NEST Protocol, a decentralized price oracle based on Ethereum, that seeks to provide unique possibilities syncing off-chain data to on-chain prices has revealed an increase of a massive $10 billion in the total value locked (TVL) of the DeFi protocol year-to-date (YTD). It also aims to provide traders with nearly “infinite liquidity”, through risk sharing. Let us take a look at the application possibilities of NEST in the burgeoning world of decentralized finance (DeFi).

On February 15, NEST took to Twitter to announce the protocol has experienced an exponential growth in its total lock-up value unveiling several application possibilities. Some of the features the protocol brings include, providing technical support to develop a decentralized exchanges (DEX), reducing the initial set up costs.

The protocol enables developers to design numerous financial derivatives such as barrier options, Asian options, two-way options, and a type of interesting income such as square-root return, squared return, and exponential return. NEST provides on-chain and off-chain risk hedging allowing developers to seamlessly build an economic framework for the booming Metaverse and GameFi. In addition, the oracle network also provides many other functions to meet liquidity needs for the platform.

🔥An increase of $10 billion in the total lock-up value of the DeFi protocol year-to-date.

😎As a DeFi infrastructure provider, NEST is able to provide nearly infinite liquidity.

To learn more, please see👇

➡️https://t.co/UjaFoWlaoy pic.twitter.com/dqt4f2enyo— NEST Protocol (@NEST_Protocol) February 15, 2023

What can NEST do?

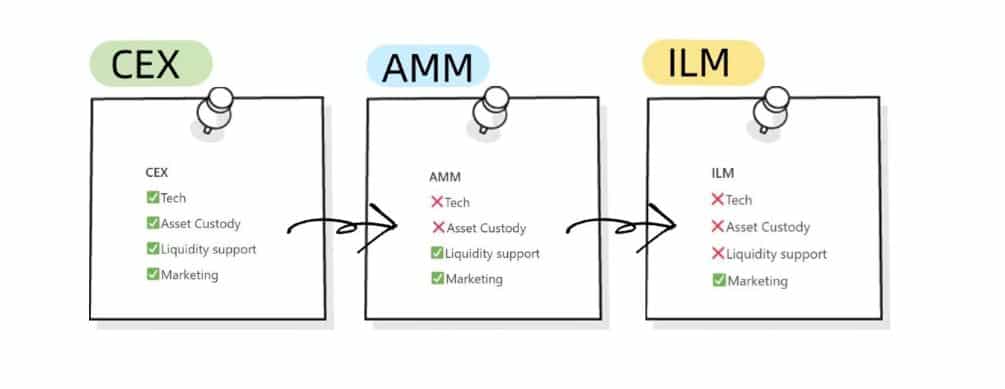

In order to build a DEX, developers need to address a number of issues like technical support, asset custody, risk management, liquidity support and marketing. However, NEST simplifies the entire process empowering developers to do a front-end page to develop the DEX, saving the first three costs except marketing.

According to the official blogpost, the platform also provides a large number of “hedging transactions” for many off-chain tradings without being affected by market makers. NEST helps developers to build a series of martingale functions, such fair games around de- terministic mathematical relations, probability relations, and random processes. NEST explained,

“Even if a game developer stop developing, its core value is still preserved in NEST, and can be integrated and exchanged across other NEST-based games.”

NEST Use Cases Grow

Earlier this month, NEST partnered with CryptoSkyland to launch its own non-fungible tokens (NFT) titled, “Cyber Ink”, with a collection of 10,000 NFTs on the blockchain. On February 6, the platform announced that NFT transactions across the network reached $946 million in January, a new high since June 2022.

🗞️NFT transactions across the network reached $946 million in January, a new high since June 2022.

🔥Each NEST Cyber Ink unlocks NESTFi membership and other benefits! Come and join us!

🔗https://t.co/6wwaLGm2NZ pic.twitter.com/H7aFD5Fju0

— NEST Protocol (@NEST_Protocol) February 6, 2023

In January, McKinsey reported the number of uses case for NEST will increase exponentially in the coming days as crypto subecosystems including NFTs and metaverse could potentially generate more than $5 trillion in value by 2030.