TL;DR

- Bitlayer, supported by Franklin Templeton, just launched its BitVM bridge on Bitcoin’s mainnet, transforming BTC into Peg-BTC for use across networks like Sui, Arbitrum, Base, and Cardano.

- Unlike typical multisig models, BitVM applies a single-signer setup to strengthen security and address past exploits.

- With over $380 million in value already locked, Bitlayer is stepping up in Bitcoin’s expanding DeFi arena alongside Taproot and Inscriptions advances.

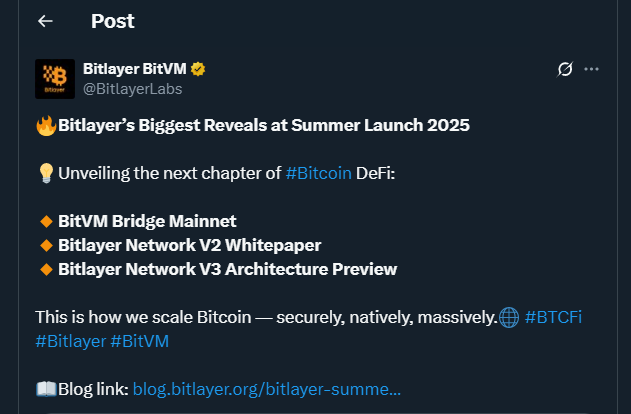

Bitlayer, a decentralized finance (DeFi) startup backed by investment giant Franklin Templeton, has unveiled its smart contract bridge BitVM on the Bitcoin mainnet. By launching this bridge, Bitlayer pushes to make Bitcoin more versatile across other blockchain ecosystems, connecting with Sui, Arbitrum, Base, and Cardano. The bridge allows users to lock up native BTC in a smart contract, mint Peg-BTC (YBTC) and use it on chains that support advanced DeFi applications.

Unlike Bitcoin’s base chain, these integrated networks offer programmable smart contract features, opening up new ways for BTC holders to put their assets to work. The demand for yield-generating products has grown significantly among Bitcoin holders, who now see more opportunities beyond simply holding or trading their coins.

Single-Signer Security Model Sets Bitlayer Apart

Cross-chain bridges have faced scrutiny due to frequent hacks and costly exploits. The notorious Wormhole bridge breach in 2022 resulted in a $321 million loss, underlining the risks in bridging mechanisms. Bitlayer claims its BitVM solution addresses these concerns with a trust-minimized design. Instead of the common multisig arrangement, BitVM uses a single signer, aiming to cut down potential attack surfaces and strengthen oversight.

Bitlayer has locked over $384 million onchain so far, bringing in more than $1.7 million in fees in just June. While the protocol still trails BabylonChain’s much larger $5.2 billion total value locked (TVL), its growth shows increasing confidence in Bitcoin-focused DeFi innovations.

Bitcoin DeFi Grows With Taproot And Inscriptions

Bitcoin has historically lagged behind Ethereum and Solana in DeFi capabilities, but this is changing fast. Key technical upgrades like Taproot, launched in late 2021, have expanded Bitcoin’s scripting flexibility and privacy potential. Meanwhile, the emergence of Inscriptions and the Ordinals protocol in 2023 unlocked novel use cases, letting users embed data directly onto the Bitcoin network.

Today, about 30 active DeFi projects operate in the Bitcoin ecosystem. Competitors like Stacks, which rewards BTC miners, and BounceBit, which enables restaking through wrapped BTC, are also gaining traction. As more liquidity shifts toward these tools, bridges like Bitlayer’s BitVM are expected to play a vital role in keeping Bitcoin relevant in a multi-chain world.