BNB is up roughly 30% in eight days, looking at the performance in the daily chart.

Even though the coin is below February lows, the trend is defined, and buyers are in a commanding position.

Per the BNB daily chart formation, the coin will likely float above $340 and towards November high. This development will set the foundation for another possible leg up that will thrust the coin toward April 2022 highs at $450.

Binance Riding the Storm

Binance, the BNB issuing platform, remains solid despite the headwinds and regulatory crackdowns, especially in the United States.

What’s worth noting is that the exchange managed to come out strongly from what it said was a “stress test” last year. However, Binance fulfilled all orders, issuing of proof-of-reserve statement as an assurance to skeptics.

The exchange created the industry recovery fund. However, following changes in stablecoin rules in the United States and the Securities and Exchange Commission (SEC) issuing a Wells Notice to Paxos, the issuer of BUSD, a stablecoin, Changpeng Zhao of Binance announced changes last week.

Their move made BNB rally to spot rates, injecting confidence in the industry.

BNB Technical Analysis

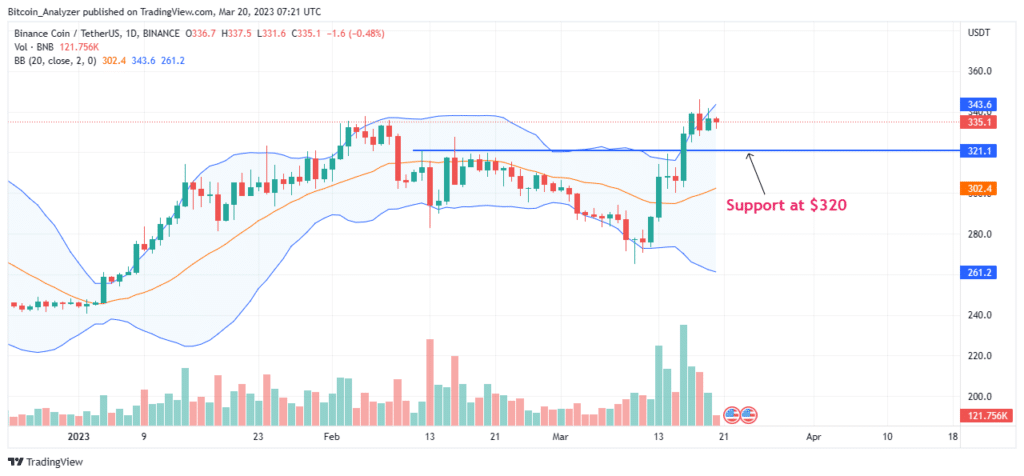

Since prices are above $320, previous support, which is now resistance, traders can look for entries on every attempt to retest this reaction line.

As long as prices remain above this level and the upside momentum strong, as bars band along the upper BB, BNB may easily tear higher above $340.

Confirmation of the March 16 bar may see BNB spike towards November highs at $350 in a bullish continuation pattern. Further gains above $350 may set the base for a rally toward $450, or April 2022 high.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.If you found this article interesting, here you can find more BNB news.