TL;DR

- Bitcoin’s dominance reached 64.98% in May, the highest level since 2021. Some analysts believe this figure could serve as a resistance point signaling an imminent altcoin rally.

- However, there are skeptics who argue that BTC.D needs to surpass 70% before a rotation into altcoins happens.

- Factors such as institutional activity and the broader macroeconomic context remain crucial for the onset of altcoin season.

In the first week of May 2025, Bitcoin’s dominance hit 64.98%, marking its highest level since 2021. This phenomenon has sparked intense debate among analysts regarding the timing of the long-anticipated “altcoin season.” Bitcoin’s dominance, which measures its market capitalization as a percentage of the total crypto market, has been steadily increasing in recent years, with the recent spike leading some to speculate that we are nearing a rotation of capital into altcoins. While some expect the shift to happen soon, others are more cautious, stressing that broader economic factors could alter the timing of this rotation.

A Turning Point for Altcoins?

Most analysts have been closely monitoring the BTC.D indicator, especially since the 65% mark represents a significant historical resistance. Some, like analyst Darky, view this percentage as a ceiling for Bitcoin and predict a correction that could allow altcoins to regain ground. In this view, a dip in Bitcoin’s dominance would trigger a shift in capital towards altcoins, sparking the beginning of altcoin season. Others see this level as a sign of Bitcoin’s ongoing strength, with more growth expected.

However, other analysts are more cautious. Milk Road, for example, believes there are still signs that Bitcoin’s dominance needs to continue rising, possibly reaching 70%, before a true rotation into altcoins occurs. Despite BTC.D rising from 64.4% to 65% in the early days of May, the total market capitalization dropped by about 4%, suggesting there are no clear signs of a trend reversal yet.

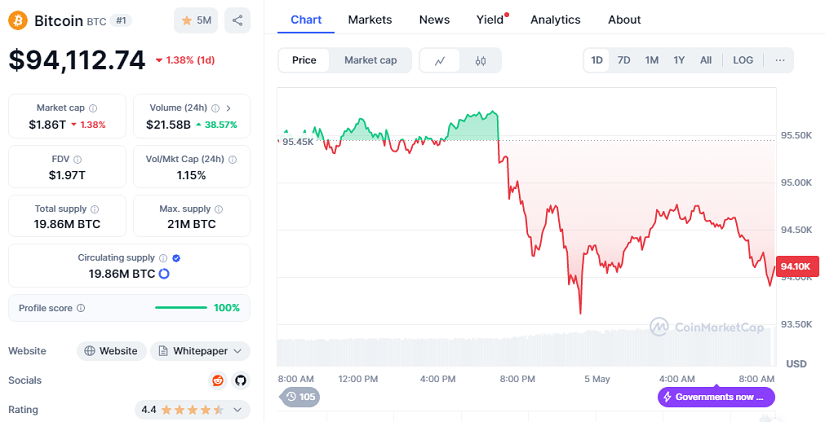

Currently, Bitcoin ($BTC) is priced at $94,112.74, having fallen by 1.38% in the last 24 hours, reflecting the constant volatility in the cryptocurrency market.

The total market capitalization of altcoins, excluding stablecoins, has decreased by 28% since the beginning of the year, reinforcing the idea that we have not yet reached a decisive phase in the rotation towards altcoins.

With these fluctuations and ongoing debates, one thing is clear: the crypto market remains uncertain, and while technical indicators suggest a possible correction, fundamental factors could make all the difference for the future of altcoins.