TL;DR

- Blockchain investigator ZachXBT has uncovered strong on-chain links between WhiteRock Finance and the infamous $33 million ZKasino scam.

- Funds from ZKasino’s presale were funneled into WhiteRock’s marketing wallet, allegedly to finance a new asset tokenization platform.

- Most notably, a shared email address connects both projects to Ildar Ilham—ZKasino’s alleged architect—suggesting WhiteRock may be a continuation of earlier fraudulent efforts.

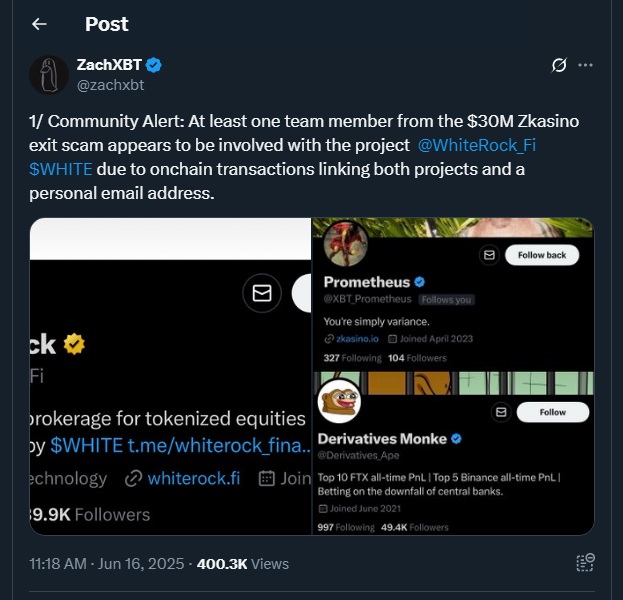

Prominent crypto analyst ZachXBT has once again shed light on what may be a major laundering scheme, revealing on-chain ties between WhiteRock Finance and the controversial ZKasino project. While WhiteRock presents itself as a real-world asset platform aiming to revolutionize access to traditional markets, evidence now points to its development being funded by stolen investor funds from ZKasino.

WhiteRock emerged in late 2024 and quickly gained traction, claiming bold partnerships and promising a USDX stablecoin backed by tokenized assets. But under the surface, ZachXBT’s investigation suggests a more troubling origin. Funds traced from ZKasino’s presale treasury flowed into WhiteRock wallets, which were then used to pay influencers and create an image of credibility.

Evidence Points To Shared Leadership And Wallet Activity

The most damning revelation came from a deployer wallet tied to WhiteRock’s smart contracts. A leaked email—“[email protected]”—was found to be registered on Chess.com under the name “IldarTheGrandMaster,” linking directly to Ildar Ilham, one of ZKasino’s alleged masterminds operating under the alias “Prometheus.”

Additional analysis found that WhiteRock’s promotional wallet interacted with addresses previously flagged for laundering ZKasino’s stolen ETH. These funds were obfuscated using instant exchanges, moved across multiple chains—including zkSync and Solana—and ultimately used to boost the public profile of WhiteRock. Patterns in February and March 2025 showed a surge of Monero-based conversions, followed by matched deposits into WhiteRock’s ecosystem.

From Exit Scam To Asset Tokenization?

ZKasino, which launched in early 2024, promised a decentralized gambling experience but rerouted over 10,000 ETH from presale investors into Lido staking pools without consent. Dutch authorities arrested one member, Elham Nourzai, but other suspects including Ilham fled abroad. The remaining funds then appeared in a sophisticated laundering network.

WhiteRock, with its anonymous team and questionable claims of collaboration with firms like BlackRock and Saudi Aramco, now faces scrutiny not only for misrepresentation but as a possible continuation of ZKasino’s deception. ZachXBT has urged centralized exchanges such as MEXC and Gate.io to reconsider WHITE’s listing, while reinforcing the need for investors to verify project transparency before engaging.

While the crypto space remains fertile ground for innovation, cases like this underscore the importance of robust on-chain analysis and accountability, tools that, when used effectively, can protect the long-term legitimacy of decentralized finance.