TL;DR

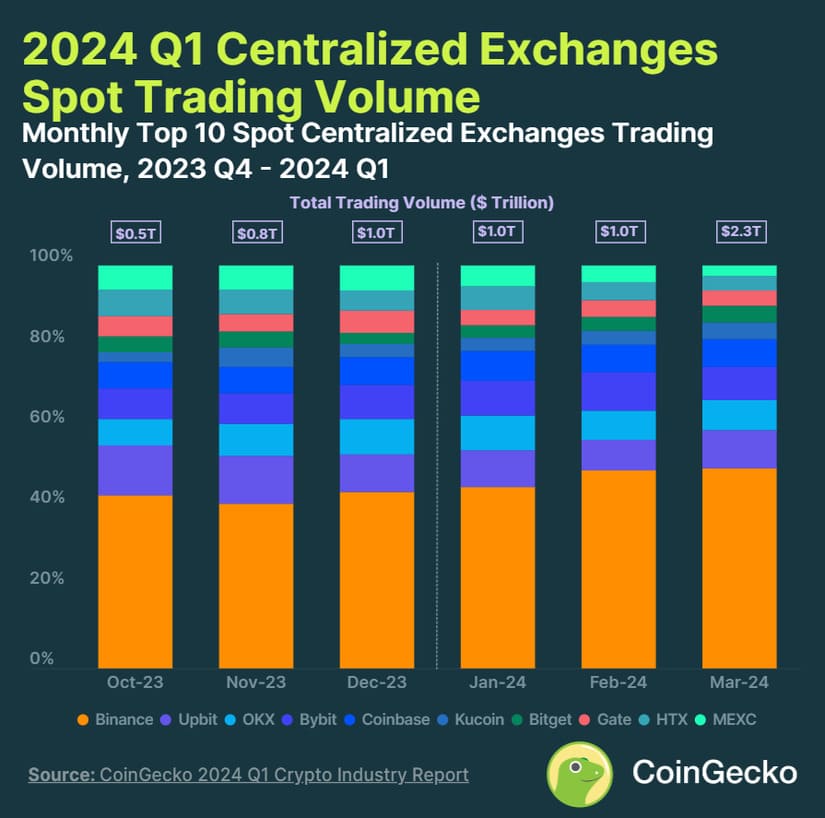

- Centralized exchanges experienced unprecedented growth in the first quarter of the year, surpassing $4 trillion in transactions, according to CoinGecko.

- Binance stood out with exceptional performance, recording a trading volume of $1.1 trillion in March, marking a 131% increase from the previous month.

- Smaller platforms in offshore markets, such as OKX, Bullish, MEXC, and Bithumb, saw significant increases in their trading volumes.

In the first quarter of the year, centralized exchanges experienced unprecedented growth in their trading volumes, surpassing $4 trillion in transactions, according to a report published by CoinGecko.

Binance delivered exceptional performance. Despite facing various regulatory challenges over the past year, the exchange has gradually regained its market share. In March, the platform recorded a trading volume of $1.1 trillion, totaling a 131% increase compared to the previous month. The unexpected growth has been largely attributed to new listings and project launches that have provided traders with a wide range of opportunities.

Another exchange that has found success is Upbit, which remains the second-largest platform with a market share of 9.4%. During the first quarter, Upbit recorded a trading volume of $216.4 billion, representing a growth of 181.6% compared to the previous month.

Binance: Undisputed Leader of Centralized Exchanges

On the other hand, Bybit has consolidated its position in the third position on the podium, with a market share of 8.2%. During the first quarter, Bybit recorded a trading volume of $368 billion, an increase of 112% compared to the previous quarter. Additionally, the platform has managed to increase its market share in Bitcoin trading volume by 7.3% in the last year, according to a report by research firm Kaiko.

Kaiko analysts also point out that smaller exchanges in offshore markets have experienced strong momentum in the last year, especially in Bitcoin markets. Therefore, this phenomenon has fostered more intense competition for platforms like Binance, which previously dominated the Bitcoin market. Examples of this are OKX, Bullish, MEXC, and Bithumb, which have also experienced considerable increases in their trading volumes.

Undoubtedly, the first quarter of the year has brought extraordinary growth in the trading volume of centralized exchanges. Despite the challenges and increasing competition, the main platforms continue to consolidate their strength and demonstrate their ability to adapt to a market characterized by volatility.