TL;DR

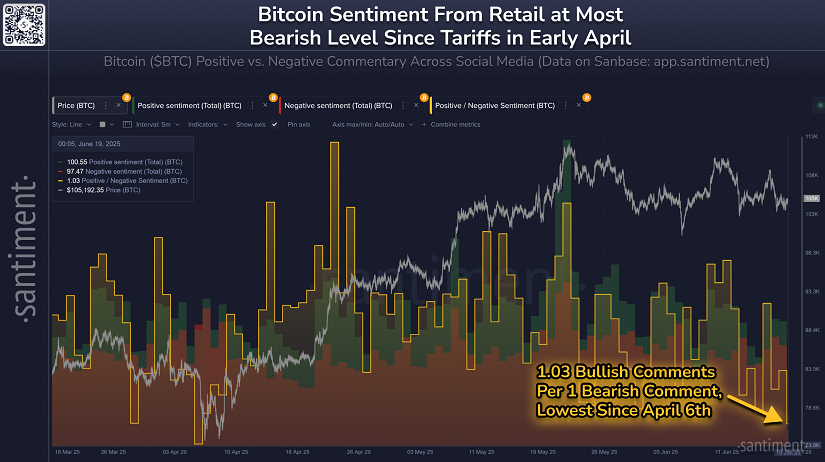

- Bitcoin sentiment has fallen to its lowest level since the U.S. trade tariff announcement in April 2018, according to on-chain analytics firm Santiment.

- Despite growing pessimism among retail traders, large holders continue to accumulate Bitcoin, a historically bullish signal.

- Meanwhile, market indicators like the Crypto Fear & Greed Index are signaling a cooling period after months of optimism.

Bitcoin sentiment has reached rare lows, according to the latest data from blockchain analytics platform Santiment. The ratio of bullish to bearish comments on social platforms like X, Telegram, and Reddit has dropped to nearly 1:1, something not seen since April 2018, when U.S. tariff announcements rocked global markets. At that time, widespread uncertainty signaled what would eventually be a strong upward move in the following months.

Today’s market shows a similar setup. Brian Quinlivan, Marketing Director at Santiment, noted that this sharp drop in sentiment is not necessarily a negative signal.

“Historically, markets tend to move against the general sentiment of retail traders,” he explained.

With only 1.03 bullish comments for every 1 bearish, history may once again be preparing a reversal, offering a fresh opportunity for long-term investors.

Retail Doubt Meets Institutional Confidence

While retail investors have been trimming their holdings, larger players are accumulating. In the last 10 days alone, 231 new wallets have acquired over 10 BTC each. In contrast, more than 37,000 wallets with under 10 BTC have exited their positions. This behavior has often preceded strong rebounds in past cycles, where big money enters as small holders capitulate.

This trend extends beyond Bitcoin. Ethereum has also seen a concentration of coins into the hands of long-term holders. Exchanges report decreasing balances of ETH, which often reflects movement into cold storage or DeFi protocols—a sign of longer-term conviction and reduced short-term selling pressure.

Sentiment Tools Signal Cooling Phase

The “Crypto Fear & Greed Index”, which evaluates market mood using social data, Google search trends, and trading activity, has dropped from “Greed” to “Neutral,” with a current score of 54. It had been hovering around 70 just a month ago. This cooling in emotional extremes can offer space for steady, organic price growth.

At the time of writing, Bitcoin is trading around $104,600 and has gained over 3% in the past two weeks. While retail sentiment appears shaky, on-chain activity and accumulation patterns suggest a more optimistic outlook just beneath the surface. As past cycles have shown, fear often marks the foundation of future rallies.

![Is Dogecoin [DOGE] Security? Mad Money's Jim Cramer believe so](https://crypto-economy.com//wp-content/uploads/2022/01/Capture-2-300x184.jpg)