Bullish sentiment around Bitcoin (BTC) is coming from many sources. Most recently, crypto investment firm Bitwise Asset Management said in a note that Bitcoin may be undervalued at current prices. According to the firm’s Chief Investment Officer Matt Hougan, Bitcoin could be trading above the $100,000 level.

Bitcoin remains a large asset by market value, even after price declines. As with any asset, future returns are uncertain; historical performance (including widely cited annualized returns since 2018) does not guarantee future results.

Alongside discussion of Bitcoin’s valuation, some market commentary has also highlighted Digitap ($TAP), a project that describes itself as building an “omni-bank.” Digitap is running a token sale for its $TAP token, according to its materials.

Source: Digitap

Why Bitwise Says Bitcoin Undershoots $137T Money Base

According to a recent Bitwise Monthly Bitcoin Macro Investor report, the firm argues that Bitcoin is undervalued relative to measures tied to global monetary conditions. The report references developments including Japan’s $110 billion stimulus package, Canada’s adjustments to quantitative easing, and China’s approval of a $1.4 trillion fiscal initiative.

The report estimates that the global M2 money supply stands at a record $137 trillion. Bitwise’s calculations suggest that BTC is priced well below what its model would imply versus that money supply, producing a model-based “fair value” estimate near $270,000. Such figures are analytical estimates and are not predictions of future price.

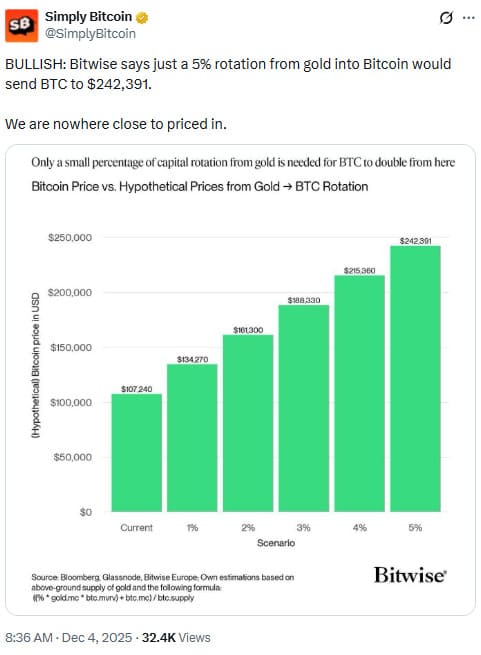

The firm also discusses a scenario in which a small percentage of gold demand shifts into Bitcoin, presenting a model outcome that it says could imply a BTC price around $250,000. This is a hypothetical scenario and may not occur.

Bitwise characterizes this gap as “mispricing,” suggesting that markets may be slow to reflect Bitcoin’s role as a digital store of value.

Source: @SimplyBitcoin

What a $100K BTC Thesis Means for Smaller Tokens Like $TAP

Bitwise’s analysis is one example of how some firms frame Bitcoin’s valuation relative to macro indicators. It reflects a view that Bitcoin’s market price may not fully incorporate the factors the firm tracks.

Even if some participants believe Bitcoin should be trading over $100,000, that view does not determine market outcomes, and price movements can be driven by many variables.

Smaller tokens can experience sharper price swings than large-cap assets like Bitcoin, and they often carry higher project and liquidity risk. Mentions of any specific token should not be read as a recommendation.

Digitap, for its part, is being discussed in some online commentary alongside broader market narratives. The project says its $TAP token sale began in the summer and that it plans marketing efforts to grow its user base.

Source: @nightwatch_94

Source: @SimplyBitcoin

Digitap’s Banking-Related Claims Around $TAP

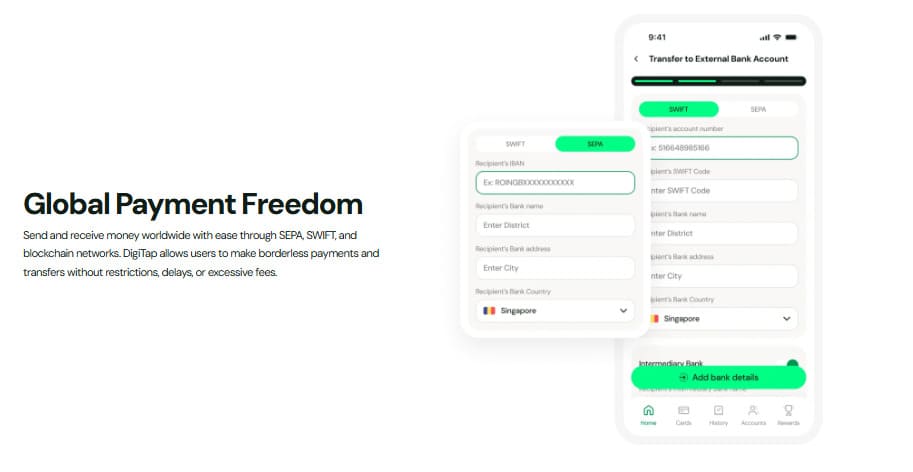

Digitap describes itself as a fintech bank app that blends crypto and fiat in one app. The project says its app is available on iOS and Android and provides access to multiple fiat accounts and more than 100 cryptocurrencies.

According to project materials, users can hold and transfer fiat and crypto within the app. Digitap also states that it has a partnership with Visa connected to prepaid debit cards, and that cards can be funded through the app, including via crypto conversion at the time of transaction.

The project positions this as an attempt to make crypto balances more usable for everyday spending where card payments are accepted. Availability, fees, and supported features may vary by jurisdiction and provider terms.

Digitap also claims to use a multi-rail payments architecture, including AI-based routing, to optimize speed and cost for transfers. The project compares this to industry averages for remittance fees and describes lower-cost transfers on its peer-to-peer platform; such comparisons depend on many factors and are not independently verified here.

Source: Digitap

Digitap’s $TAP Token Sale and Stated Token Model

Digitap’s token sale for $TAP has continued during broader market volatility, according to the project. Digitap also reports that it has surpassed a $2 million fundraising milestone.

The project says the token sale is structured in stages and that the $TAP token price has increased between rounds (for example, from $0.0125 in an earlier round to $0.0361 in a later round). These figures are project-reported and do not indicate future performance or market value.

Digitap also describes a tokenomics model that includes buyback-and-burn activity and staking rewards funded from platform profits, according to its materials. The implementation and impact of such mechanisms can vary and may be subject to change.

Bitcoin Valuation Debate Continues as Projects Seek Attention

As Bitcoin traders debate whether BTC is undervalued relative to macro indicators, early-stage projects may seek attention during periods of heightened market focus. Digitap’s token sale has been marketed during this period, according to project communications.

As with other early-stage tokens, outcomes for $TAP depend on execution, adoption, regulation, market liquidity, and broader crypto-market conditions. Readers should treat forward-looking statements as uncertain.

Project website (for reference): https://digitap.app

Social (for reference): https://linktr.ee/digitap.app

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.