The BTC price is holding above $113,000 after bouncing from recent lows, keeping traders alert to near-term volatility. Analysts say the next daily closes could influence sentiment into October. While Bitcoin remains the market leader, some market participants are also tracking PayFi projects such as Remittix. The project says it has raised more than $26.8 million through a token sale involving more than 673 million tokens priced at $0.1130 each.

BTC Price Consolidates At A Critical Range

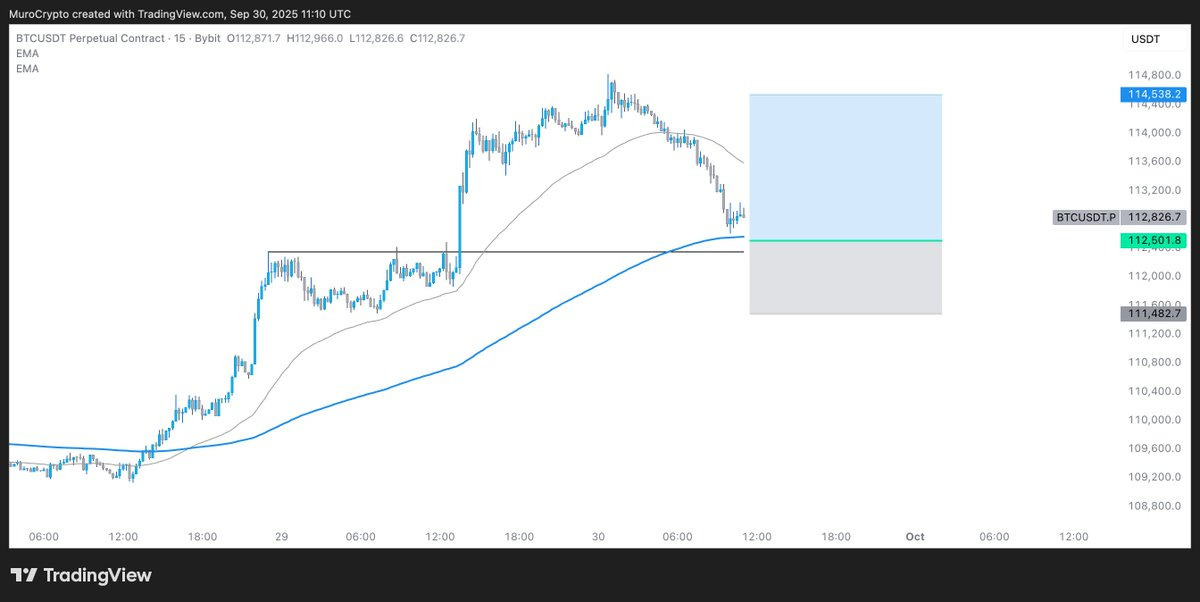

Source: MuroCrypto

The BTC price is currently trading between $113k and $114k after bulls defended the $109k level. Keith Alan of Material Indicators noted that the 21-day, 50-day, and 100-day SMAs have clustered, forming a key resistance area. Some traders are watching $116k as a near-term ceiling; any move above that level could shift focus to higher ranges, though outcomes remain uncertain.

ETF flows have been mixed, with some sessions reflecting caution and others showing renewed demand. Meanwhile, open interest in futures and options has been rising, suggesting traders continue to position for volatility.

Analysts have also warned of a potential pullback toward $105k if Bitcoin falls below $108k. More broadly, market commentary continues to focus on how capital is allocated between Bitcoin and higher-risk altcoins, which can be more volatile and less liquid.

Remittix: Project Claims and Token-Sale Details

As Bitcoin consolidates, Remittix has been highlighted in some PayFi discussions. The project describes its product as supporting crypto-to-bank transfers across 30+ countries. It also states that it has completed a KYC process with CertiK; readers should note that KYC or audit-related checks do not eliminate market, operational, or regulatory risks.

Project-reported points that have been cited by commentators include:

- The project says it has raised $26.8M, with 673M+ tokens sold at $0.1130 each

- A wallet beta that the project says enables cross-border transfers

- Planned or announced exchange listings, including BitMart and LBank (per project statements)

- Marketing incentives described by the project, including a referral program

- A position shown on CertiK’s pre-launch leaderboard at the time of writing (as displayed by CertiK)

Any expectations about future performance, adoption, or liquidity remain speculative, and token-sale participation can carry heightened risks, including price volatility and limited secondary-market availability.

BTC Stability and Broader Market Watch

The BTC price continues to influence the broader market, particularly risk appetite across altcoins. As traders assess macro conditions and crypto-specific catalysts, projects in sectors such as PayFi—including Remittix—may remain on watchlists, but outcomes will depend on delivery, liquidity conditions, and overall market sentiment.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.