TL;DR

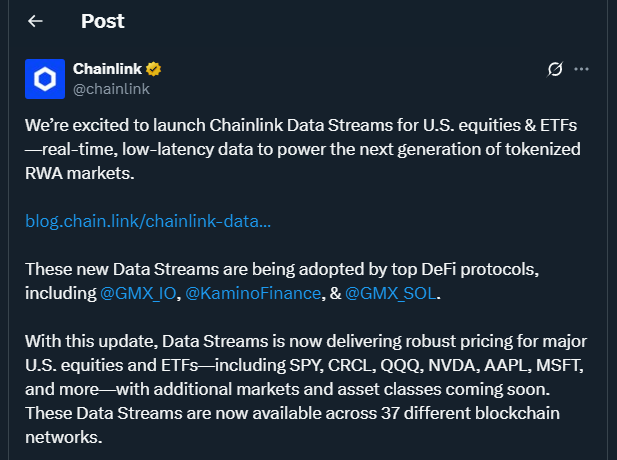

- Chainlink has introduced Data Streams for U.S. stocks and ETFs, enabling on-chain tokenization of real-world assets through partners like GMX and Kamino.

- The solution spans 37 blockchain networks and delivers institutional-grade market data with built-in features like market status indicators and staleness detection.

- This positions Chainlink as a critical infrastructure provider in the growing $275B tokenized asset market, paving the way for deeper TradFi integration in DeFi ecosystems.

Chainlink has expanded its role as a data infrastructure leader in DeFi by launching new Data Streams tailored for U.S. equities and ETFs. These innovative streams provide real-time pricing data from traditional financial assets like Apple, Microsoft, and S&P 500 ETFs, making them accessible directly on blockchain. This innovation brings tokenized versions of familiar Wall Street instruments into the hands of decentralized applications, widening the scope of financial products that can be built on blockchain rails.

The launch already has backing from projects like GMX, Kamino, and GMX-Solana, all of which are leveraging the data to build trading and synthetic asset solutions. These integrations span 37 chains, offering multi-chain composability and reinforcing the trend of DeFi protocols looking beyond crypto-native assets.

Expanding DeFi Utility With TradFi Asset Pricing

What sets this rollout apart is its technical depth. Chainlink’s Data Centers not only deliver price feeds but also include contextual market metadata: trading hours, update timestamps, and circuit-breaker logic to mitigate risks like flash crashes or exchange outages. The data is sourced from providers like Finalto, Tiingo, and Finnhub, and processed through decentralized oracle networks (DONs), ensuring trust-minimized delivery.

Developers can now create synthetic ETFs, perpetuals, lending markets, and even structured products using real-time U.S. market data. This expanded functionality blurs the lines between traditional and decentralized finance, allowing for advanced trading strategies and new arbitrage models that were previously siloed.

The Future Of Capital Markets May Be On-Chain

The tokenized RWA market has already reached $275 billion, and forecasts suggest it could grow beyond $30 trillion by 2030. Chainlink’s move arrives just as financial institutions and crypto protocols align toward that future. By enabling secure, composable access to equity and ETF data, Chainlink gives developers powerful tools to compete with traditional trading platforms while preserving DeFi’s open and programmable nature.

Chainlink also plans to extend coverage to forex, commodities, and OTC instruments, further solidifying its role in the infrastructure stack of on-chain finance. Upcoming SDK and tooling improvements are expected to make integration even smoother, opening the door for new use cases in asset management, credit markets, and beyond.