Chainlink has drawn attention following Bitlayer’s use of its Cross-Chain Interoperability Protocol (CCIP) as a cross-chain framework for certain Bitcoin-related DeFi use cases across multiple networks. Separately, Chainlink has reported reserves exceeding 280,000 LINK. These updates have been discussed by market participants alongside broader trends in crypto infrastructure adoption.

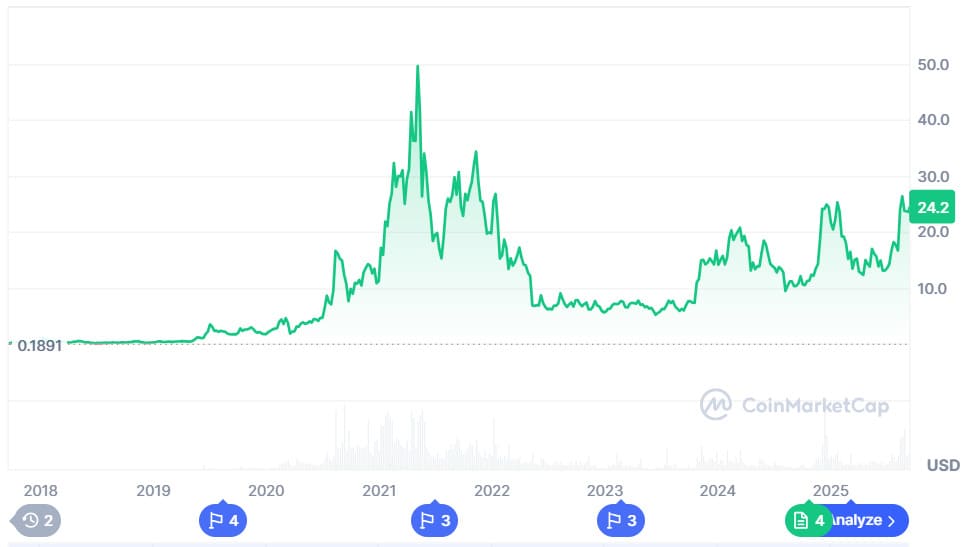

LINK has also seen notable price movement, with some analysts pointing to the $24 level as a recent reference point and discussing higher price scenarios. Such projections are inherently uncertain and depend on market conditions. Separately, Chainlink’s partnerships with firms such as Mastercard and UBS have been cited by commentators as part of a broader discussion around tokenized assets (often estimated at tens of billions of dollars, depending on methodology).

The market discussion has also included BullZilla ($BZIL), an early-stage token sale referenced in project materials. The project describes features such as token supply reductions (“burns”) and staking mechanics; any potential outcomes are not guaranteed and depend on token design, demand, and broader market factors.

Chainlink CCIP Adoption Boosts Cross-Chain BTC DeFi

Bitlayer, a Bitcoin Layer 2 project, has integrated Chainlink CCIP as its canonical cross-chain framework. This upgrade is described as enabling transfers of assets such as USDC, USDT, ETH, and wstETH between Bitlayer and Ethereum, with support for YBTC (a BTC-pegged token) referenced as a planned addition.

According to Chainlink Labs, this integration is intended to help developers extend BTCFi applications across Ethereum, Avalanche, BSC, and other EVM-compatible networks. Chainlink Labs has also stated that CCIP has secured and processed large amounts of on-chain activity; such figures are reported by the project and may vary depending on definitions and data sources.

More broadly, cross-chain systems aim to reduce operational and security risks associated with moving assets between ecosystems, though interoperability remains a complex area with evolving standards.

Chainlink Reserves and Whale Accumulation Signal Long-Term Growth

Chainlink has stated that its reserve has exceeded 280,000 LINK, and described a “revenue conversion” mechanism that may purchase LINK on decentralized exchanges such as Uniswap. The potential impact of such activity on circulating supply, liquidity, and market dynamics can be difficult to assess and is not necessarily indicative of future price performance.

Some market trackers have also reported increased holdings among large addresses over recent weeks. In parallel, technical analysis commentary has cited patterns such as a cup-and-handle formation, though such interpretations are subjective and do not reliably predict outcomes.

Commentary about potential institutional participation, possible exchange-traded product developments, or strategic reserve narratives remains speculative unless confirmed by primary sources.

BullZilla Token Sale Figures Cited in Project Materials

In separate coverage circulating online, BullZilla ($BZIL) has been presented as a retail-focused token sale. Project materials describe branding tied to a meme theme, along with mechanisms such as token “burns,” staking, and marketing incentives, which may include referrals. Terms, eligibility, and risks depend on the project’s documentation and applicable regulations.

The project claims the sale has sold 24.7 billion tokens, raised more than $360,000, and reached 1,200+ holders. These figures are project-reported and have not been independently verified here.

BullZilla ($BZIL) Token Sale Snapshot (Project-Reported)

| Metric | Value |

| Current Stage | Stage 2 (labeled “Dead Wallets Don’t Lie” in project materials) |

| Current Price | $0.00004575 |

| Tokens Sold | 24.7 Billion |

| Token Sale Raised | $360,000+ |

| Token Holders | 1,200+ |

Conclusion

Bitlayer’s CCIP integration and Chainlink’s reported reserve figures are among the recent developments being discussed in the context of cross-chain infrastructure and on-chain market activity. Separate project-reported information about BullZilla highlights how early-stage token sales continue to appear alongside coverage of larger, established crypto networks.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions About Chainlink and BullZilla

What is Chainlink CCIP and why is it important?

CCIP is Chainlink’s Cross-Chain Interoperability Protocol, designed to support messaging and asset transfers across multiple blockchains.

What is the value of LINK in reserve of the Chainlink?

By September 2025, Chainlink reported a reserve of more than 280,000 LINK. The implications of reserve activity can vary and do not provide certainty about future market outcomes.

What is the current Chainlink price outlook?

Some analysts have discussed scenarios involving higher price levels, but forecasts are speculative and can change quickly with market conditions.

What is BullZilla ($BZIL)?

BullZilla is described in project materials as an Ethereum-based token being distributed via an early-stage token sale, with features such as burns and staking.

How much has BullZilla raised so far?

The project claims it has raised over $360,000 and sold 24.7B tokens to more than 1,200 holders; these figures are project-reported.

Glossary of Key Terms

- Chainlink (LINK): Oracle network connecting external data to blockchains.

- Chainlink Price: The market price of LINK, which can be volatile.

- CCIP: Cross-Chain Interoperability Protocol supporting cross-chain communication.

- Bitlayer: A Bitcoin Layer 2 project that has announced adoption of Chainlink CCIP.

- Whales: Large holders of cryptocurrency, sometimes tracked for market-analysis purposes.

- BullZilla ($BZIL): Meme-themed token described by the project as using burn and staking mechanisms.

- BullZilla Token Sale: The project’s early-stage token distribution event prior to any potential exchange listing.

- Roar Burns: Project term for a token supply reduction mechanism.

- BTCFi: Bitcoin-related decentralized finance applications.

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.