There is nothing to write home about Bitcoin at spot rates. The coin remains under pressure and is yet to shake off sellers of last week.

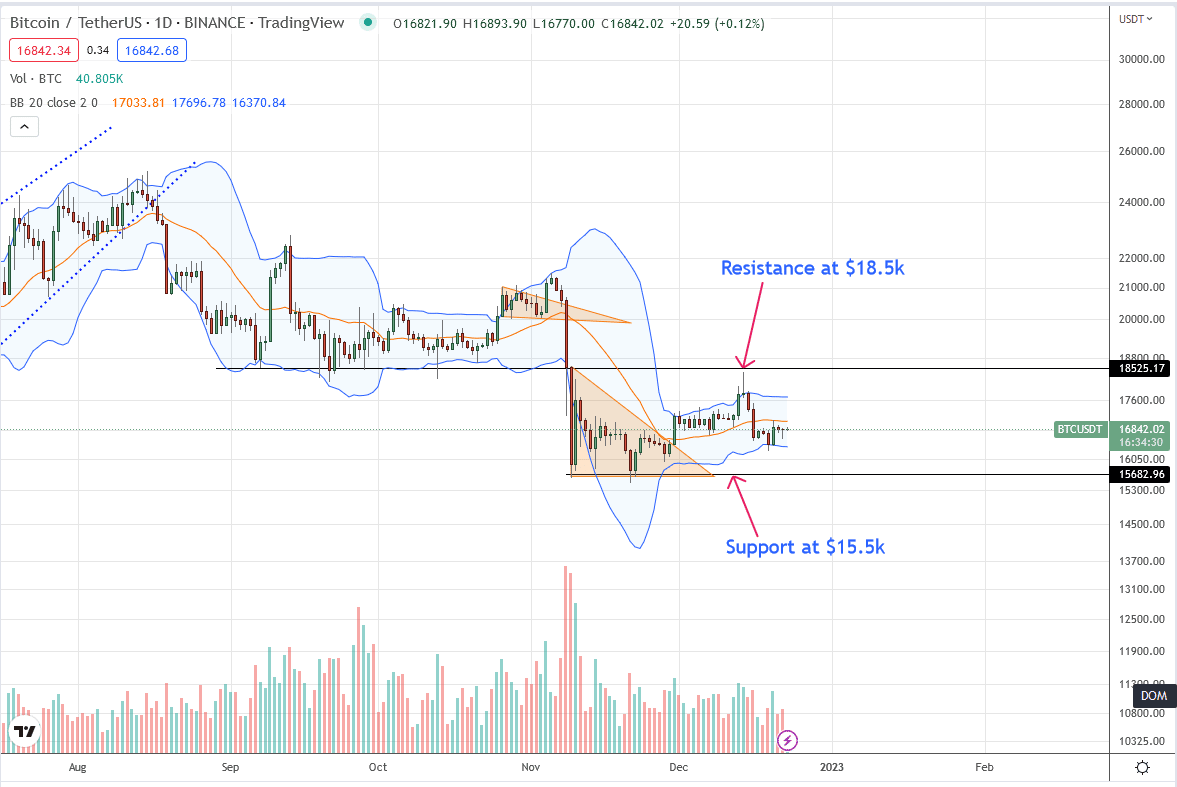

Furthermore, the failure of BTC to pump higher and above $18.5k swings price action in favor of sellers of the past trading year. While there are high hopes that prices may recover, considering past candlestick arrangements, traders should be cautious before initiating longs.

In the short term, there is a high probability of BTC dropping below $16.5k and November 20 lows that the coin flying above $17.5k and $18.5k. As an illustration, BTC is already down 10 percent from last week’s high. On the back of this, prices remain in consolidation inside a tight trade range.

Debate on BTC’s Proof-of-Work

Presently, Bitcoin could end the year uneventfully, with tapering momentum and fizzling participation rates. Nonetheless, the crypto community remains hopeful. This week, the CEO of Paxful, Ray Youssef, endorsed Bitcoin as the only game in town after delisting Ethereum.

Paxful is one of the world’s leading peer-to-peer marketplaces, and confidence from the executive is massive for the project. Ray mentions the proof-of-work consensus algorithm in Bitcoin as a differentiator, distinguishing the world’s first crypto network as a truly secure and solid project.

Amid this stance, one analyst is doubtful of Bitcoin’s security model. In a recent interview, Jordi Alexander, the CIO of Selini Capital, claims that the proof-of-work system isn’t sustainable and could break.

1. #Bitcoin's security model is flawed.

— Miles Deutscher (@milesdeutscher) December 20, 2022

"If we don't talk about it, we might end up in a situation where we're unprepared." pic.twitter.com/TIHkTpVDCO

Bitcoin Price Analysis

Bitcoin is down 10 percent from December highs and 33 percent down from H2 2022 highs as bears continue to pressurize buyers.

At spot rates, BTC prices remain in a consolidation inside the bull bar of December 20. In the short term, buyers can buy the dips if prices are above $16.3k to $16.5k. The immediate target will be at around $17k and later $17.5k.

However, for true trend definition, BTC must either break above the upper limit at $18.5k and December highs or sink below $15.5k, or November lows, before committing to trade.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news.