TL;DR

- Bitcoin’s price has risen to between $66,000 and $68,000, increasing activity in perpetual futures, with 75% of Short-Term Holders’ (STH) assets now in profit.

- Binance, Bybit, and OKX dominate the perpetual futures market, accounting for 84% of the open interest, with a range of 260,000 to 280,000 BTC since June.

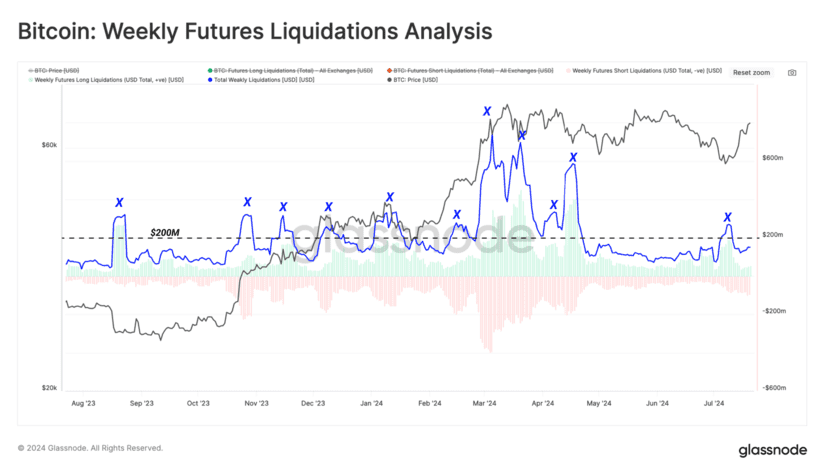

- Highly leveraged positions have been liquidated, with liquidation volumes exceeding $200 million per day.

The Bitcoin market has experienced a notable recovery, moving between $66,000 and $68,000, which has driven an increase in perpetual futures activity. This surge has been particularly beneficial for Short-Term Holders (STH), who have seen 75% of their assets move back into profit, providing considerable financial relief after a period of losses.

In the perpetual futures market, Binance, Bybit, and OKX continue to lead, accounting for approximately 84% of the total open interest. So far in 2024, open interest in these markets has fluctuated between 220,000 and 240,000 BTC, with a recent increase to a range of 260,000 to 280,000 BTC, indicating a rise in speculative appetite since early June.

Leverage has played a significant role, with highly leveraged positions being liquidated. These events are often accompanied by a substantial reduction in open interest, and recent data shows that the volume of liquidations has exceeded $200 million per day, highlighting the impact of margin call liquidations on the decline in open interest.

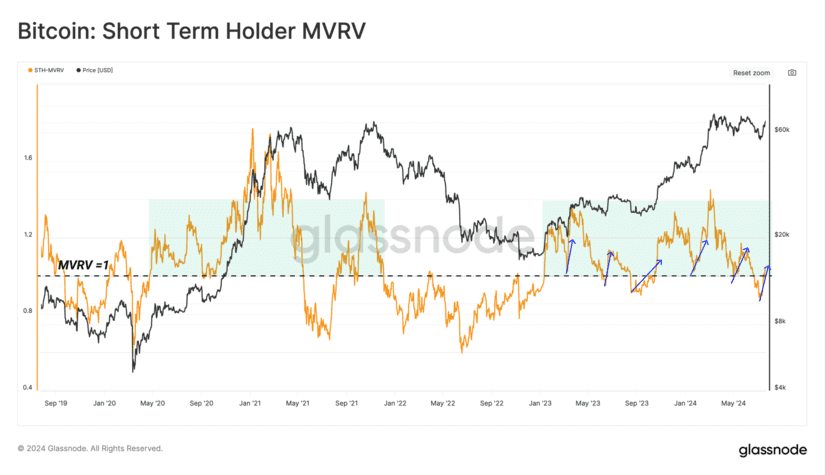

A Lifeline for Bitcoin STHs

A new analysis model has been introduced to track the sensitivity of leverage and open interest in futures relative to changes in the spot price of Bitcoin. The funding rate in perpetual futures, measured using a 7-day moving average, has revealed a decrease in demand for long positions since the all-time high of $73,000 in March, with a neutral to negative market sentiment since then.

The recent price rebound has been a lifeline for Short-Term Holders, who had seen more than 90% of their holdings fall into losses by late July. Now, 75% of their holdings have returned to unrealized profit, marking a positive recovery in their profitability.

Furthermore, the evaluation of capital flows and profitability across different buyer groups shows signs of improvement, with most subgroups experiencing positive capital flow. This recovery in profitability underscores the strength of the current bullish trend and is a promising indicator for overall investor sentiment in the Bitcoin market.