Cardano has returned to the center of crypto news after several analysts highlighted it as a closely watched large-cap asset during a period where market sentiment remains cautious. Market participants tracking institutional adoption and on-chain activity continue to assess ADA’s smart-contract ecosystem while broader pressure persists across major altcoins.

Some market researchers have also pointed to utility-focused projects such as Remittix as examples of teams attempting to build products aimed at day-to-day use cases rather than short-term trading narratives.

Recent crypto trends show investors reallocating between established altcoins and newer projects amid ongoing volatility.

This has kept Cardano and utility-oriented tokens in the same market discussions, particularly as staking, liquidity conditions, and DeFi activity continue to evolve. The changing landscape has increased attention on networks that can demonstrate practical usage, though outcomes remain uncertain.

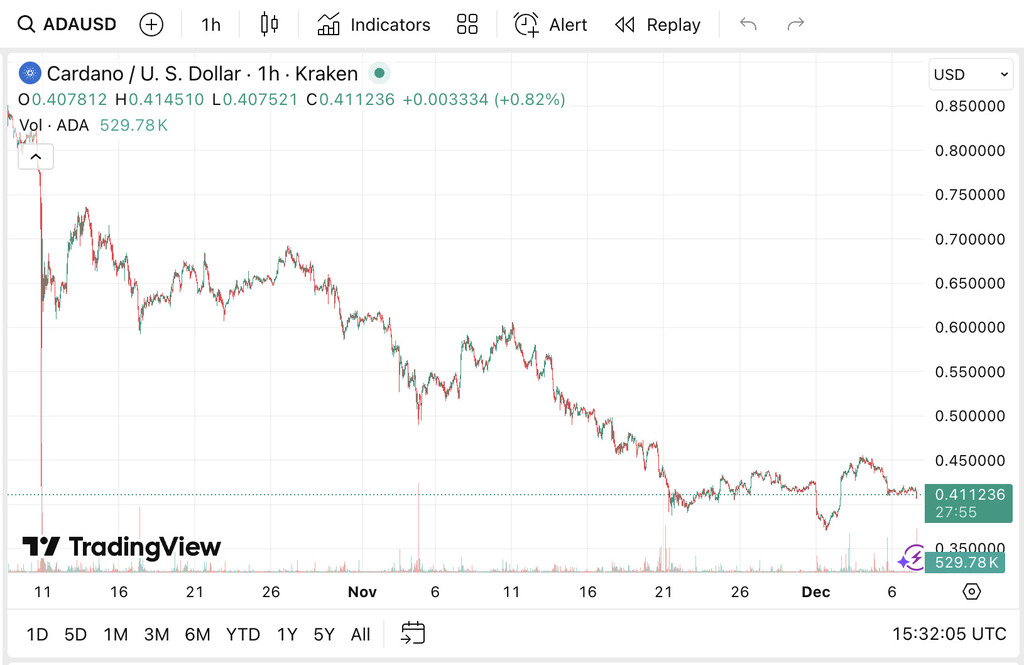

ADA Market Update: Price Moves Below a Key Support Area

Cardano is currently trading at $0.4109, down 0.97%, with a market cap of $14.75B and trading volume at $437.95M, down 2.56%. A recent analyst update noted that ADA has moved below a major support zone, a development they interpreted as increased selling pressure in the near term.

According to the latest community post, the breakdown could increase the risk of further downside if the area is not reclaimed, though short-term market direction remains uncertain.

This shift has created mixed reactions among crypto investors who are monitoring ADA’s position among smart-contract platforms. Some observers argue its longer-term roadmap remains intact, while others point to competition from newer projects that are trying to capture attention with different product focuses.

Despite the recent decline, ADA continues to be cited in market commentary due to its ongoing development activity.

Some analysts also emphasize that ADA’s near-term trading dynamics are sensitive to overall liquidity conditions and changes in staking participation. How price reacts around prior support areas may influence short-term positioning during current market conditions.

Remittix: Project Updates Highlighted by Supporters

Alongside ADA, Remittix has been referenced by some commentators as a utility-oriented project focused on payments. The project reports RTX is priced at $0.119 per token and that it has raised more than $28.5M through funding activities, with over 693.1M tokens sold; these figures have not been independently verified by this outlet.

The project has also described several ecosystem updates, including an iOS wallet release and an expansion of beta testing. A video preview has also circulated via social media.

Separately, the team states it has completed identity-related verification steps with CertiK, and the project is listed on CertiK’s Skynet portal. Any rankings or badges shown on third-party platforms should be interpreted in context and do not eliminate risk.

The project has also referenced plans for a crypto-to-fiat payments feature and described various marketing incentives (such as bonuses, referral programs, and giveaways). Such promotions are project-run and may change at any time.

Summary of reported developments

- Beta wallet testing is being expanded, according to the project

- The project is listed on CertiK’s Skynet portal

- The team reports raising private funding and selling tokens

- A crypto-to-fiat integration has been discussed in project updates

Conclusion: ADA Remains Closely Watched as Competition Broadens

Analysts continue to monitor Cardano due to its development history and its role among large smart-contract networks. At the same time, utility-focused projects such as Remittix are increasingly mentioned in commentary about payments-oriented crypto applications, though their products and adoption remain to be proven.

Both assets appear in ongoing market discussions, but they differ significantly in maturity, liquidity, and risk profile.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Frequently Asked Questions

What do analysts typically look at when assessing crypto projects?

Common factors include ongoing development activity, public documentation, security reviews or audits where available, and whether a project has a clear use case. These indicators do not guarantee outcomes.

Which themes are being discussed for crypto projects in 2025?

Commentary often highlights areas such as payments, AI-related applications, and cross-chain tooling, alongside continued interest in infrastructure and DeFi.

How risky are newer crypto tokens?

Newer tokens can involve elevated risks, including limited liquidity, incomplete products, and higher uncertainty around execution. Readers may consider reviewing disclosures, security assessments, and product progress before making decisions.

What affects crypto price movements?

Market sentiment, liquidity, regulatory developments, macro conditions, and on-chain activity can all influence short- and long-term pricing.

This article contains information about a token sale. This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.