TL;DR

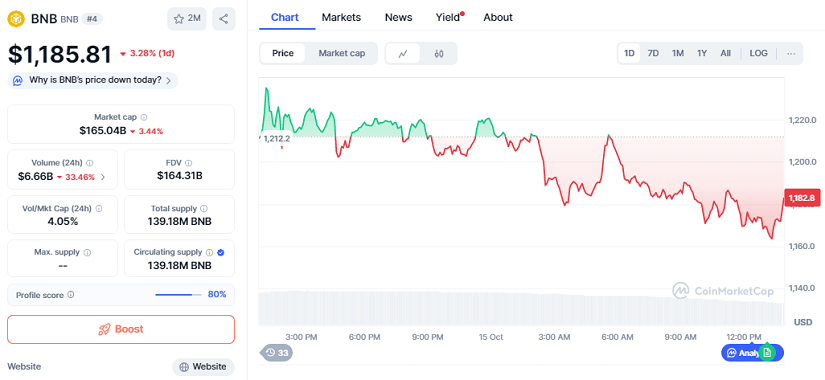

- BNB is trading near $1,185.81 after a 3.28% drop in the past 24 hours, and several analysts are watching a potential double-top pattern that could pull the price toward the $830–$850 range if key supports fail.

- Trading volume has slipped 33% to $6.66 billion, while market capitalization holds at $165 billion.

- Some experts still see technical zones that could trigger a rebound if selling pressure cools and sentiment improves.

BNB enters the second half of October with mixed signals. After touching the $1,350 to $1,375 range twice last week, the price failed to generate enough momentum to break above that ceiling. That behavior drew the attention of analysts who see a double-top pattern potentially forming. The most closely watched support area is around $1,100; a decisive drop below that zone would strengthen expectations of a sharper decline. Conversely, a solid reaction above the 20-day and 50-day exponential moving averages, currently at $1,155 and $1,042, could weaken the bearish argument.

The current price of $1,185.81 highlights the uncertainty around short-term direction. The 3.28% dip over the last twenty-four hours coincides with lower buying activity, evidenced by a daily volume reading of $6.66 billion, 33% below recent highs. Even so, the market cap of $165 billion underlines the size of the asset and the presence of holders who still see room for recovery if technical and exchange-related concerns ease.

Technical Pressures And Momentum Signals

Indicators such as the RSI have retreated from overbought territory, suggesting a loss of immediate buying enthusiasm. The bearish crossover on the MACD adds weight to the argument that bullish strength is fading. Still, some traders with a constructive outlook argue that this kind of pullback can open accumulation opportunities if the 1,150 to 1,100 range holds. They also note that BNB has historically rebounded quickly during volatility when broader sentiment stabilizes.

Talk of a possible 30% correction is rooted in the implications of the double-top pattern. A firm break below 1,100 could accelerate losses toward the 830–850 area. For now, the ongoing defense of the exponential moving averages has encouraged some analysts to consider a potential reversal if buyers regain traction in the coming sessions.

Exchange Flows And Investor Confidence

Several weeks of heavy flows on Binance have influenced market sentiment. Large withdrawals sparked questions about institutional confidence. However, observers with a longer-term outlook believe these concentrated outflows do not necessarily indicate structural weakness, but rather a reaction to short-term uncertainty. Supporters of the asset argue that if Binance maintains operational stability, the negative effect of those withdrawals may fade.