TL;DR

- According to Ki Young Ju, CEO of CryptoQuant, Bitcoin has reached a value of over $1.03 trillion stored in wallets and exchanges, establishing itself as a powerful store of value.

- The Bitcoin store of value metric has increased by 85% this year, reflecting the growing interest and trust of investors in the cryptocurrency.

- Although Bitcoin’s price has not risen significantly, network indicators like hashrate and mining difficulty have reached historic highs.

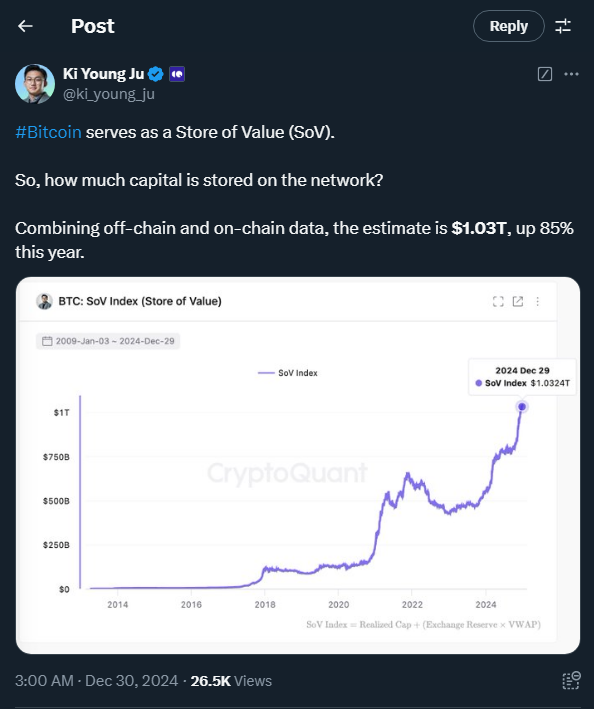

Bitcoin (BTC), has reached an impressive milestone as a store of value, with over $1.03 trillion stored across various wallets and exchange platforms. This analysis was provided by Ki Young Ju, CEO of the CryptoQuant platform, who shared the data on his Twitter account, which has over 390,000 followers.

This calculation, which measures the amount of capital stored in Bitcoin across centralized exchanges (CEX) and over-the-counter (OTC) platforms, reflects an impressive figure. Throughout 2024, the Bitcoin store of value metric has grown by 85%, highlighting the increasing confidence of investors in the cryptocurrency as a safe haven amid market volatility. It further emphasizes Bitcoin’s increasing role in global finance.

Complex Calculation and Methodologies Used

Measuring this metric is complex due to Bitcoin’s inherent volatility and the lack of transparency in many centralized exchanges and OTC platforms. Ki Young Ju explained that the calculation is based on exchange reserves multiplied by the volume-weighted average price (VWAP), which estimates the capital entering the market through exchanges. Additionally, USD-denominated deposits and withdrawals on exchanges and OTC platforms, as well as the actual transaction prices, are included in the formula for accuracy.

This indicator has seen an impressive rise, from $130 billion in 2017 to $700 billion in 2021, and surpassing $1 trillion in 2024. While Bitcoin’s price has not experienced significant growth, network indicators like hashrate and mining difficulty have reached new highs. Bitcoin’s hashrate hit a record 841.64 Ehash/s, while mining difficulty reached 108T, suggesting strong optimism from miners. Despite these advancements, Bitcoin’s price dropped by 3.04% in the last 24 hours, now sitting at $91,493. This price fluctuation underscores Bitcoin’s continued volatility despite its store of value status.