Investing in early-stage crypto presale projects is often compared to participating in the early phases of well-known digital assets. In this context, some market observers have drawn comparisons between Digitap ($TAP), the developer of an “omni-banking” application, and Bitcoin (BTC) during its earlier growth period.

Bitcoin’s rise from levels near $2,000 in 2017 is frequently referenced as an example of how early-stage participation in a new technology can precede wider adoption. During that year, Bitcoin moved from a relatively niche asset to broader market recognition, eventually reaching significantly higher price levels by the end of the cycle.

Digitap is currently positioned at an early stage of development, operating as a fintech project with a live product and an ongoing presale. Supporters of the project point to these early conditions when discussing potential long-term scenarios, while noting that outcomes remain dependent on execution, adoption, and broader market factors.

How Digitap’s Omni-Bank App Is Positioned Around Practical Financial Use

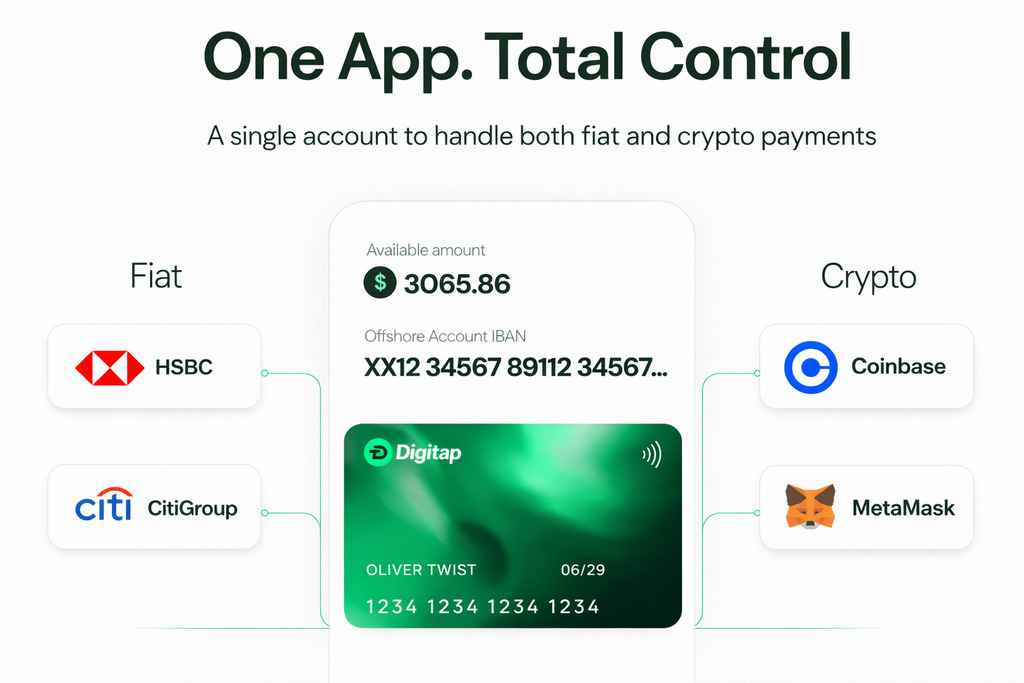

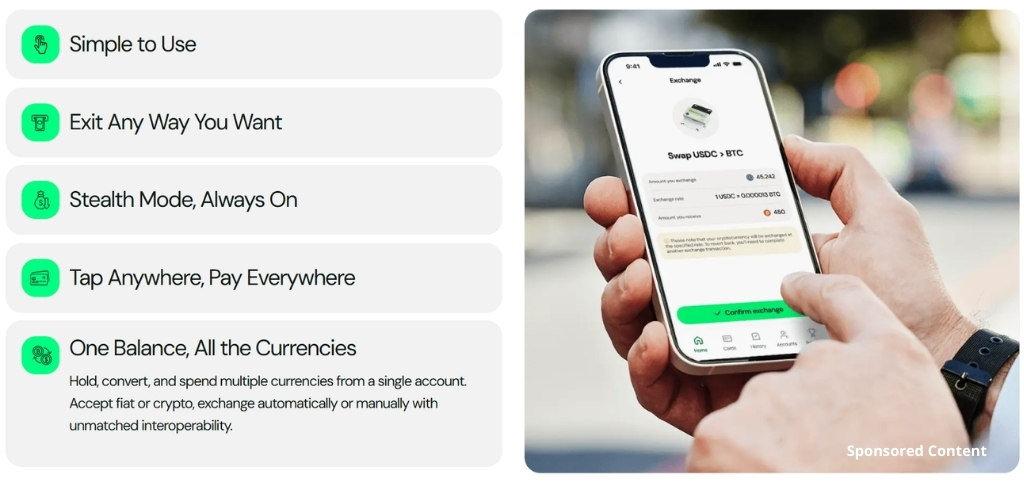

Digitap operates as a fintech platform that integrates traditional financial services and digital assets within a single application. Users are able to manage multiple fiat currencies, conduct cross-border transfers, and hold a wide range of supported cryptocurrencies. The project has also introduced prepaid debit cards powered through the Visa network, which are currently available to users.

The project’s core proposition centers on combining features commonly associated with modern digital banking platforms with blockchain-based payment rails. This includes optimizing cross-border transfers by selecting available routes that may reduce settlement times and transaction costs when compared with traditional remittance methods.

Digitap also offers optional identity verification tiers. Users may access certain services without completing full verification, while additional features and higher limits are available to verified accounts. This structure is intended to broaden accessibility while maintaining compliance options for users who require them.

$TAP Presale Structure and Token Supply Design

The presale for Digitap’s native token, $TAP, began last year and is organized into multiple stages. Each stage is priced incrementally higher than the previous one, reflecting a common tier-based presale structure. Early participants entered at lower price levels, while later stages reflect higher valuations.

According to project disclosures, Digitap has raised more than $4.5 million to date, with participation spread across a large number of wallets. The team has also indicated plans for future exchange listings, with indicative pricing shared publicly, though final market pricing will ultimately depend on trading conditions at launch.

From a supply perspective, the total number of $TAP tokens is capped at 2 billion. The project has outlined a mechanism where a portion of platform-generated revenue is allocated to token buybacks, burns, and staking rewards. This design is intended to link token dynamics to platform activity, although the effectiveness of such mechanisms depends on long-term usage and revenue generation.

Bitcoin’s Market Context When It Reached $2,000

Bitcoin first reached the $2,000 level in mid-2017, a period when adoption was still developing and mainstream awareness remained limited. At that time, market sentiment was mixed, combining optimism about the technology with uncertainty about regulation and scalability.

As adoption expanded later that year, Bitcoin experienced significant price appreciation, coinciding with increased media attention and broader participation. Looking back, the $2,000 level is often described as an early stage relative to the subsequent market cycle, though such comparisons benefit from hindsight.

It is important to note that Bitcoin’s growth was influenced by a unique set of historical conditions, and similar trajectories are not guaranteed for other projects.

Why Some Compare Early Participation in $TAP With Bitcoin’s Early Phase

Comparisons between Digitap and early Bitcoin are generally based on timing rather than equivalence. Digitap is positioned as an early-stage platform with an operational product, a defined target market, and a presale-based distribution model. Supporters argue that its current scale does not yet reflect its potential user base if adoption expands over time.

The project combines a working application, a focus on payments and banking services, and a token model designed to align with platform usage. These factors are often cited when discussing why early participation may appeal to certain investors seeking exposure to emerging fintech and crypto infrastructure.

However, as with any early-stage project, outcomes depend on execution, regulatory developments, competition, and user adoption. While historical comparisons can provide context, they should not be interpreted as predictions.

Learn More About Digitap

- Presale: https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Promotion: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.