Recent commentary from a market analyst has brought renewed attention to Cardano, including discussion of a possible move toward the $10 level. Such price targets are speculative and depend on broader market conditions. Alongside Cardano, other crypto projects are also drawing attention, including Paydax (PDP), which has published its own growth projections that are not independently verified.

Paydax describes a DeFi lending and insurance concept

Cardano continues to be followed for its development roadmap and network upgrades. However, any timeline for a specific price level remains uncertain and should not be treated as a forecast.

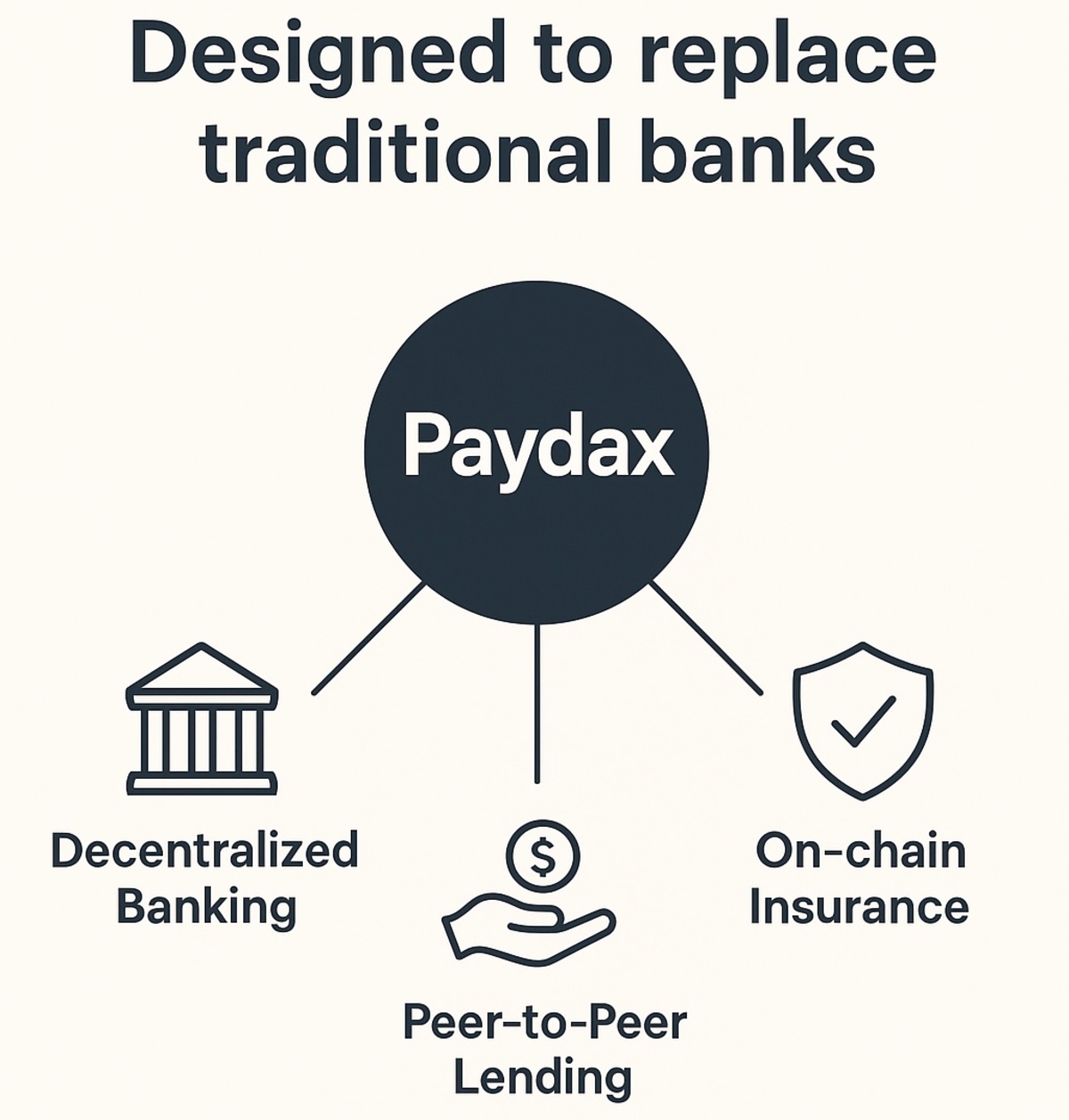

Paydax (PDP) is presented by the project as a decentralized alternative to certain banking functions, including peer-to-peer lending and on-chain insurance. Claims about potential upside or performance are promotional in nature and cannot be confirmed from publicly available information in this article.

Market commentary and project claims should be treated as uncertain

Discussion about Cardano reaching $10 has also circulated on social media. Some posts on X (formerly Twitter) have shared views based on chart interpretation, which are opinions rather than verified predictions.

Other analysts have cautioned that any move toward that level could take time. For example, crypto analyst Ssebi shared commentary suggesting a gradual path based on chart structure. Separately, Paydax has promoted a token sale and published performance projections; these statements are project-reported and should be viewed as marketing claims, not guarantees.

According to project materials, Paydax aims to let users borrow against cryptocurrencies and tokenized real-world assets (for example, commodities or real estate representations), with configurable loan-to-value settings. Specific parameters, fees, and eligibility can vary by implementation and may change.

The project also describes potential lender returns from different product lines (such as lending, an underwriting or default-related pool, staking, and leveraged strategies). Any yield figures referenced in marketing materials are variable, may involve significant risk, and are not assured.

- Peer-to-peer lending yields (project-described).

- Underwriting or default-related pool rewards (project-described).

- Protocol staking rewards (project-described).

- Leveraged yield strategies, which may increase both potential returns and losses (project-described).

Security and verification claims

Concerns about exploits and fraud have affected parts of DeFi. Paydax states that it intends to use multiple layers of security and verification, including third-party services. These are project-reported claims and should be independently validated where possible:

- Brinks for securing high-value collateral (as described by the project).

- Smart contract verification and a reported audit by Assure-DeFi (document linked here).

- Sotheby’s for validation of tokenized real-world assets (as described by the project).

- Onfido for KYC checks (as described by the project).

- Chainlink for pricing data (as described by the project).

The project also states that it operates as a registered business and that team members are publicly identified, with public AMAs and podcasts. These statements are not independently verified in this article.

Context on comparisons with large-cap assets

Some commentary contrasts large-cap assets like Cardano with early-stage tokens on the basis of potential volatility and growth. It is important to note that assets at different stages of maturity can have very different risk profiles, liquidity conditions, and disclosure standards, and past market behavior does not predict future results.

Project links (for reference)

Website: https://pdprotocol.com/

X (Twitter): https://x.com/Paydaxofficial

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.