There are positives to be taken after Bitcoin’s decisive move in the past three weeks or so. Unlike other networks, the platform’s simplicity is its strongest strength.

Indeed, there might be functionality extension with smart contracting—which underpins almost all innovations in supporting platforms.

Bitcoin security and Coin Distribution

However, Bitcoin’s use case is laser-focused. By relying on ASIC miners—and therefore highly concentrated form of computing power to support its rails–, Bitcoin is the most secure.

Also, despite the current price dump, BTC ownership is being distributed across the board. Gradually, the number of coins in circulation is being channeled to regular folks.

According to Willy Woo, an on-chain analyst, 25 percent of all BTC in circulation—around 18.8 million—is in the hands of whales.

#Bitcoin distribution keeps getting better. Whales now hold only 25% of the supply.

I've updated this chart to include holdings by public companies. Though they are whales, their coins are owned by a large number of public shareholders.

Satoshi's coins omitted (assumed lost). pic.twitter.com/fEHFFQ5rOS

— Willy Woo (@woonomic) August 12, 2021

Of note, there is a growing group of minnows; these are individuals who own more than 10 BTC.

The security and token distribution are among some of Bitcoin’s salient features attracting high-profile investors who help highlight the true potential of the transactional layer.

The Bitcoin Pullback Isn’t Supported

At the time of writing, Bitcoin is stable at around this week’s highs. Even despite yesterday’s contraction, the uptrend is still evident.

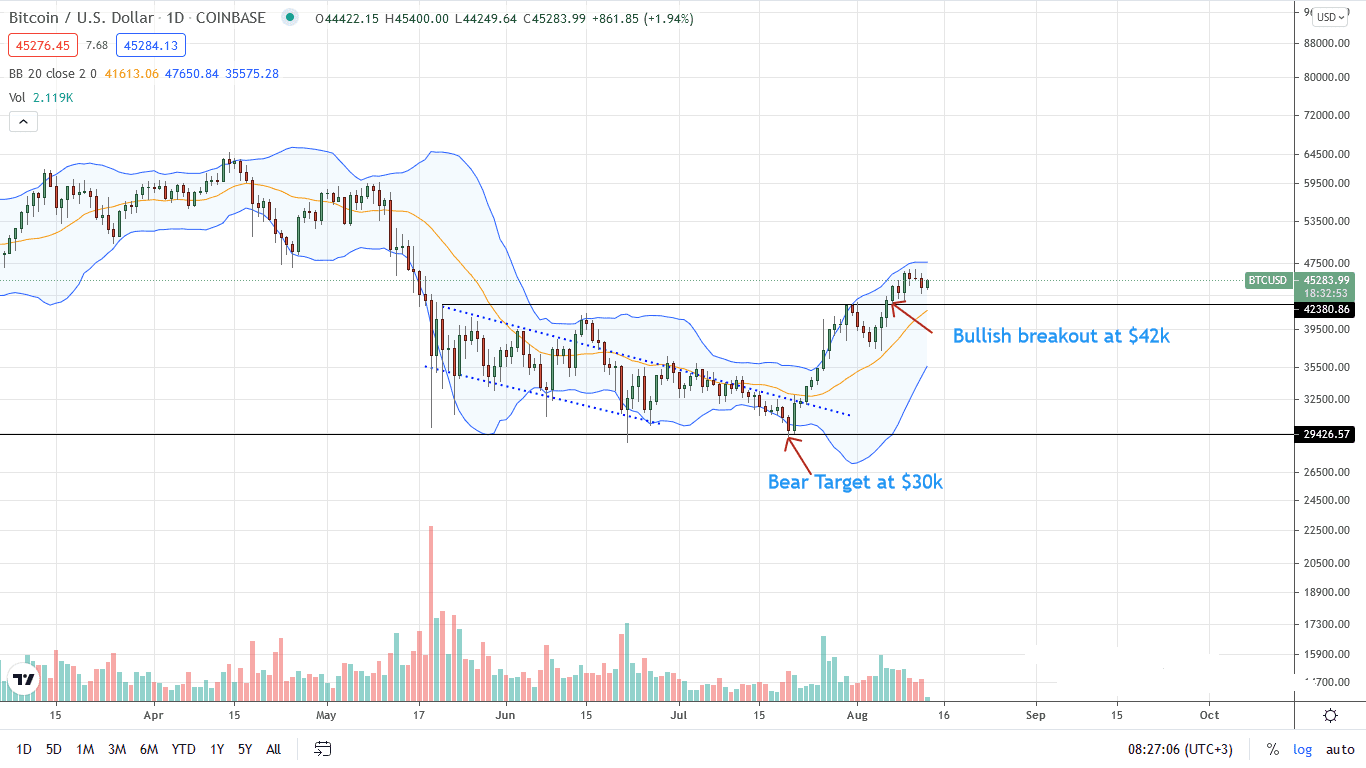

Notably, Bitcoin prices are still within a bullish breakout pattern, firm above January 2021 highs of around $42k.

BTC/USD technical candlestick arrangement favors the buyers with early Asian session’s gains of Aug 13 entrenching existing bulls.

Bitcoin Price Analysis

At the time of writing, BTC is stable on the last trading day, adding an impressive 14 percent on the last week of trading.

However, the August 12 bar is conspicuous in the daily chart, forming a bear engulfing pattern and completing the three-bar bearish reversal pattern. In all, there are lower lows relative to the upper BB, signaling weakness and reducing momentum.

Even so, the uptrend is firm since the August 12 bear bar is with significantly lower trading volumes, disqualifying sellers from an Effort-versus-Results perspective.

Additionally, Bitcoin prices are still trending above the psychological $42k level—a round number of critical significance. Notably, today’s gains squarely put back buyers into contestation.

On the lower end, the region between $36k and $42k offers a strong buying zone for optimistic bulls. A rebound from this mark provides the necessary impetus to thrust BTC/USD above $46k towards $60k in the medium term.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news

![Bitcoin [BTC]](https://crypto-economy.com//wp-content/uploads/2021/04/andre-francois-mckenzie-JrjhtBJ-pGU-unsplash-e1618324096656-1024x576.jpg)