TL;DR

- Bitwise has registered the “Bitwise Aptos ETF” in Delaware, signaling its intent to file a formal application with the SEC to launch a fund based on Aptos (APT).

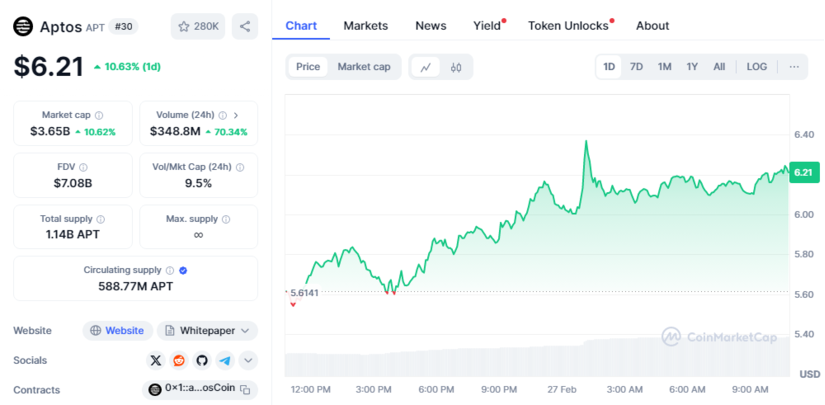

- APT’s price surged 10.63% in 24 hours, defying the bearish trend in the crypto market and highlighting the growing interest in this Layer 1 blockchain.

- The rise of crypto ETFs continues, with firms like Grayscale and Canary Capital submitting similar proposals for DOT and HBAR, reinforcing the trend of institutionalization of digital assets.

The renowned crypto fund manager Bitwise has officially registered the “Bitwise Aptos ETF” in the state of Delaware, a strategic move that suggests an upcoming S-1 filing with the U.S. Securities and Exchange Commission (SEC). If approved, this ETF would become the first in the country to offer direct exposure to the APT token, solidifying the growth of cryptocurrency-based financial products and marking a new milestone in the institutional adoption of digital assets.

Aptos is a Layer 1 blockchain designed to optimize scalability and transaction speed. Since its launch in 2022, it has seen sustained growth in its ecosystem. According to data from Token Terminal, more than six million unique addresses have interacted with Aptos-based applications in the past month, demonstrating its increasing adoption and the trust it has gained from developers and users.

Growing Interest in Aptos and Crypto ETFs

Bitwise’s registration also aligns with the recent wave of altcoin ETF applications in the U.S. Grayscale has submitted a proposal for a Polkadot (DOT)-based ETF, while Canary Capital has done the same for Hedera (HBAR). These developments reflect a shift in regulatory stance, suggesting a more favorable future for institutional investment in digital assets and a progressive validation of the blockchain ecosystem.

The announcement has triggered an immediate market reaction: Aptos (APT) saw an impressive 10.63% surge in the last 24 hours, reaching $6.21.

This spike occurred despite a broadly bearish market, where Bitcoin and Ethereum experienced declines of more than 3%. This movement strengthens Aptos’ perception as an emerging blockchain with solid backing and a promising future, attracting more speculative and long-term investors.

While ETF approval is not guaranteed, the SEC’s willingness to engage with fund managers has strengthened investor confidence in the sector’s expansion. The arrival of ETFs like Aptos’ could mark a turning point, bridging traditional markets with the blockchain revolution and cementing the presence of digital assets in the global financial landscape. As more institutional investors enter the space, Aptos and other altcoins may gain greater traction, boosting adoption and opening new opportunities in the crypto market, particularly in decentralized finance (DeFi) and enterprise solutions.