this whale movement could precede a breakout above $20.

Chainlink (LINK) is once again capturing attention as on-chain data reveals that whales have withdrawn more than 16 million LINK—worth roughly $300 million—from major exchanges like Binance in less than three weeks. The trend suggests a steady phase of accumulation that has coincided with renewed optimism surrounding Chainlink’s expanding utility and network growth.

According to data from Lookonchain, the number of wallets holding over 100,000 LINK continues to climb, while the total balance of LINK on centralized exchanges has fallen to its lowest point since early 2022. Analysts interpret this as a sign that large holders are preparing for long-term holding, reducing the available supply and creating favorable conditions for upward price momentum.

Chainlink Price Eyes Key Breakout Zone

Over the weekend, LINK climbed 5% to touch $19.02 before a modest correction brought it back to $18.56 by Monday morning. Despite the short-term pullback, technical indicators remain supportive of a potential breakout. The 5-day moving average has crossed above the 10-day, while the Relative Strength Index (RSI) sits near 47—indicating a market leaning toward bullish sentiment without being overheated.

Traders are closely watching the $18.70 resistance level. A confirmed break above this zone could push LINK toward $23–$25, aligning with targets projected by multiple analysts. Failure to maintain momentum, however, might lead to a short-term retest of $15.40, a zone of previous consolidation.

Growing Institutional Confidence In Chainlink’s Ecosystem

The timing of this accumulation wave aligns with Chainlink’s rollout of its Treasury Pool program, which rewards node operators and early contributors who have supported the project’s decentralized oracle network. This move reinforces confidence among institutional and long-term investors.

With trading volume soaring to $855 million in 24 hours—up 92%—and market sentiment tilting positive, Chainlink appears positioned for a renewed bullish phase. If whale activity remains strong, LINK could soon reclaim the $20 level and establish a higher base, reflecting a broader revival in the DeFi sector’s momentum.