Bitcoin (BTC) fell to a six-month low, renewing caution around near-term price outlooks. With BTC dipping below US$95,000 and sentiment weakening, some analysts have suggested the move could extend beyond a short-term pullback. While longer-term views on Bitcoin vary, the near-term outlook has turned more uncertain.

The recent decline has been linked to several factors. According to market data, Bitcoin traded around US$95,100 after falling roughly 7% over a week, extending a multi-week decline. Some market commentary has also cited shifting expectations for US monetary policy, alongside ETF outflows and reduced institutional activity. One analyst said that a move below US$100,000 increased the risk of additional downside, describing the chart as a descending channel.

From a technical perspective, the breakdown below US$98,000 has been interpreted by some commentators as a negative signal. One crypto research firm cited the possibility of a decline of around 30% toward the US$70,000 area if support around US$94,000–US$92,000 fails, though such outcomes are uncertain. Separately, CryptoQuant has reported elevated distribution by long-term holders in recent weeks, including figures it says amount to more than 815,000 BTC sold over 30 days.

Why the “Bitcoin Price Prediction” Outlook Is Turning Bearish

Several indicators are being cited by analysts who have become more cautious in the near term. First, macro uncertainty remains elevated, and some traders appear to be reducing risk. Second, derivatives positioning has shown increased use of downside protection, which can be interpreted as hedging demand. Third, some market watchers have pointed to weakening technical structure, including the potential formation of a “death cross” (a 50-day moving average crossing below a 200-day moving average), a pattern that is often viewed as bearish but is not determinative.

Against that backdrop, some price models and analyst commentary have shifted toward more conservative scenarios. If Bitcoin does not recover above US$100,000, some analysts have identified potential support zones in the mid-US$80,000s and the low US$70,000s, although these levels are speculative and depend on broader market conditions.

What This Means for Investors

Market participants commonly respond to heightened volatility by reviewing risk exposure, including leverage and position sizing. Others may choose to stay on the sidelines until price action stabilizes. Approaches vary widely based on individual circumstances, time horizon, and risk tolerance.

Some commentary has also noted shifting attention toward infrastructure-focused tokens and layer-2 projects. These narratives are not a guarantee of performance, and smaller or early-stage projects can carry substantially higher risk than established assets.

Bitcoin Hyper: Project Mentioned in Market Commentary

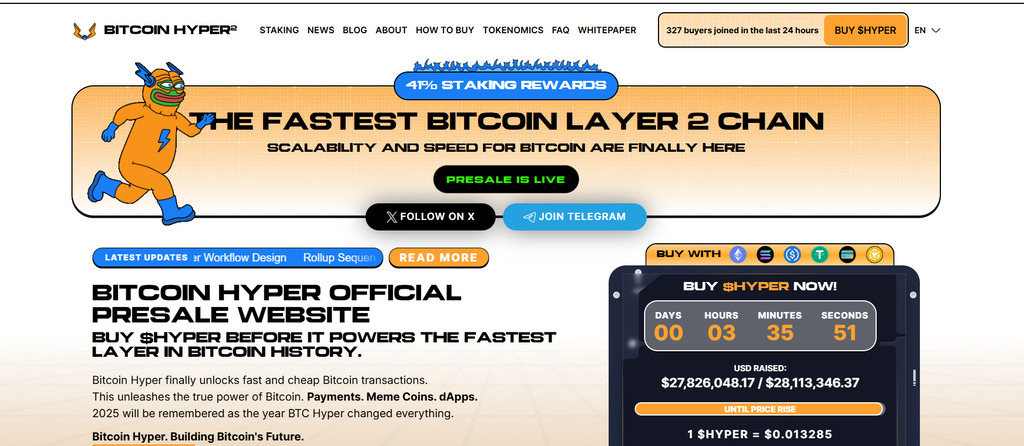

In the context of discussions about Bitcoin’s slowdown, some commentators have referenced infrastructure projects that aim to extend Bitcoin’s functionality. One such project is Bitcoin Hyper stands out. The project describes itself as a Layer 2 network for Bitcoin intended to address scalability and application support, though readers should treat project claims as unverified unless independently confirmed.

Stated Use Case: Building on Bitcoin

According to project materials, Bitcoin Hyper aims to provide faster transactions, lower fees, and smart-contract functionality while remaining connected to Bitcoin. As with any new network, how these features work in practice depends on adoption, security assumptions, and implementation details.

The project has also reported fundraising activity related to a token sale, including a figure of more than US$27 million raised. Such figures are self-reported unless verified by independent sources, and fundraising totals do not indicate future performance.

Architecture and Token Utility (Project Claims)

The project says it uses a Solana Virtual Machine (SVM) framework and a “Canonical Bridge.” It also claims the network can process up to 700,000 transactions per second, a figure that should be treated as theoretical or test-environment performance unless independently validated. The project states that this design is intended to support payments and on-chain applications, while anchoring to Bitcoin for security-related properties.

Project materials state that the token, $HYPER, is intended to be used for transaction fees, governance, and other ecosystem functions. The project also describes staking features; any reward rates, if offered, may change and can involve smart-contract, liquidity, and market risks.

Broader Implications for the Crypto Market

If Bitcoin remains under pressure, the broader crypto market may also stay volatile. While Bitcoin often influences sentiment across the market, different sectors can behave differently depending on liquidity, narratives, and product developments.

Two commonly discussed scenarios include:

- A further correction in Bitcoin toward the US$70,000 area, in which case many risk assets could also weaken.

- A stabilization period where Bitcoin trades in a range, while certain higher-risk segments show relative strength. This is not assured and can reverse quickly depending on market conditions.

Final Take

Bitcoin’s move to six-month lows and its break below key levels have led some analysts to adopt a more bearish near-term outlook. While longer-term views differ, short-term conditions appear more fragile, with elevated uncertainty and volatility.

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.

This article contains information about a cryptocurrency token sale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, readers should do their own research before participating and carefully consider the risks involved. This content is for informational purposes only and does not constitute investment advice.