TL;DR

- Coinbase CEO Brian Armstrong says the exchange is quietly buying Bitcoin every week under its new “Long Bitcoin” push, hinting at a future BTC treasury without formalizing it, yet.

- The announcement sent COIN shares to fresh all-time highs above $375, as investors embrace Coinbase’s own Bitcoin accumulation as a potent growth signal.

- The strategy mirrors Strategy’s corporate treasury model, bolstering scarcity and potential rallies but raising balance sheet volatility if firms rush to liquidate.

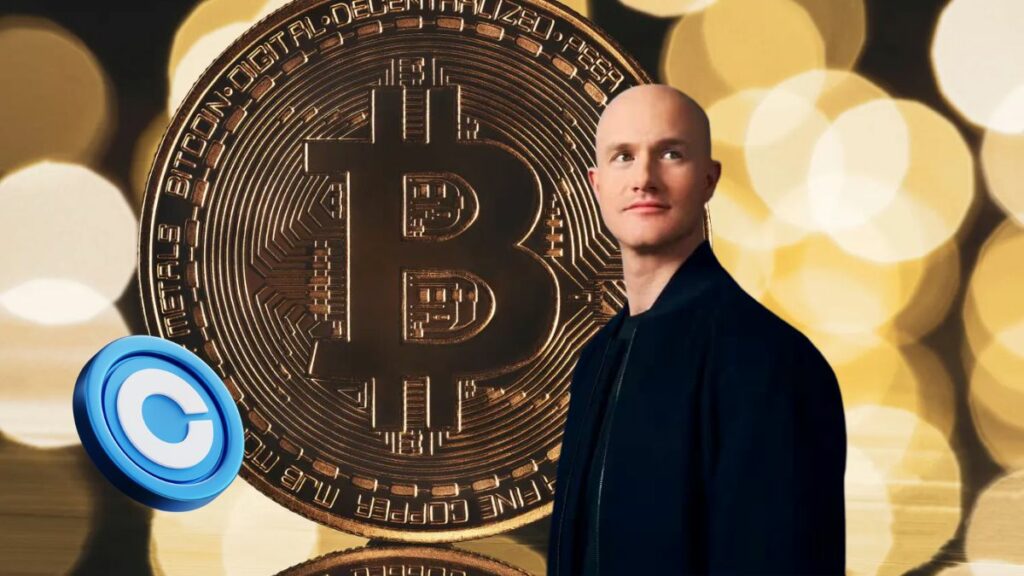

On June 27, Coinbase CEO Brian Armstrong revealed a surprising fact: the exchange is discreetly purchasing Bitcoin weekly. Labeling the effort “Long Bitcoin,” Armstrong confirmed what insiders have long speculated, that Coinbase may be inching toward a formal BTC treasury. While he stopped short of pledging those coins to a corporate reserve, the move has sent ripples through both crypto and traditional markets.

We're buying more Bitcoin every week. Long #Bitcoin https://t.co/LleWBXGYTG

— Brian Armstrong (@brian_armstrong) June 26, 2025

Weekly Bitcoin Buys Signal New Strategy

Armstrong revealed that Coinbase has been steadily adding to its Bitcoin holdings, stacking fresh BTC on the balance sheet each week. This weekly accumulation underscores a deeper conviction in Bitcoin’s store-of-value thesis, even as prices ebb and flow around the six-figure mark.

Though Armstrong insists these purchases aren’t yet part of a formal treasury policy, the consistency and cadence suggest a longer-term play beyond simple trading inventory.

Coinbase Stock Surges on BTC Confidence

Investors rewarded the hint of a strategic pivot: Coinbase’s COIN shares rocketed to a new all-time high of $369.21, later climbing past $375 in after-hours trading. With COIN now outperforming most growth stocks this year, analysts point to Bitcoin advocacy as a powerful growth catalyst.

The stock’s rally also reflects broader U.S. enthusiasm for crypto equities, where exchanges serve as a proxy for direct token exposure without custody hassles.

Echoes of the Strategy Model

Market watchers can’t help but draw parallels to Strategy’s famed Bitcoin treasury. That firm famously swapped much of its cash reserves for BTC, sparking both a rally and debate over corporate risk. Coinbase once debated a similar thesis but deemed an all-in sprint too perilous during its early years. Now, with regulatory clarity improving and institutional momentum building, Armstrong’s weekly buys may mark a shift toward that once-rejected playbook.

Market Implications and Risks

While adding Bitcoin strengthens Coinbase’s long-term alignment with its user base, it also raises questions about balance sheet volatility. Coinbase’s Head of Research warned that a proliferation of corporate treasuries could introduce structural imbalances, potentially amplifying price swings if companies rush to sell. For now, though, Armstrong’s “Long Bitcoin” mantra stands as a bold statement.