BNB prices remained stable in the past day and week.

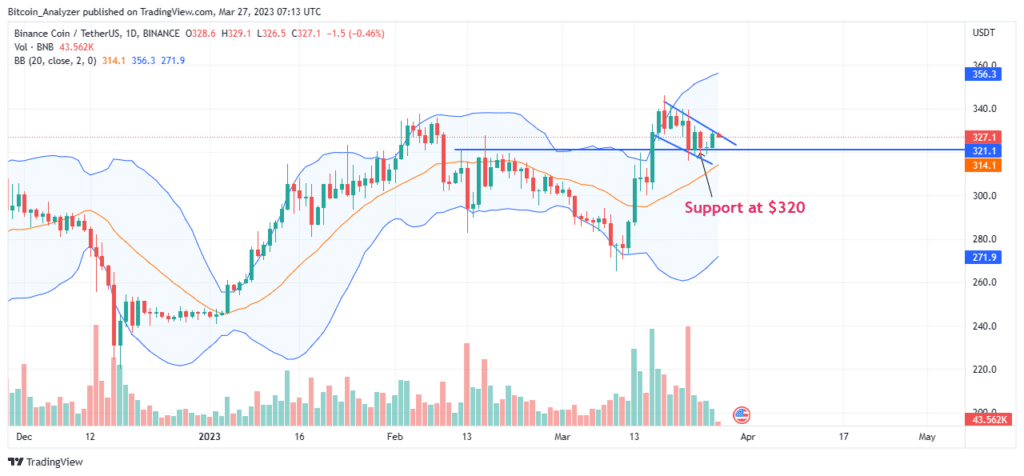

Technically, the uptrend is valid, and bulls expect the coin to extend gains. The recent contraction of BNB forced the coin to a critical support line at $320.

Per this candlestick arrangement, BNB would likely build on their gains and resume the uptrend, aligning with buyers from mid-March 2023.

BINANCE RESUMES OPERATIONS WHILE QUESTIONING CHINA

Last week, Binance temporarily halted deposit, withdrawal, and spot trading.

After maintenance and resolving a bug that had affected the exchange’s matching engine, Binance is now back in operation.

Binance is the world’s largest exchange by trading volumes and counts. The downtime affected millions of traders, suppressing BNB’s use.

This development is amid news that alleges that Binance representatives were aiding users in China to circumvent the existing ban and register accounts. China remains hostile to crypto, outlawing any crypto trading or mining.

Fresh reports reveal that users in China can easily evade systems and the exchange’s know-your-customer (KYC) measures or outrightly manipulate their systems to secure accounts and trade cryptocurrencies.

BNB Technical Analysis

This is valid as long as prices are above $320, an important support level matching with March 22 lows. Trading volumes have been decreasing, with the bear bar of March 22 tagged with above-average volumes.

Since the recent contraction printed a retest after impressive growth from mid-March, BNB prices must expand above the channel. A break above March highs and $340 may see BNB rally to November highs of $360 or better. Conversely, any dip below $320 could nullify this preview, forcing the coin toward March 16 lows at $300.

If you found this article interesting, here you can find more BNB news.