Recent market commentary on Cardano has highlighted continued volatility. ADA has struggled to reclaim the $1 level, and some analysts have discussed scenarios in which the price could fall substantially by 2026 if bearish conditions persist.

Cardano remains one of the more established altcoins, but sentiment can shift quickly across the sector. Some traders have also been watching newer “PayFi” projects such as Remittix (RTX), though claims about adoption and future performance are inherently uncertain.

Cardano Price Outlook: ADA Faces Resistance Ahead

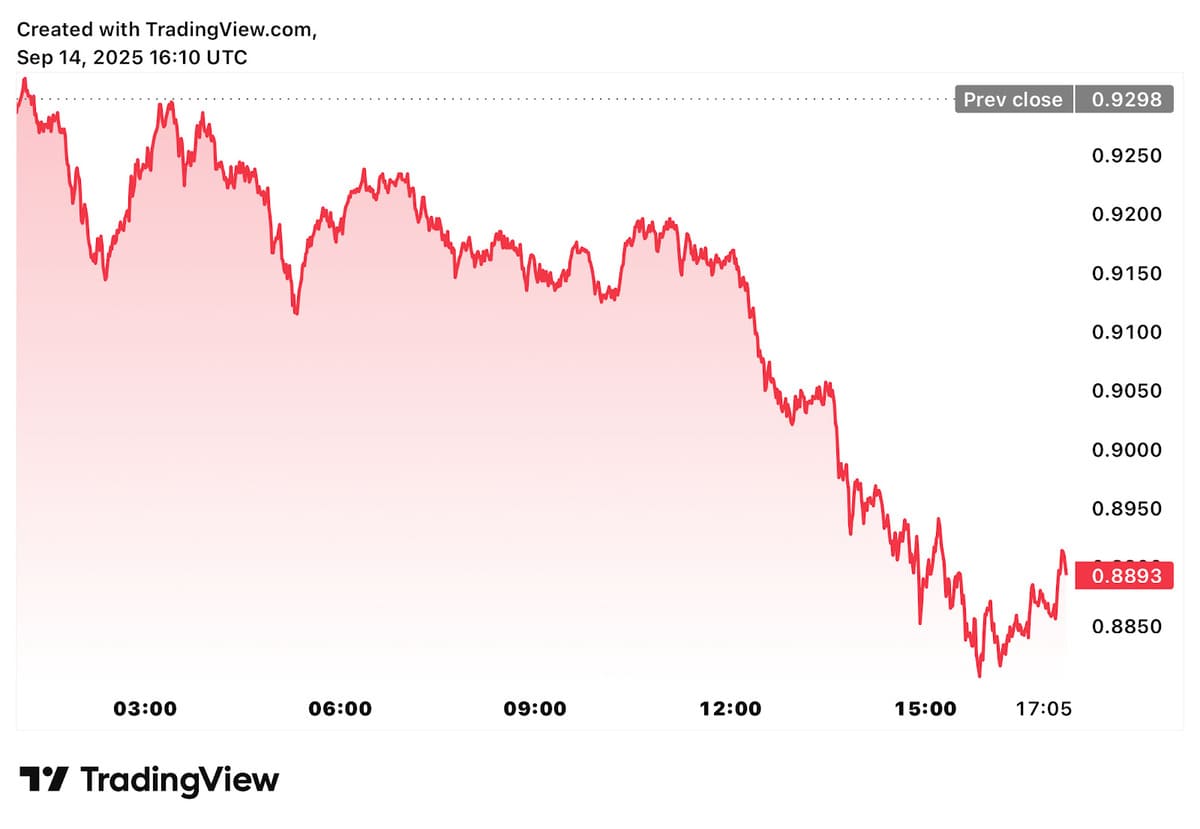

Cardano (ADA) was trading around $0.89, up slightly on the day. Despite the move, ADA has spent weeks struggling to sustain momentum above $0.90. In technical analysis, the $1 area is often cited as a key psychological level. If the price were to break and hold above that zone, some traders would point to higher resistance levels such as $1.20 and $1.40; if it fails to hold, some market participants watch lower areas such as $0.78 and $0.50. These levels are not guarantees of future price action.

Large-holder (“whale”) activity has also been cited as a factor in recent price discussions. Reports referencing on-chain data said more than 140 million ADA (valued at roughly $120 million at the time) was sold recently, and that whale-held supply fell to under 15%. Such figures can vary by data source and methodology, and they do not by themselves predict market direction.

ETF-related headlines, including references to applications such as Grayscale’s GADA, have kept ADA in broader market conversations alongside Bitcoin and Ethereum. Still, given Cardano’s scale (often cited at around a $30 billion market capitalization, depending on the day), some commentators argue that price moves may look different than in smaller, less liquid assets. Some projections have also discussed a scenario in which ADA could trade below $0.20 in 2026, but any such outlook is speculative and subject to market conditions.

Remittix: A PayFi Project Being Discussed

While Cardano’s outlook remains debated, Remittix (RTX) has been mentioned in discussions about “PayFi” use cases. According to the project’s materials, it aims to address cross-border money transfers by reducing friction and improving transaction transparency. As with any early-stage crypto project, product capabilities, timelines, and user adoption are uncertain and should be evaluated independently.

Items the project has highlighted include:

- A wallet beta launch date (September 15, 2025) and features described as supporting crypto-to-fiat conversions for freelancers and merchants

- Plans described as multi-chain support across networks such as Solana, Avalanche, and Polygon

- Statements about exchange listing intentions, including mention of BitMart, though listings and timelines can change

Remittix (RTX) has also described token mechanics such as buybacks, token burns, and staking-related rewards. These mechanisms are project-defined and do not ensure specific market outcomes.

How Some Market Participants Compare Cardano and Newer Tokens

Some commentators argue that larger, more established assets such as ADA may have different risk and volatility profiles than newer tokens. However, claims that any asset has a “limited” upside or that another offers outsized returns are opinions and not reliable forecasts.

Cardano continues to be followed as a long-running smart-contract network, while projects like Remittix are discussed in connection with payment and remittance narratives. Whether these themes translate into sustained usage or token demand depends on execution, regulation, market liquidity, and broader crypto conditions.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.