TLDR:

- Derivatives market sentiment for CAKE has turned positive with a funding rate of 0.0046%.

- The community approved reducing the maximum supply from 450M to 400M tokens to drive scarcity.

- Technical indicators like the RSI show a momentum recovery, pointing toward the $2.06 resistance level.

PancakeSwap is once again capturing the DeFi ecosystem’s attention following a series of strategic moves and favorable figures. In recent hours, the PancakeSwap price experienced a 4.5% surge, nearly reaching the psychological $2.00 mark.

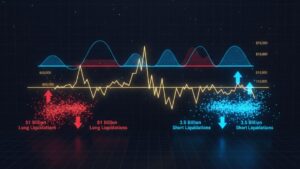

This upward push is no coincidence, as Coinglass derivatives data show a significant trend shift. On Wednesday, the Open Interest (OI)-weighted funding rate flipped green, indicating that long-position investors are paying shorts, evidencing clear “bull” dominance in the market.

Furthermore, the long-to-short ratio climbed to 1.11, its highest level in over a month. This confirms that the majority of traders are betting on a continuation of the rally, motivated by recent changes in the protocol’s governance.

Supply Reduction and Technical Outlook for CAKE

The approval of the proposal to reduce CAKE’s maximum supply is undoubtedly the driver of this renewed optimism. The community decided to cut the cap from 450 million to 400 million tokens, ensuring that periodic burns consistently outpace new network emissions.

Technically speaking, the PancakeSwap (CAKE) price is looking to consolidate its rebound after hitting a weekly low. Currently, the asset is heading toward the 50-day Exponential Moving Average (EMA) at $2.06, which acts as the first relevant barrier for buyers.

On the other hand, the Relative Strength Index (RSI) on the 4-hour chart stands at 46 points with an upward trajectory. If this indicator manages to break above the neutral 50 level, it would confirm the fading of bearish momentum, allowing the token to retest the $2.13 resistance reached last Saturday.

In summary, analysts warn that maintaining the $1.88 support is crucial. A daily close below this level would invalidate the current bullish thesis, potentially extending the correction toward the demand zone located at $1.79 in the short term.