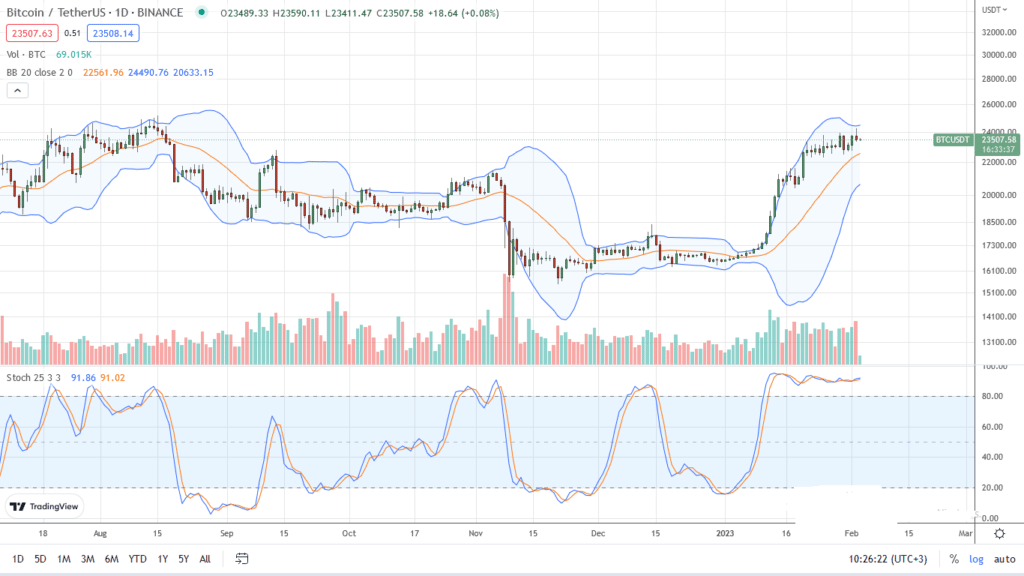

Bitcoin prices are relatively firm as of writing, trending higher and around critical resistance levels. From the Bitcoin price formation in the daily chart, the $24k resistance line is crucial.

Therefore, for the uptrend to be valid, there must be a sharp, high volume close above this level. Most importantly, the leg up must be with rising trading volumes.

Macroeconomic factors, considering comments from central banks, already support the markets.

Since the February 2 bar closed with a long upper wick, suggesting intense liquidation in lower time frames, traders can wait for a close above $24k or the confirmation of February 1 gains before doubling down.

Per the candlestick arrangement in the daily chart, the coin may retest $25k should buyers conclusively close above this week’s high.

FED Raises Interest Rate to 4.75%

As expected, the United States Federal Reserve raised interest rates on February 1 to 4.75%. However, comments from its chair, Jerome Powell, sparked demand, lifting the coin during the New York sessions.

Though he acknowledged that inflation is decreasing, the chair said they would remain open, even raising rates to manage core prices. Their goal, eventually, is to see inflation drop to the 2% level in the months and years ahead.

Subsequently, considering factors that may assist this trend, the central bank forecasts periods of tight labor market conditions.

Because of this, there might be a drop in other growth factors in the economy. Combined, this could weaken the USD, helping pump BTC in the near to long term.

Bitcoin Price Analysis

Bitcoin is nearly 50% from January lows when writing. The path of least resistance remains northwards.

However, there are attempts for lower lows. Notably, there are lower lows versus the upper BB, suggesting weak bulls and fizzling upside pressure. This may slow down the uptrend, allowing bears to flow back.

Even so, as long as prices are trading above $22.5k and November 2022 highs, every low may offer an opportunity for traders to buy the dip, targeting $24k, or better. Conservative traders may wait for a clean break above $24k before ramping up.

The trend could shift bearish, aligning with losses of January 30, only once there is a break below the dynamic support line, and $22.5k is with high trading volumes. In that case, BTC may easily slip to $20k.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.If you found this article interesting, here you can find more Bitcoin news.