Bitcoin’s rebound to $92,000 attracted significant investor attention, but the reversal rally appears to be cooling. In the past four sessions, BTC has been consolidating in a tight range between $90,000 and $92,000, with $92K acting as a resistance level.

As Bitcoin bulls and bears fight for dominance, Digitap ($TAP) has drawn attention as a banking-focused crypto project that, according to its materials, aims to merge traditional finance rails and blockchain activity within a single platform via a multi-rail infrastructure.

Digitap has also promoted a Black Friday marketing campaign that it says includes a prize pool and other incentives tied to its ongoing token sale. The terms and availability of these offers are determined by the project and may change.

Bitcoin Stalls at $92K as Momentum Weakens

Bitcoin has experienced a sharp pullback and is down 28% from its all-time high. However, the recent rebound provided some relief, as BTC rose about 13% to $92,000. Market participants are watching whether BTC can move decisively above this area or whether the price could revisit lower support zones.

In a recent analysis, Trader Michaël van de Poppe said Bitcoin is at a crucial resistance level, coinciding with the 20-DMA. He added that this level could serve as a profit-taking area for some traders and that the market may need more time to recover. He also suggested a bottom could form in December, though timing remains uncertain.

Another market commentary came from Swissblock, which said Bitcoin’s break below $93,300 was a decisive move. Swissblock added that bulls may attempt to regain control if key demand zones hold, but this is not guaranteed.

Periods of consolidation can increase short-term uncertainty and volatility. Alongside major assets like BTC, some traders also watch early-stage token projects, which can involve additional risks, limited public data, and heightened execution risk.

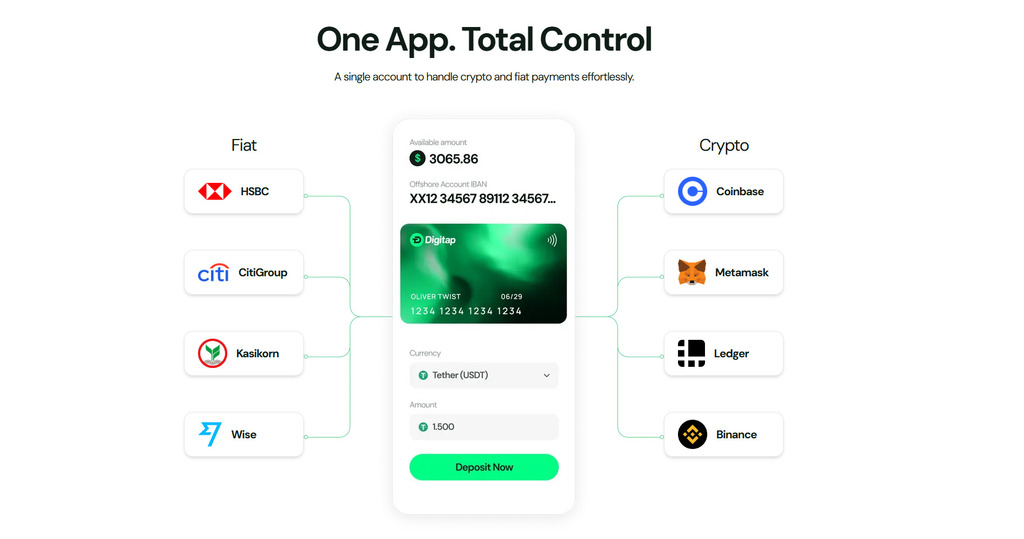

Digitap outlines an “omnibank” model

Digitap is presenting itself as an “omnibank” platform that aims to bring banking-style features and crypto services into one system. In project materials, it describes features such as virtual accounts, transfers, wallets, and payments within a single interface.

The project says its multi-rail approach connects major blockchains with traditional networks such as SWIFT and SEPA, with the goal of supporting cross-network transfers.

Digitap also says it supports card-based spending where Visa is accepted, including compatibility with Apple Pay and Google Pay, enabling users to spend funds sourced from supported balances.

Digitap further states that onboarding and custody/payment services may involve third-party partners. Requirements such as identity verification and eligibility can vary by jurisdiction and provider.

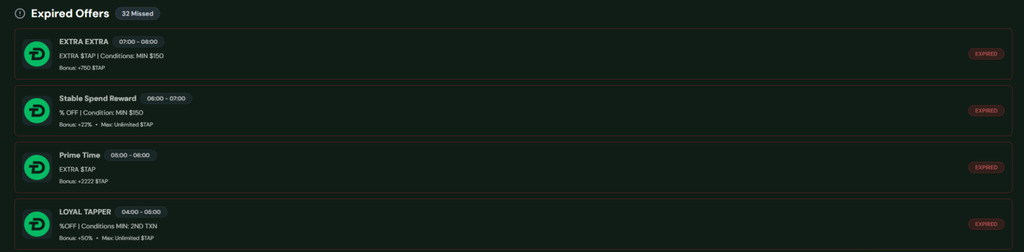

Digitap promotes a Black Friday marketing campaign

Digitap has advertised a Black Friday campaign tied to its token sale, describing rotating offers and a rewards program. Any discounts, bonuses, and availability are determined by the project and should be reviewed carefully in the official terms.

According to the project, the campaign includes a prize pool and other promotional incentives. As with similar campaigns, users should verify the rules, eligibility, and distribution mechanics directly with the organizer.

Digitap says the $TAP token is intended to support platform-related functions such as fees and governance, and that it may be used for access to program tiers (for example, cashback levels). The project also describes a staking feature; any rewards are variable, subject to change, and are not guaranteed.

Context: early-stage token projects carry distinct risks

While Bitcoin remains a major benchmark for the crypto market, early-stage token sales operate under different conditions than established assets, including liquidity, disclosure, and execution risk. Readers should treat project claims as unverified until supported by independent information and should consider the risks specific to token-sale participation.

Project links (for reference): Website | Social

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.