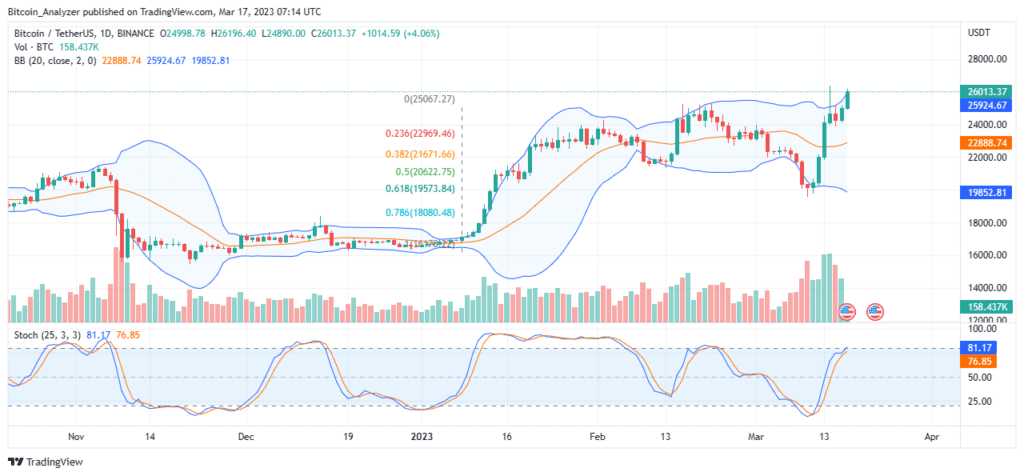

Bitcoin is up roughly 6% on the last day, adding 30% in the past week of trading. Encouragingly, the leg up is with rising trading volumes, cementing the uptrend.

Bitcoin is up over 30% in the last week of trading, solid above $25k, and in a bullish formation.

Notably, there are high volumes behind the recent close above February high meaning buyers are firmly in control.

Today’s push above the tight trade range solidified bulls, and set the base for more gains in the near term.

In the days ahead, traders should watch out for how BTC pans out at around $26.3k and this week’s high.

A high volume close above this line may see BTC extend gains, lifting prices toward $28k in a buy trend continuation formation.

This will be a massive development for long-term holders who expect gains ahead of next year’s Bitcoin halving event.

Banking Crisis in the United States

In the last week, Bitcoin has emerged as a choice store of value for investors.

The banking crisis in the United States, occasioned by the closure of three crypto-friendly banks, including Signature Bank, has heaped pressure on the government and the Federal Reserve (Fed).

Although bank stocks have since recovered, and the Fed’s intervention averted further contagion, Bitcoin remains solid and functioning as intended.

The banking crisis and fear of bank runs might have been one of the triggers, but news that Binance bought, among other coins, Bitcoin, from their $1 billion Industry Recovery Fund supported bulls.

Bitcoin remains dominant and is at around its 9-month high of 45%. This is a massive endorsement of the digital asset, indicating that the coin’s fundamentals are bright.

Bitcoin Price Analysis

If you found this article interesting, here you can find more Bitcoin news.