TL;DR

- A viral X thread alleges Celestia insiders, including co-founder Mustafa Al-Bassam, dumped 25 million TIA via OTC deals after an October token unlock, while paid influencers hyped prices for retail investors.

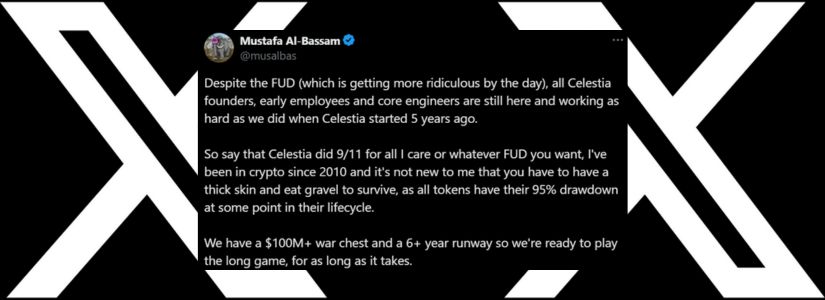

- Al-Bassam pushed back, calling the FUD “increasingly ridiculous,” and revealed a $100 million reserve to fund six years of operations, underscoring the team’s five-year commitment.

- TIA climbed over 10% to about $1.60 after his statement, but Celestia now faces the critical task of restoring trust with transparent unlocks, governance upgrades, and real user adoption.

Celestia’s community was rattled this week after a viral thread accused its leadership and early backers of quietly offloading massive TIA holdings while retail investors watched prices crater. Charges of coordinated token dumps, lucrative over-the-counter sales, and an opaque unlock schedule lit up social media.

In response, co-founder Mustafa Al-Bassam stepped forward to defend the team, touting Celestia’s financial strength and long-term vision amid growing mistrust.

Allegations Rock the Community

A detailed X thread by “Startup Anthropologist” claimed Celestia’s C-suite had full token unlocks last October, after which Al-Bassam allegedly sold over 25 million TIA in OTC deals before relocating to Dubai. The post accused paid influencers of hyping the token at its peak while insiders quietly lightened their stakes. Further criticisms focused on Celestia’s multi-year unlock plan, claiming it favors early investors at the expense of long-term holders.

Founder’s Shield: $100M War Chest

In a candid Monday post, Al-Bassam dismissed the “increasingly ridiculous” FUD and underscored that all founders, early employees, and core engineers remain fully committed five years in. He disclosed that Celestia has over $100 million in reserves, which is sufficient to support operations for at least six years. He contended that significant drawdowns are common across the industry and not indicative of wrongdoing.

Pushback Rooted in Past Critiques

These accusations echo earlier skepticism. In May, investor Larry Sukernik warned that Celestia risked chasing hype without sufficient dApp traction, arguing that appchains need solid user bases to succeed. At that time, Al-Bassam pointed out that Celestia predated today’s rollup boom and now supports over 30 integrated rollups, claiming roughly half the data-availability market share and cementing its infrastructure role.

What Lies Ahead for Celestia

Despite the turmoil, TIA rose by more than 10% after Al-Bassam revealed his financial backing, trading close to $1.60, yet it remains down over 90% from last June’s peak of over $20.

The key test now is rebuilding trust: Celestia must prove transparency around its token unlocks, deliver on roadmap milestones like governance upgrades, and foster genuine developer and user adoption. If it can square its growth ambitions with clearer tokenomics, the project may emerge stronger from this bout of scrutiny.