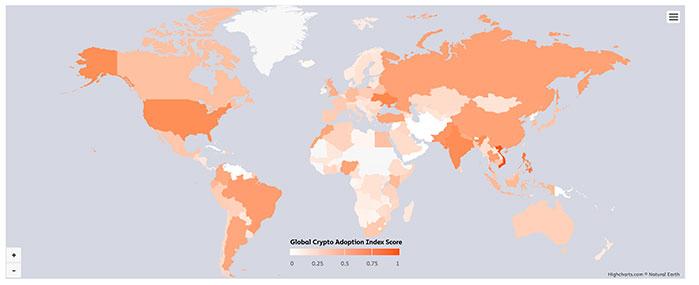

Chainalysis has published a study on the global adoption of cryptocurrencies in 2022. According to the report, grassroots cryptocurrency adoption continues to rise in all countries for a third consecutive year.

Adoption is Leveling Off

According to the data, the global adoption of blockchain technology has slowed down considerably over the last year after being on an upward trend since mid-2019. As of Q2 2021, cryptocurrency adoption has reached an all-time high in terms of its global market share.

In the past few months, adoption has moved in waves – it has been decreasing in Q3, a period when crypto prices were declining, rebounding in Q4, when prices rose to new all-time highs, and declining in each of the past two quarters as we have entered a bear market. It is essential to note that global adoption remains well beyond the pre-bull market 2019 levels, even though it is a relatively small phenomenon.

As noted last year, there has been an ever-increasing trend in the growing importance of emerging markets this year: they dominate the index as a whole.

Depending on the level of income and economic development within the country, the World Bank categorizes countries into four main categories: high income, upper middle income, lower middle income, and low income. On the basis of that framework, the top of the index has been dominated by the middle two categories.

There are ten countries in our top 20 list that fall within the lower-middle income range: Vietnam, Philippines, Ukraine, India, Pakistan, Nigeria, Morocco, Nepal, Kenya, and Indonesia. There are eight countries with an upper-middle-class income: Brazil, Thailand, Russia, China, the United Kingdom, Turkey, Argentina, Colombia, and Ecuador. The United States of America and the United Kingdom are two countries in this index with high incomes.

In terms of cryptocurrency adoption, Vietnam has been ranked first for the second consecutive year. Based on the sub-rankings of the country, we can observe that Vietnam has extremely high purchasing power and a high level of population-adjusted adoption for centralized, decentralized, and peer-to-peer cryptocurrency tools.

As noted previously, global adoption of bitcoin has remained well above the levels that were prevalent prior to the start of the 2020 bull market, despite the recent sporadic growth in growth that has accompanied the onset of the latest bear market.

Data suggests that a critical mass of new users who invest in cryptocurrencies during periods when the price increases tend to stay even after the price declines, allowing the ecosystem to grow steadily on a net basis across market cycles regardless of whether the price rose or fell.

As a result, users in emerging markets may be attracted to cryptocurrency for a variety of reasons, including its value. There is a clear dominance of these countries in the adoption index, in large part because cryptocurrency provides people living in unstable economic environments with one-of-a-kind, tangible benefits.