Bitcoin recently dipped below $100,000, a widely watched technical and psychological level for the BTC price. The move contributed to liquidations and added to broader market uncertainty.

During this period, the market’s Fear and Greed index fell to 22, signalling “Extreme Fear.” Against that backdrop, Digitap ($TAP) attracted attention around its ongoing token sale, according to the project’s communications and third-party commentary.

The King Wobbles: A Market Gripped by Fear

The recent move unfolded as Bitcoin, often described as “digital gold,” faced a renewed test of sentiment. After trading around the $100,000 level, it briefly broke below it, prompting heightened volatility across exchanges.

This also coincided with liquidations, contributing to a weaker risk appetite across the market.

Some analysts linked the pressure to broader macroeconomic uncertainty. The BTC move also underscored a recurring dynamic in crypto markets: when Bitcoin falls sharply, many major altcoins often decline as well, including Ethereum and Solana.

In that context, some commentators avoided framing any large-cap asset as a clear “best” choice, given the recent weakness across major tokens.

The Hidden Flaw in the Digitap Gold Narrative

Bitcoin’s primary investment thesis is often described as its role as “digital gold.” Many view it as a decentralized store of value and a potential hedge against aspects of traditional financial systems. However, its volatility can complicate that narrative.

Factors that can influence BTC’s price—including macro liquidity conditions, ETF flows, and regulatory developments—may also affect traditional markets.

Bitcoin’s utility in everyday payments remains limited in many settings, and price swings are a well-known feature of the asset. Market participants should not assume that short-term rebounds eliminate downside risk.

At the time of writing, BTC was trading around $105,965.10. This reflects a 1.47% decrease over the past week, based on the referenced data source.

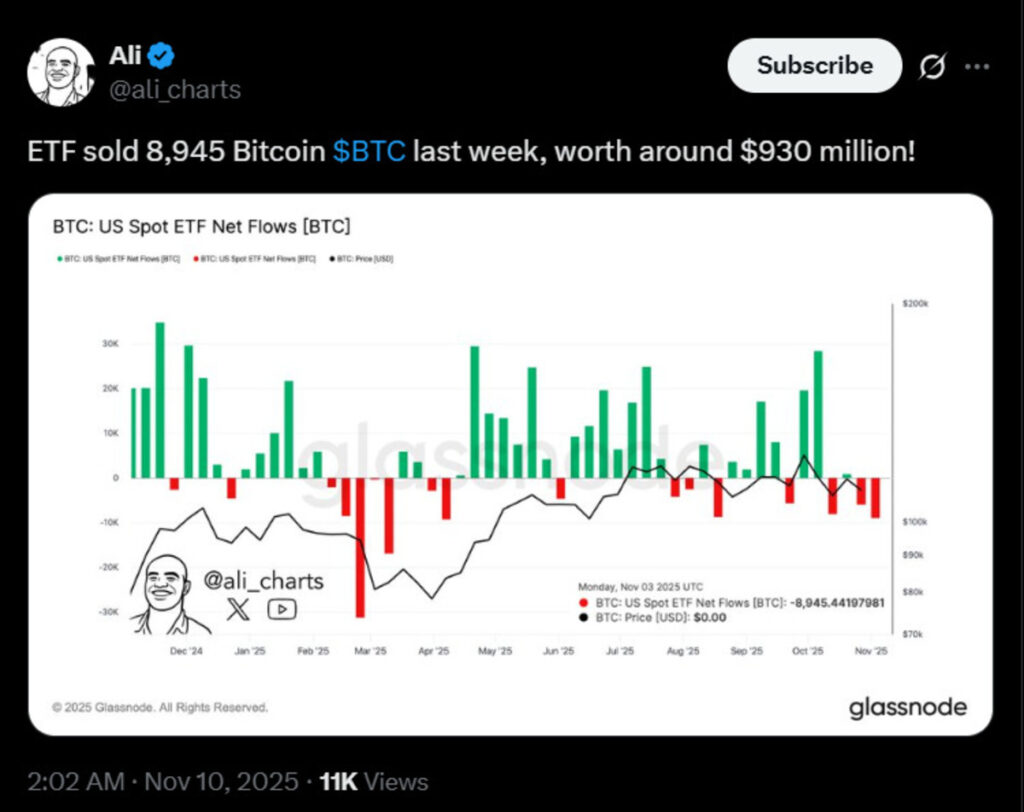

Even after a rebound, future price moves remain uncertain. For example, one market post claimed that ETFs sold 8,945 BTC last week, worth around $930 million. Separately, some analysts track levels such as the short-term holder realized price (cited by some sources around $111,937), though these indicators do not guarantee future direction.

Digitap’s Product Pitch and Token Sale Details

While BTC and the broader market were volatile, Digitap continued marketing its ongoing token sale. According to project-provided figures, $TAP fundraising had raised over $1.7 million and sold over 108 million tokens at the time these figures were published.

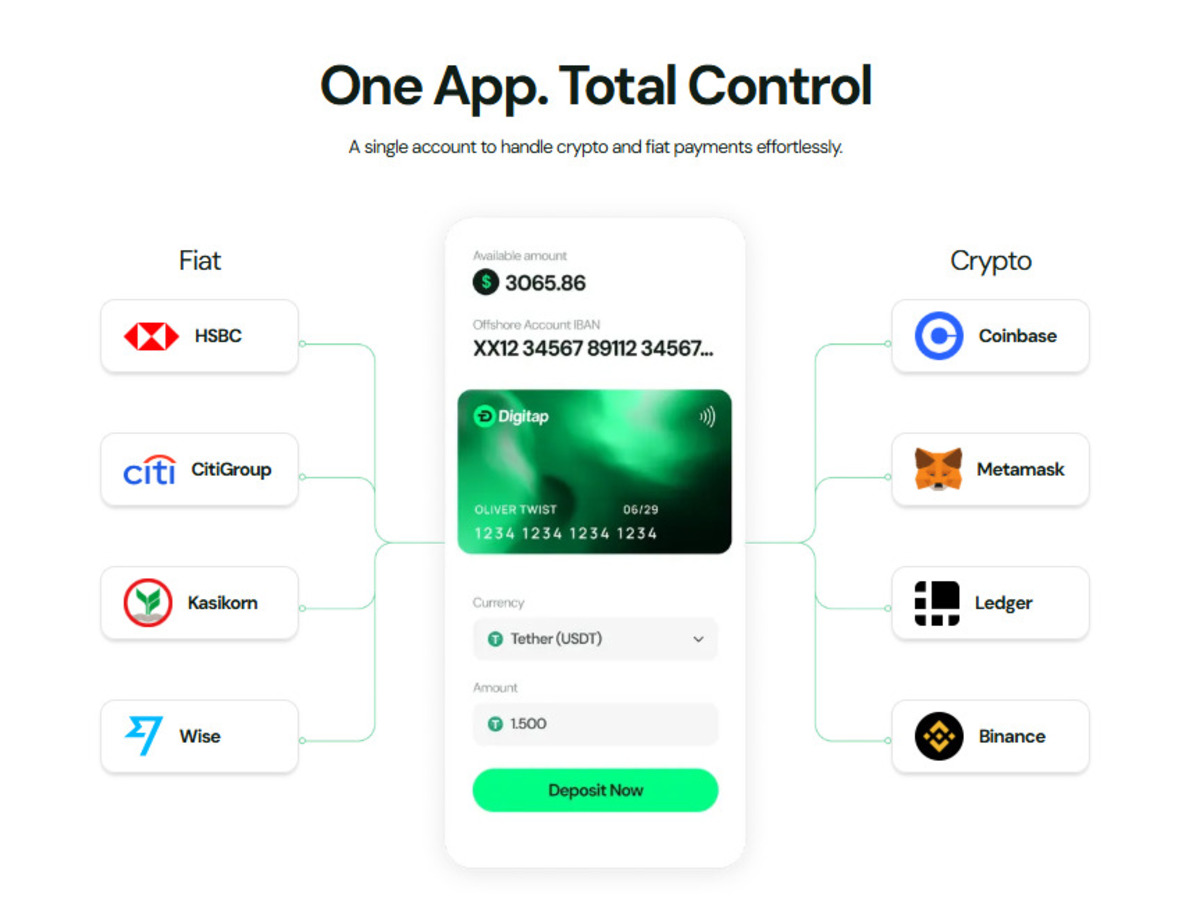

Digitap describes itself as an “omnibank” aiming to combine crypto and fiat features in one platform. The project says its app is live and supports holding and spending crypto and fiat with conversion and settlement features, though availability and terms can vary by jurisdiction and provider.

The project also states that users can access a Visa-branded crypto card, subject to eligibility and local availability.

| Metric (project-reported) | Details |

| Current sale-stage price | $0.0297 |

| Later sale-stage price (as listed) | $0.0313 |

| Tokens sold | Over 108 million |

| Capital raised | Over $1.7 million |

| Fundraising goal | $10 million |

Utility Is Back and Better Than Ever

In recent months, attention in crypto markets has often shifted between different themes, including memecoins and so-called utility projects. Some commentators argue that payment and financial-service features could regain interest if products reach wider usability, although adoption is uncertain and can be influenced by regulation, competition, and market conditions.

Digitap positions its offering as targeting both crypto-native users and users who primarily use traditional financial services. As with similar products, practical take-up depends on execution, compliance, and whether card and app services are available in a user’s region.

Project materials emphasize everyday spending via a card product and highlight benefits such as speed and cost, though these claims depend on network conditions, fees, and third-party providers.

Smart Money Is Looking Beyond the Obvious

Some market narratives contrast established assets like Bitcoin with earlier-stage tokens. Readers should note that newer tokens can carry substantially higher risks, including liquidity, disclosure, and execution risk, and there is no reliable way to predict outperformance.

Digitap’s token sale has been promoted as an early-stage opportunity by project-linked marketing materials; however, such framing is not a guarantee of future performance.

Links (for reference)

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about a token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.