TL;DR

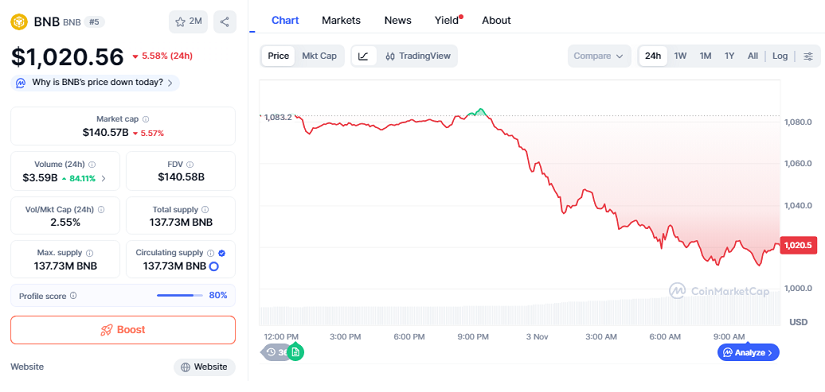

- BNB’s price recently slipped to around $1,020, falling through the crucial support at $1,080 and signalling increasing bearish momentum in the short term.

- Trading volume surged by approximately 84% to $3.59 billion in the past 24 hours, revealing heavy repositioning by market participants.

- Despite the drop, the token remains fundamentally strong: its market cap stands at about $140.57 billion and major holders hold less than 1 %.

The native token of the BNB ecosystem, $BNB, recently slid over 6 %, dropping to USD 1,020.56 and breaching the $1,080 support level that had held for several sessions. The breakdown coincided with a sharp uptick in trading volume, which jumped to approximately USD 3.59 billion (+84 %) in the past 24 hours while market cap settled near USD 140.57 billion. Analysts suggest that short-term volatility could continue over the next few sessions as traders digest recent price swings. Some technical indicators hint at potential consolidation before any meaningful recovery, while market participants monitor broader crypto trends that may influence BNB’s trajectory.

Technical Breakdown Shows Key Support Failure

Historically, the $1,080 zone acted as a floor for BNB, but the recent session saw repeated attempt to rebound into the $1,070–$1,075 area and each rally was met with fresh selling pressure. The spike in volume suggests that large‑scale players or algorithmic systems triggered exits as the support failed. In many bullish narratives for crypto assets, such breaks tend to reset market structure before a new leg higher. Here, the breakdown opens the door to the next psychological and technical floor near $1,000 unless BNB can quickly reclaim $1,080.

Long‑Term View Remains Pro‑Crypto Despite Short‑Term Weakness

Although the short‑term chart is flashing caution, the broader picture for BNB remains constructive. On‑chain data point to a diversified holder base and lower concentration risk: major risk of “whale” dominance is diminished, which supports long‑term resilience. The token is native to the BNB ecosystem (BNB Chain) which continues to expand in decentralized applications, DeFi and cross‑chain integration. Given its solid infrastructure and evolving use‑case, the current dip could present a buying window for investors aligned with the crypto thesis. Analysts also note that ongoing network upgrades and ecosystem incentives could gradually improve market confidence, potentially attracting new participants and fostering healthier liquidity conditions.

In conclusion, while BNB’s drop under $1,080 is technically bearish in the near term and signals increased volatility, the underlying fundamentals still favour an optimistic perspective. If the token can stabilise a