TL;DR

- Bitcoin surged past $88,000 this week, but analysts warn the rally might be a bull trap due to low participation and weak trading volumes.

- Negative funding rates in futures markets suggest traders are no longer willing to pay premiums for bullish bets.

- Despite macroeconomic fears, many veteran crypto investors are holding their positions, confident in a long-term uptrend.

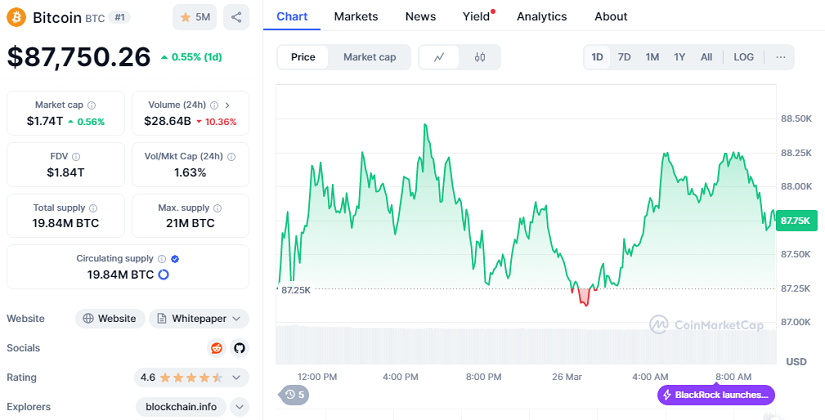

Bitcoin sparked excitement among enthusiasts this week by climbing above $88,000, setting a new two-week high. However, the excitement hasn’t translated into a genuine bullish wave. Despite the momentum, low trading volume, declining open interest, and negative funding rates are prompting several analysts to warn of a possible “bull trap“, a false rally that could reverse sharply, catching impatient investors off guard. This phenomenon has been observed in past cycles, often preceding sharp corrections that flush out overleveraged positions and speculative trades.

One of the most concerning signs for experts is the funding rate in the futures markets. In a healthy bullish market, futures typically trade at a premium over the spot market, but right now the opposite is happening. According to CryptoQuant, even after the recent surge, Bitcoin’s funding rate turned negative. This indicates that traders are no longer willing to pay a premium to hold leveraged long positions, clearly reflecting a shift in sentiment.

Short-Term Outlook vs. Long-Term Crypto Vision

Adding to the technical uncertainty are macroeconomic factors like the possibility of new U.S. trade tariffs, especially those that could be announced on April 2 under a Trump administration, and global geopolitical tensions, all of which affect risk assets, including crypto. These external pressures could add volatility to an already shaky market environment, influencing both retail and institutional behavior.

But while some are fearful, others see opportunity. The crypto ecosystem has proven resilient during similar periods in the past. Unlike the widespread panic often seen in other markets, long-term holders (known as HODLers) remain steadfast, trusting that Bitcoin’s price will not only recover but reach new all-time highs.

Currently, Bitcoin is priced at $87,750.26, having posted a modest 0.55% increase over the last 24 hours.

The drop in lending rates for stablecoins like USDT and USDC on DeFi platforms such as Aave reflects an environment of reduced risk appetite, but also one of quiet accumulation. In other words, many are patiently waiting for the perfect moment to strike.

In the crypto world, temporary pullbacks have historically been disguised opportunities. As always, the long term remains the true playing field for Bitcoin believers.