TL;DR

- Bybit requests that the DeFi protocol ParaSwap return nearly $100,000 in fees earned from transactions conducted with assets stolen by the Lazarus Group.

- Members of ParaSwap’s DAO are divided, with some supporting the conditional return of funds, while others oppose the proposal.

- The debate centers on the potential regulatory implications and the precedents that returning the funds could set within the DeFi ecosystem.

The recent request by Bybit to recover funds obtained from hacked transactions has sparked an intense debate within the ParaSwap DAO. On March 4th, a proposal was posted in the DAO forum asking to freeze and return 44.67 Wrapped Ether (wETH), which is nearly $100,000, to a specific address. The proposal initially raised skepticism among members, who called for a thorough verification before proceeding with the request.

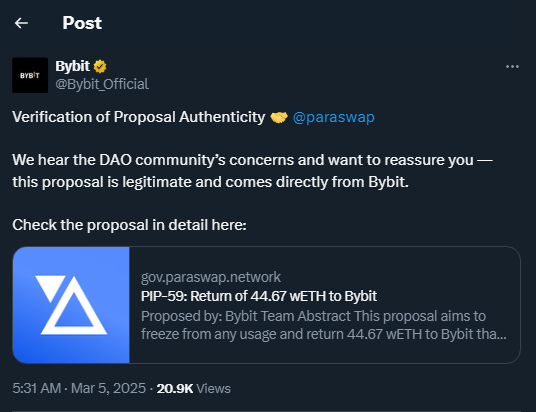

Bybit, confirming its involvement in the proposal, published a statement on March 5th through its official X account, supporting the request for the funds to be returned. This move has caused controversy within the DeFi community, due to the potential implications of returning funds obtained through a hack. Many believe this action could set a bad precedent for the sector.

An Ethical and Regulatory Dilemma for DeFi

ParaSwap delegate and DeFi researcher Ignas expressed on X that the situation puts the DAO in a difficult position. According to Ignas, the ParaSwap community is in a challenging spot, as receiving fees from a hack presents a “bad image” for the protocol. However, he also pointed out that returning the funds could attract unwanted attention from regulators and lead to legal issues. Despite the controversy, Ignas emphasized a larger dilemma: if the funds are returned, it could set a dangerous precedent within DeFi.

“Code is law,”

he argued, reminding that decisions within smart contracts must be carried out as written, without external alterations.

The situation also affects other protocols, such as THORChain, which was used by the hackers to swap the stolen funds. By February 27th, THORChain’s swap volume had surpassed $1 billion, generating millions in fees for the network. If Bybit seeks a similar refund request from THORChain, it could recover even more funds, adding pressure to the case.

Within the ParaSwap DAO forum, members have been divided into three possible actions: returning the full amount, rejecting the request, or negotiating a structured return that allows keeping 10% as a reward, in line with Bybit’s bug bounty program. Some members of ParaSwap’s DAO have expressed reluctance to return the funds, arguing that doing so could damage the protocol’s reputation.