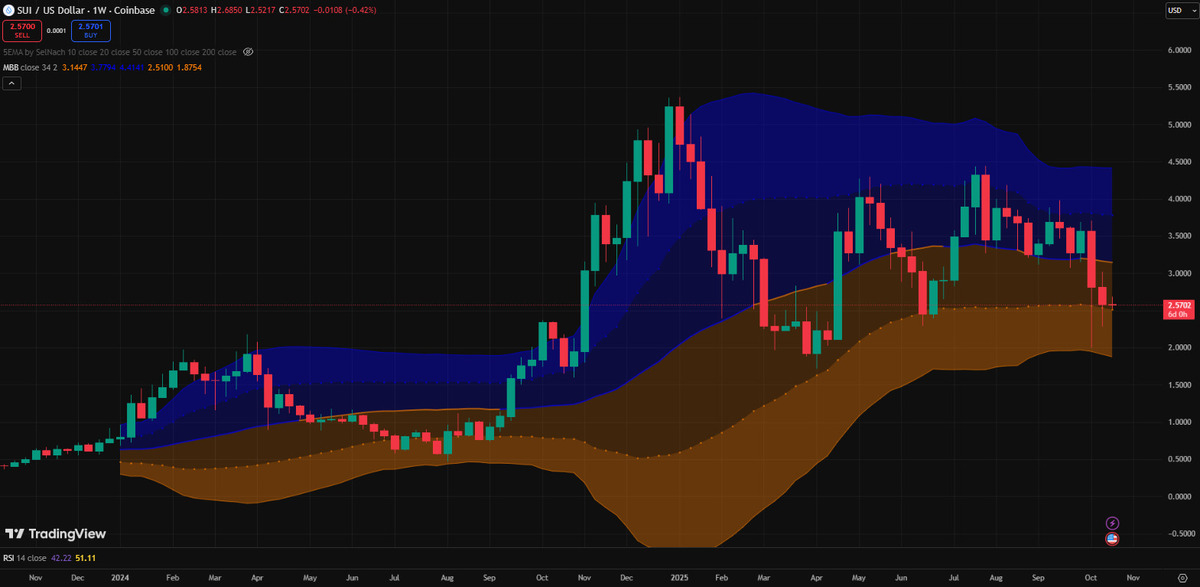

BNB fell by nearly 15% and Sui declined by more than 13% following a period of sharp volatility. In thin liquidity conditions, order books can shrink and pricing can become more erratic, particularly in smaller pairs.

Some market participants have also been looking at early-stage fundraising events as an alternative to highly volatile spot markets. One project referenced in this context is Digitap ($TAP), which is conducting a token sale. Claims about pricing structure and valuation are project-reported and have not been independently verified.

The project has also published future pricing steps for its token sale; these figures are marketing terms and do not indicate future market performance. Below is a general overview of the market backdrop and the project’s stated plans.

October Flash Crash & Market Liquidity Conditions

Billions were liquidated and the after effects continue to ripple through crypto. During forced deleveraging events, liquidity providers may reduce exposure, which can widen spreads and reduce depth on both major and smaller trading pairs.

With thinner books, some altcoins can trade more erratically, and short-term price moves may be driven more by positioning and liquidity than fundamentals. Market direction after a sudden liquidation event is uncertain.

Against this backdrop, some participants have shifted attention to early-stage token fundraising, where pricing is typically set by the project’s terms rather than continuous market trading.

BNB Pullback and Exchange-Related Risk

BNB was trading below its prior peak. Some technical analysts watch short-term moving averages (such as the 10-day) as potential areas of interest, but these levels do not provide certainty about future price direction.

BNB is closely tied to Binance’s ecosystem, which can influence liquidity, integrations, and usage. During periods of market stress, exchange-related events and changes in leverage conditions can also affect sentiment toward associated tokens.

As with other large-cap assets, near-term positioning may remain sensitive to broader risk appetite and market structure conditions.

SUI and Layer-1 Competition

Sui is often discussed as a newer layer-1 network emphasizing throughput and developer tooling. In lower-liquidity environments, investors may focus more on network usage, fee generation, and how token value accrues (if at all) from on-chain activity.

Broader competition among general-purpose layer-1s can also influence pricing, and short-term declines do not necessarily indicate longer-term outcomes. Any projection based on charts alone remains speculative.

Digitap ($TAP): Project Overview and Stated Token-Sale Terms

Early-stage token fundraising can have different risk characteristics than traded markets, but it can also introduce additional risks (including limited disclosures, limited liquidity, and uncertain timelines). The following details about Digitap are based on project materials and have not been independently verified.

Digitap describes itself as an “omni-bank” product that aims to combine fiat, stablecoins, and crypto balances within a single app experience. The project says it is building a multi-rail architecture that integrates traditional payment rails with blockchain networks.

Digitap has also referenced card-program and wallet features (including virtual and physical cards and support for mobile wallets), as well as the ability to exchange between supported assets. Availability, fees, and compliance requirements can vary by jurisdiction and provider.

BNB, SUI and TAP: Different Profiles and Uncertainty

BNB and SUI are widely traded tokens and can be sensitive to changes in leverage, liquidity, and broader market sentiment. By contrast, a project token sale is typically priced on terms set by the issuer and may not reflect secondary-market conditions.

Digitap has described token mechanics that include supply-reduction measures funded by platform revenue. Such mechanisms depend on the project’s execution, revenue generation, and governance decisions, and do not guarantee any particular outcome for tokenholders.

Project links (for reference)

- Website: https://digitap.appc/strong>

- Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.